REA Group [ASX:REA] climbed 5% in afternoon trade after releasing its FY22 results on Tuesday.

Despite today’s rise, REA shares are down 20% year-to-date.

Source: www.tradingview.com

REA FY22 results

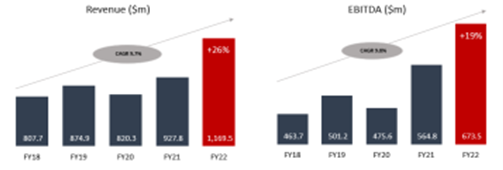

This morning, the real estate advertiser released its full-year results for the year ended June 30, 2022, with revenue up 26% and core Australian revenue up 23% year-on-year.

These are the highlights:

- Group revenue climbed 26%, with a total of $1,170 million, helped by strength in Australian residential revenue, in comparison with $928 million earned in 2021

- EBITDA also rose 19%, bringing in $674 million (including associates) this year, compared with $565 million in 2021

- Net profit after tax was up 25%, totalling $408 million this year, up from $326 million last year

- The company’s full-year dividends increased by 25%, at 164 cents per share, including a record final dividend of 89 cents, fully franked

- Earnings per-share came to 304 cents, another increase of 25%

- Core operating costs increased 34%, incurring $499 million in 2022, increasing from 2021’s $372 million

Source: REA

Source: REA

These results include contributions from its newest acquisitions, REA India (Housing.com) and Mortgage Choice.

The acquisitions of REA India and Mortgage Choice hiked up the company’s operating costs, with other costs merely contributing 11% to the overall 34%.

REA Group said that a squeezed labour market drove renumeration costs higher, on top of regular investments, revenue variables, brand, and marketing expenses.

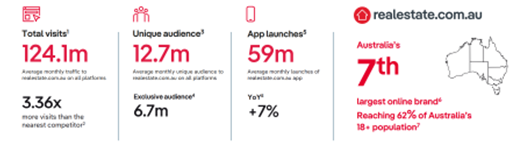

The company highlighted that it owns the ‘leading residential and commercial sites’ in Australia, with realestate.com.au and realcommercial.com.au on top of brokers and data-businesses PropTrack and Mortgage Choice.

There was an 8% increase in residential listings in Sydney for 2022, in comparison to 2021, and an 18% rise in Melbourne listings, contributing to a national increase of 11%.

These changes resulted in an increase of residential revenue of 24%, totalling $776 million.

REA’s CEO Owen Wilson commented:

‘FY22 has been an exceptional year for REA. The record take up of our premium listings products enabled us to fully capitalise on the buoyant listings environment, and it demonstrates the value we provide to our customers and vendors.

‘Key milestones were also achieved in our property data, financial services and Indian businesses, building strong momentum. These markets present great opportunities and the revenue contribution of these businesses is growing rapidly.’

Source: REA

Source: REA

REA’s real estate outlook

REA shared that it believes the Australian residential property market will maintain its moderate state while inflation pushes interest rates to rise.

The company also said that, despite the adjustments at play, low unemployment levels and rising household savings, along with higher numbers of migration should be strengthening the market and boosting demand.

Mr Wilson stated:

‘REA enters the new financial year in a very strong position with a clear strategy for future growth. While we’re mindful of changing economic conditions, with further interest rate rises expected, Australia’s property market is healthy and supported by strong underlying fundamentals.

‘REA’s growth momentum is backed by an unrivalled audience and a product pipeline that will deliver exceptional value to our customers and consumers in FY23 and beyond.’

How to survive…and thrive…during a bear market

ASX stocks have had a tough time of it this year.

With inflation still elevated, markets everywhere are set to see further interest rate hikes as central banks fight to tamp down inflation.

Stocks may fall further from here.

So should you stick with cash or buy the dip?

These are common questions in today’s market.

And if you’re looking for answers, I recommend reading the latest ‘Bear Market Survival Guide’ from our very own editorial director, Greg Canavan.

As Greg notes in his report:

‘What you decide to do in the next few weeks will determine the success of your portfolio in the next few years.’

If you’re feeling lost in the current market and are wondering how to protect your portfolio, click here to access Greg’s latest report ‘Your Bear Market Survival Guide’.

Regards,

Kiryll Prakapenka