“A nudge… is any aspect of the choice architecture that alters people’s behavior in a predictable way without forbidding any options or significantly changing their economic incentives.” – Richard Thaler

First the bad news:

Source: Bloomberg

So it looks like the market won’t get the rate cut it wants.

Inflation has ticked up recently, hence the likely reluctance of the RBA to give us another sweet, sweet 25bps cut.

Source: Bloomberg

How did we get here? And what does it mean for the ASX?

I want to break things down into three parts over the next three days:

- Today, the whacky world of Australian economics

- Tomorrow, the surprise sectors and stocks that are performing despite the RBA and Canberra’s antics

- Wednesday, where I’m looking next for my next small-cap and micro-cap recommendations – and why.

Let’s start with Australian economics.

Australia’s economy is in a disoriented state

Where am I? This isn’t where I parked my economy.

I barely know where to start on this one. Australian economics would be comical if it wasn’t so dismal.

If economics is the “dismal science” then being an Australian economist is surely the saddest clown show at the circus.

Let’s look at where the inflation is coming from.

The stuff that is keeping the RBA from providing much needed relief to the peasants (myself included) that kamikazed into a mortgage in the age of AI:

Source: ABS

Ok, food and non-fun bevs?

We’ve got a duopoly – Coles and Woolworths.

(They aren’t even that profitable in terms of margins – but that’s another matter)

The fun beverages and durries?

Yep, government mandated price increases – thank you Albo for freezing the beer excise tax, we are so grateful for this brief stay of wallet execution.

Pubs can barely make a crust.

Clothing and kicks?

Well we know we don’t make much of this anyway, making stuff is expensive here (duh).

Energy costs are eating into manufacturing capacity, so best make that expensive.

Housing?

Well, we like to cluster in cities by the coast. Can’t build a house anyway, costs too much and sounds like hard work to me.

Furnishings and that fancy washing machine?

We’ll get those from another country, thank you very much.

Or we’ll take it off the street from hard rubbish like vultures because, well…see above.

Health?

Private hospitals are on the verge of collapse, so that will be a bit extra on your premium.

Yep, thank you.

What about driving to one of the only two supermarket chains to buy a $60 slab of VB and a $50 pack of “cheapest” smokes, some $200 sneakers, and then coming back home to your $2M urban “rustic beach shack”?

Well at least the petrol is only $100 bucks a tank. Phew!

Otherwise the RBA really wouldn’t cut rates.

You get the point.

Don’t get me wrong, Australia is still a wonderful place to live, for now.

But dear me, we have cooked it in terms of economics – so much so we have a “productivity crisis”.

Not once have I heard of productivity being an issue in any other economy.

India doesn’t have a productivity crisis.

People are straight up hustling there.

Same goes for pretty much every other country in the world.

With the exception of the extraordinarily mismanaged UK.

And yet, in our lucky land we can’t figure out whether to blow +$200BN on new trains, or whether that money is better spent on corporate subsidies for failing metals processing industries.

Por que no los dos? The bureaucratic masses ask.

(That’s Spanish for: why not both?)

The bureaucratic masses now account for nearly 1 in 10 of every working age person in Victoria – excluding any headcount on the ~$4.2BN that Victoria spent on contractors and consultants in 2021-2022.

Those were the latest figures I could find too.

Why would they provide a transparent number on that anyway?

This is what happens when “nudgenomics” meets complacency…

As the quote at the start suggests – a nudge is supposedly gentle prod to get a person to do something.

Richard Thaler and Cass Sunstein were the originators of “nudgenomics,” and helped create “behavioral economics” by showing that people often make “irrational” financial and life choices shaped by cognitive biases.

Wow, what an insight. Irrational choices, you don’t say? Gobsmacked.

They pioneered the concept of “nudges,” subtle changes to choice architecture that steer people toward “better” decisions without restricting freedom.

We can fix people? Nice!

This is the intellectual backing we have for the ever-increasing durry taxes (and mandated inflation) in Australia that has resulted in the firebombings of ~125 Victorian tobacco stores in the past year.

And yet, we continue to just shrug, as long as house prices go up.

This is the secret sauce that ensures the complacency continues.

In a nutshell, the RBA is playing a game of interest rate chicken with Canberra over its fiscal spending.

Cut rates and they just incentivise the government to continue its fiscal largesse.

And then inflation gets out of the bottle again.

So it appears a battle of nudge and counter nudge is playing out in the halls of power in this country.

And if we’re not careful, our complacency will give way to an even more (poorly) managed decline.

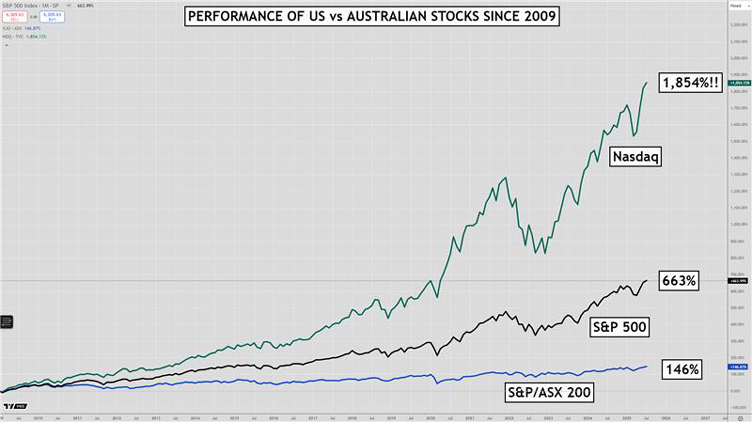

I believe that decline is evidenced in the long-term underperformance of the ASX 200 against many major international stock markets:

Source: TradingView

[Click to open in a new window]

Time for some hope…

If any of this resonates with you, I would encourage you to check out International Stock Trader – run by the rigorous and ever-astute Murray Dawes.

Capital is flowing out of Australia big time, people are now voting with both their feet and wallets.

Murray is an excellent guide on to how to trade international shares – and I know he’s been deep in the trenches waking up at weird hours to jump on overseas earnings calls.

Let him do the hard work for you.

Warm Regards,

Lachlann Tierney,

Australian Small-Cap Investigator and Fat Tail Micro-Caps

***

Murray’s Chart of the Day – Platinum

Source: Tradingview

Precious metals are in a melt-up phase with silver leading the charge.

Last week I said if silver slices through US$45.00 like butter we may be closer to the beginning than the end of the rally.

Silver hit $US46.50 this morning and has its sights set firmly on US$50.00 next.

I showed you the opportunity in platinum in June. After a few months of treading water we are seeing the next leg to the upside emerge.

In the chart above I have traced out the key buy and sell zones based on the huge rally from 1999-2006.

The point of control (POC) has acted as stiff resistance for the past decade.

Recent price action has seen a breakout above the POC which gives targets to the sell zone of the wave between US$1,800-2,050.

Now that precious metals are in a melt-up phase it may not take long to get there.

I am now applying my trading methods to international stocks. We are in one of the best bull market conditions I have seen in years and there could still be plenty of upside to come.

Don’t sit back worrying you have missed the best of the moves.

As they say, the best time to plant a tree was twenty years ago, the second best time is now.

If you want to get amongst it, trading stocks from all over the world, don’t miss your final chance to join me at a steep discount.

The offer is closing at midnight tonight and we may not offer a chance to get in at such a price for another year.

Just head here to learn how I use my trading methods to create free call options in positions where you aren’t risking your capital to find out what comes next.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

Comments