In today’s Money Morning…the key details of the RBA’s latest move…A-REITs could benefit…the AUD’s climb may hurt our exports…and more…

Editor’s note: In today’s video I discuss the headlines and charts behind the RBA’s rate cut and QE move, with a special focus on large-caps, A-REITs, and the AUD/USD pair. Please click the thumbnail below to view.

While all eyes are on the US election, the RBA has not so quietly unleashed a storm of funny money.

The consequences will take years to fully understand, but the RBA’s determination to give the beast what it wants could be felt over a short time frame.

I’ll give you three things to look out for in a moment, but for now here are the key details of the RBA’s latest move:

- Cash rate cut to .1%

- $100 billion purchase of 5- to 10-year bonds over the next six months

- Weekly purchases of around $5 billion

- 80% to come from commonwealth bonds, 20% to come from state government bonds

If the federal government’s budget was the defibrillator, then this move by the RBA is the adrenaline shot.

You’ve already heard that rate cuts rob savers to pay debtors, so I won’t go down that path again.

No, today I’m going to discuss some ‘second order effects’ that could flow from the funny money.

Three Innovative Fintech Stocks to Watch Now. Discover more.

#1: A pivot to value?

The ASX 200 [XJO] is stuck in a range still, partly because investors are still wary of Australia’s biggest companies.

Many are probably asking; will their earnings recover along with the economy?

Well, you may see some stirrings in the long-maligned value picks out there.

With low rates some of these larger companies may have access to cheaper capital, meaning an easier ride.

Now, I don’t expect a full-fledged value-investing renaissance, but it’s something to be aware of.

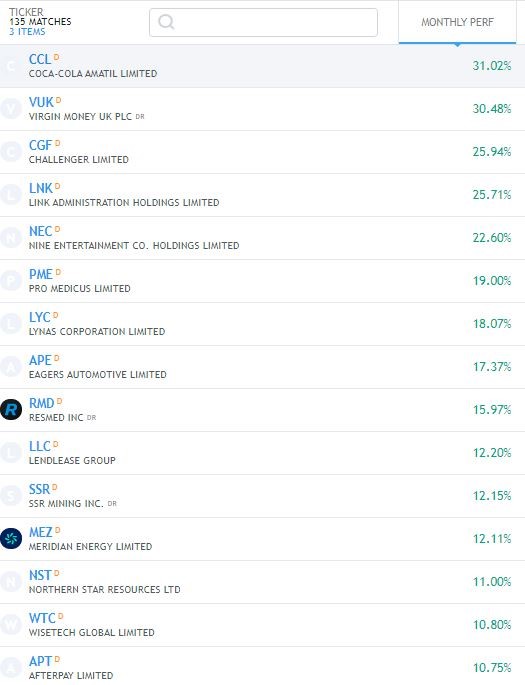

I’ve also got a selection of large-cap stocks with strong monthly performance below:

|

|

|

Source: Tradingview.com |

Coca-Cola Amatil Ltd [ASX:CCL] and Link Administration Holdings Ltd [ASX:LNK] are up there after a couple takeover bids were lodged.

You see Afterpay Ltd [ASX:APT] in there with some more muted growth at the bottom and a couple surprise packages as well.

In this case, I’m talking about Lynas Corporation Ltd [ASX:LYC] and Lendlease Group [ASX:LLC].

As relations in the Australia-China-US bizarre love (hate?) triangle deteriorate, Lynas is poised to benefit.

As for Lendlease, I have a theory about this move on the charts which segues nicely into my next point.

Namely, that the LLC share price uptick could be a leading indicator for a jolt to the largely dormant A-REIT sector.

#2: A-REITs could benefit from RBA’s move

You can see the S&P/ASX200 A-REIT Index [XPJ] below:

|

|

|

Source: Tradingview.com |

As you can see, range-bound just like the [XJO].

Now, recent A-REIT star Goodman Group [ASX:GMG] is up nearly 100% from the March market lows.

I suspect in the coming months you may see some long-term value punts for commercial real estate-focused A-REITs, and a bit more enthusiasm around A-REITs with exposure to residential real estate.

As opposed to this glut of defensive bets on industrial real estate like we are seeing with GMG.

Yes, much of the Australian residential property market has traditionally relied on wealthy foreign investors, but I wouldn’t underestimate domestic demand.

Australians love land speculation, it’s ingrained in our economic history.

More low rates should mean this trend continues.

Just look at what the Federal Reserve’s low rates are doing to the US housing market.

CNBC reported in late September that, ‘new home sales rose 4.8% to a seasonally adjusted annual rate of 1.011 million units last month, the highest level since September 2006.’

Something similar may play out in Australia.

Perhaps not as gangbusters as in the US, but definitely something to watch.

#3 AUD run to lose steam?

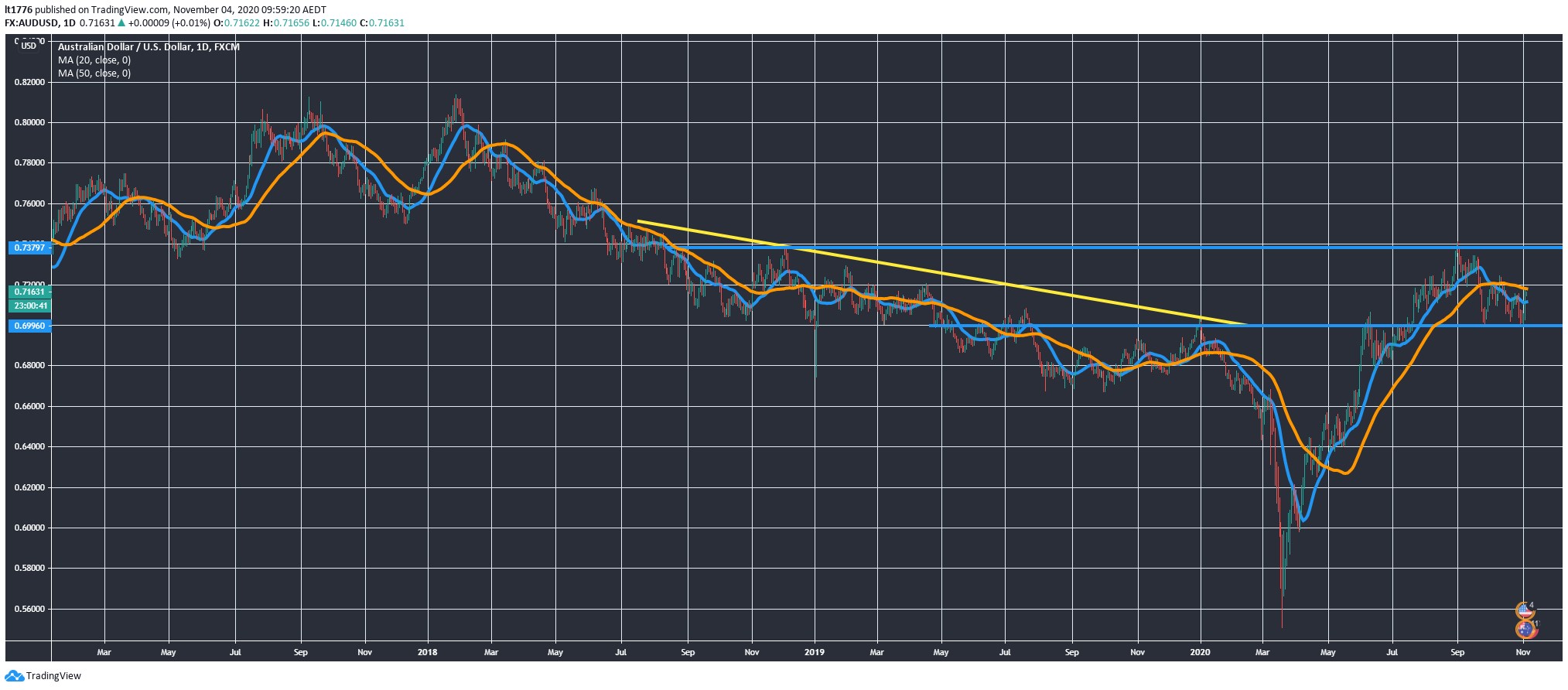

I’ve got a chart of the AUD/USD below:

|

|

|

Source: Tradingview.com |

It’s a weird one.

The USD is weak and so is the AUD.

It’s a bit of a tug of war on which will lose value quicker, the proverbial race to the bottom.

As Warren Hogan writes in the Australian Financial Review:

‘Despite years of unease at QE and various other forms of unconventional monetary policy, the RBA has finally crossed the Rubicon and joined the decade-long global currency wars.

‘It does not want to be criticised for not doing enough to support the Australian economy. Concerns about the negative consequences of these policy actions have been diminished in favour of throwing the kitchen sink at an economy it is clearly very worried about.’

The AUD’s climb may hurt our exports and the RBA clearly doesn’t want that.

The problem is when every central banker starts thinking the same way, some wild and wacky policy settings are sure to ensue.

We will see how it all plays out, but these are the three things I would be looking for in the coming weeks and months.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.