Nvidia’s results last week didn’t provide the clearcut signal for a resumption of the AI trade that I was hoping they would.

On the positive front, they beat analyst estimates on earnings and revenue, showing the AI build-out was still in full flow.

However, the glass-half-empty view was that they didn’t beat them by enough.

And on the whole, the results threw up more questions than answers for what comes next.

The stock finished the week down 8.69%.

But to put it in context…it’s still up 3.41% for the month, 141% for the year, and 2,750% over five years!

The best you can surmise from last week is that the AI story is still powering along.

However, uncertainties around timing and on where the profit opportunities lie beyond Nvidia are starting to enter investors’ minds.

In my mind, the right strategy is to be patient.

Use this time to research and build your list of quality tech companies, and then be ready to buy on market dips.

Remember, conditions could turn bullish quickly.

Interest rate cuts are coming… A certain driver of tech stock valuations!

Markets have virtually priced in a US rate cut in September. The only question is whether it is 0.25% or 0.5%.

And bond markets have priced in a likely 1% cut over three more meetings by the end of 2024.

Even here in Australia, there are signs that the big banks are expecting rates to fall.

Analysis from Rate City shows that 11 lenders have cut fixed-rate mortgages since August.

Some have even started cutting variable rates. Last week, I personally managed to get a small cut to my existing home loan rate by asking my bank questions.

Give it a go; you’ve nothing to lose!

Back on the global front, I also saw this interesting story come out of China on Friday:

| |

| Source: Bloomberg |

Rate cuts to US$5.4 trillion worth of Chinese loans will stimulate the economy.

And as I said last week, this is all good for the debasement trades of gold and Bitcoin over the longer term.

But in the short term look how the Chinese tech sector reacted to this news when it came out:

| |

| Source: CNBC |

This was the biggest one-day move for Chinese tech since June. And all thanks to the sniff of a defacto rates cut coming.

It’s not crazy to think we’ll see such moves play out in Australia and the US before Christmas.

So, go all in tech?

Not so fast…

You see, some tech companies out there could do worse in a lower-interest-rate environment.

Including one household name you’re probably familiar with.

Today’s piece is all about underlining the importance of knowing the business you’re investing in.

And by that, I mean how the company makes a profit.

Because it’s not always what you think at first glance.

Let me explain…

It’s not what you think

If you’re like me, you probably book a lot of holidays through Airbnb.

For a family of five with three young children, the convenience of having a kitchen, a garden, and several bedrooms (and hopefully a games room) trumps the luxury of a hotel.

Though I do miss room service!

But for us, Airbnb usually works out cheaper, too—our third child really scuppered hotels, as most deals are set up for two adults and two kids!

And we’re clearly not alone…

Airbnb is now a U$74 billion behemoth operating around the world.

It’s a classic start-up success story…

Airbnb was founded by Joe Gebbia and Brian Chesky in 2007.

The idea sprang up when the duo struggled to pay their rent and decided to use their loft’s empty space by turning it into a lodging space for people attending a design conference in San Francisco.

The rest, as they say, is history.

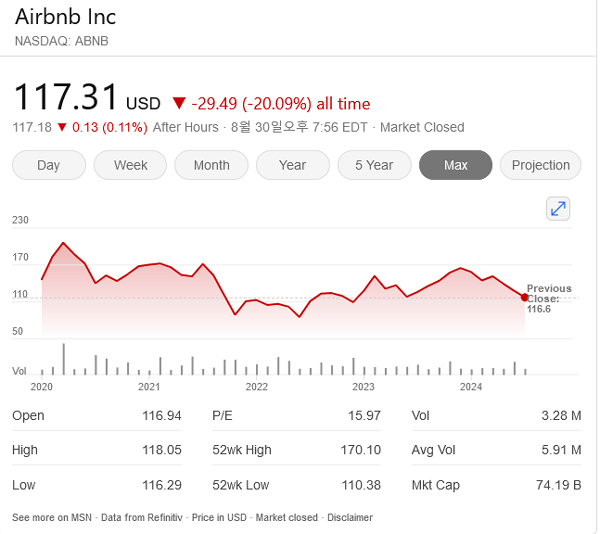

After 13 years of growth, the household name listed on the Nasdaq exchange in 2020.

It has traded mostly sideways since then (and is down 20% from its IPO price):

| |

| Source: Refinitiv |

So, with rates coming down, is it a good buy now?

I don’t know.

But here’s the thing…

If you bought Airbnb stock today thinking you were buying a travel company, you’d be wrong.

Well, half wrong, at least.

You see, right now, Airbnb makes a stunning 40% of its income from interest!

Yep, that’s right, interest on money in the bank is almost half their current earnings.

But where does that money come from?

Thanks for the interest

You and me!

When you book a holiday through Airbnb, you pay the cash up front, but the property owner doesn’t get the money until much later (when you actually go on holiday).

This free ‘float’ is worth approx. U$7 billion at any one time to Airbnb!

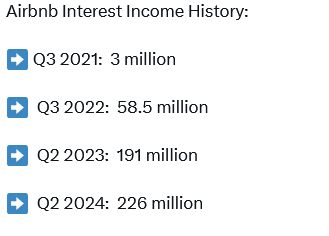

So, how much interest are we talking about here?

This is the interesting part (no pun intended!)…

Check out these stats from the financials:

| |

| Source: Airbnb |

Notice how income from interest has grown over the past four years as interest rates have risen?

As I said, this now accounts for 40% of Airbnb’s net income, up from 29% last year in the same quarter.

So, as you can see, the tailwind of interest rate rises has really helped Airbnb’s revenue.

But it leads to the next question…

What happens to this ‘income’ when rates fall?

That’s the hidden risk in Airbnb as an investment right now. And it’s a key fact if you’re considering this stock.

Airbnb is not alone in the tech world in this regard.

Stock trading app Robinhood currently makes around 47% of its total revenue from interest income, as it holds investors’ cash when they are between share trades.

There are others, and it’s worth digging into this when you analyse a company’s accounts.

The point is…

Know what you own as rates fall

My deeper point today is to point out that understanding how a company’s business model reacts to interest rate cuts should probably be front of mind right now.

You can’t just assume ‘interest rates down’ is good for every stock.

Of course, it’s not the only consideration.

However, in Airbnb’s case, you could argue interest rate cuts due to a recession would be a double whammy on the stock price (fewer people taking holidays).

Anyway, food for thought…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments