So, here’s the situation…

Stock markets are within a whisker of all-time highs.

Credit spreads – the difference in borrowing rates between various different types of borrowers – are as tight as they can be. This indicates lenders aren’t too worried about the risk of defaults.

Employment is at a level that would’ve been considered maximum employment for much of the last 50 years.

And yet…

Over the weekend at the annual Federal Reserve pow-wow in Jackson Hole, Fed chief Jerome Powell just told us all rates are coming down.

And fast!

The question everyone is asking is, why?

Let me explain what I see coming next, as well as three investments to play this ‘Powell pivot’…

Sticking the soft landing

Why the sudden pivot?

Is inflation no longer the worry it once was?

From Powell’s own words, it seems not.

The bigger worry now is a fast-deteriorating jobs market.

Some choice quotes from the Jackson Hole meet-up include:

“The cooling in labour markets is unmistakable.”

“It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon.”

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

That’s the official line, at least.

Or maybe it’s just an excuse to do what he wants to do anyway?

One theory I’ve seen floating around is that the Fed is trying to pre-empt the pain.

This is the ‘stick the soft landing’ scenario.

To do that, the Fed needs to get things back on an even keel before it becomes too obvious in the data.

They want to return to a neutral interest rate setting as soon as possible, which most agree is around 3.5%.

Today, we’re at the far more restrictive level of 5.25%.

Whatever the reasons, it seems Powell and Co. will reduce rates. On that everyone is in agreement.

Markets have already priced in interest rate cuts at every meeting through to June 2025!

And I’ve seen reports over the weekend that the big banks here in Australia are already lowering their fixed rates on mortgages, too.

So that’s a bit of good news for struggling mortgage holders.

But does it mean markets are about to fly too?

They certainly could…but with some important provisos…

Record funds ready to be deployed

Make no mistake…

In the short term, this Powell pivot could well and truly juice the markets.

The theory is simple enough to understand.

As interest rates come down, investors tend to rotate their money out of safer assets like cash savings and bonds, and into riskier plays like stocks.

If that happens, what’s interesting to note is just how much dry powder there is ready to be deployed.

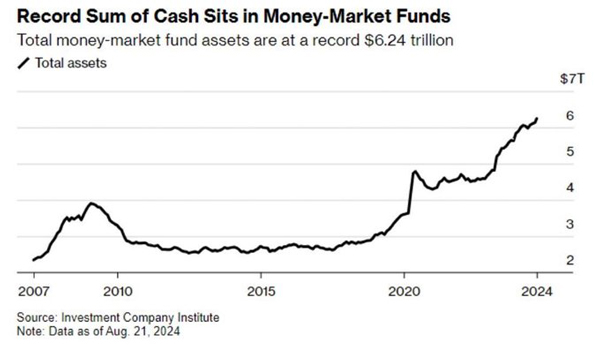

Check out this chart:

| |

| Source: Investment Company Institute |

Money market funds are currently sitting on a record amount of money. US$6.24 trillion dollars to be exact.

If that money starts to enter the stock market, we could see the bull run roar up again in earnest.

It’s not just the US that has the potential to juice the markets with more money either.

Check out this chart of liquidity injections from the Chinese central bank (PBOC):

| |

| Source: Bloomberg |

After tightening conditions for the past 12 months, there are early signs the PBOC is easing up again.

Much like in the US, more money floating around tends to find its way into all sorts of asset prices, including the stock market.

Of course, all this central bank intervention isn’t without risk.

For one, we could see inflation rise faster than central bankers hope.

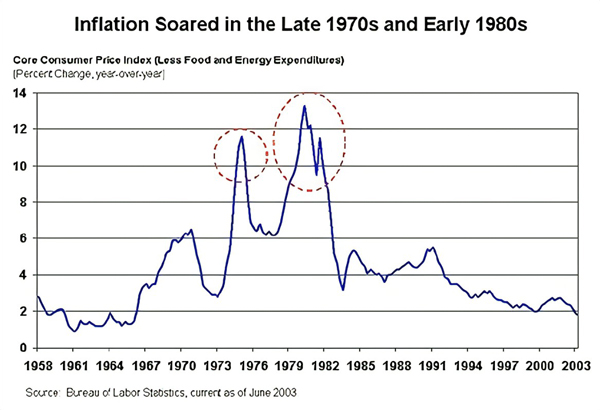

And if you look at this chart from the inflation-riddled era of the 1970’s you can see a ‘false starts’ before eventually they got things under control:

| |

| Source: Bureau of Labor Statistics |

The other major risk is that the Fed is reacting this way because economic conditions are worsening faster than the data shows.

If that’s the case, the faster and lower rates go, the worse things might turn out to be in the economy.

As Aussie analyst David Scutt put it recently:

‘With markets pricing a cut at every #Fed meeting out to June 2025 (including a 50 somewhere), we’re arguably starting to border on hard landing territory. If we see easing bets swell further, it’s unlikely to be good news for riskier asset classes. Be careful what you wish for!’

A global recession wouldn’t be good for stock markets, no matter what rates are doing.

And then there’s the Japanese carry trade dramas we’ve discussed a lot recently.

Lower interest rates in the US have the potential to increase the value of the Japanese Yen, resulting in a resumption of the stock market sell-offs we saw three weeks ago.

The Yen already started strengthening against the US dollar last week and is up 6.52% for the month.

So what do you do?

Given all these competing factors, I think there are three compelling areas for you to look at this week…

Two debasement trades and one date to watch

The first investment opportunity is the ‘hard money’ trade.

I’m talking Bitcoin [BTC] and gold.

After all, if central bankers in both the East and West are turning back on the money printers, the appeal of currencies that can’t be debased becomes even more obvious.

Gold is already at record highs, a clear signal that investors are acutely aware of this fact.

And as Powell spoke over the weekend, Bitcoin shot 10% higher, clearly indicating what the crypto community thinks of it all.

The relationship between gold and Bitcoin is interesting to note too.

Check out this chart:

| |

| Source: Peter Brandt |

This chart shows the relationship between the price of Bitcoin and the price of gold.

The ratio is presently at 23.4.

Bitcoin remains below the 2021 high. An advance above 32.5 is needed to declare BTC/GC in a bull trend.

If that happens, expect to see a parabolic rise in the price of Bitcoin, even as gold rises too!

Beyond the ‘hard money’ trade, I’m also closely monitoring the tech sector this week too.

More specifically, the potential resumption of the ‘AI trade’ that dominated much of 2023 and early 2024.

On that front, a key date to watch will be Wednesday, the 28th of August.

This is the day Nvidia Corp [NASDAQ:NVDA] is due to release their next set of quarterly earnings results.

Given Nvidia’s dominance in the production of GPU chips for AI, it will tell us how the overall AI story is playing out.

If these results surprise the upside, it could spark the entire tech market back to life after a couple of months of pulling back from previous highs.

The key figures to watch are:

- Earnings per Share (EPS): Analysts project an EPS of approximately $0.63, representing a year-over-year increase of about 133.3%.

- Revenue: Revenue is expected to be around $28.54 billion, reflecting a year-over-year growth of over 211%.

A ‘beat’ on these two figures against a backdrop of falling interest rates could re-ignite the AI trade with a vengeance!

That’s the bullish outlook, at least.

On the other hand, a surprise to the downside might confirm broader economic fears and do the exact opposite!

Whatever way it falls, it’s set to be a very interesting week with lots of moving parts for you to watch…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments