The RAIZ Invest Ltd [ASX:RZI] said it is set to reach $1 billion in funds under management (FUM) ahead of schedule.

Despite this, RZI share price was down 5% at time of writing.

Today’s sell-off comes a week after a company associated with Raiz’s CEO George Lucas — and which is a substantial shareholder in Raiz — called for a general meeting to remove three company directors.

The management turbulence is likely clouding today’s solid growth metrics.

Zooming out, however, shows RZI shares gained over 140% in the past 12 months.

Now, let’s switch our focus to the recent announcement by the company.

RZI’s August key metrics

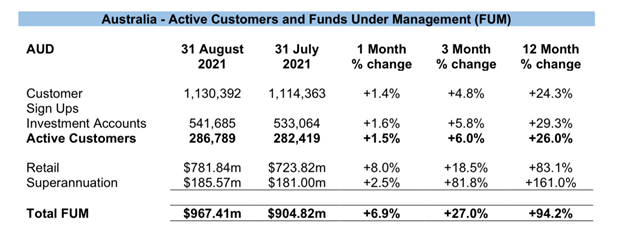

Raiz released some promising Australian, Indonesian, and Malaysian Active Customers and Australian Funds under Management (FUM) numbers.

Global active customers jumped from 484,975 on 31 July 2021 to 508,124 on 31 August 2021, marking a 4.8% increase for the month.

Global active customers increased by 85.4% in the 12 months to 31 August.

Let’s breakdown these numbers by segment.

Active customers in Indonesia are up 11.3% for the month, jumping from 129,574 to 144,269 by 31 August 2021.

Malaysia also saw an increase of 5.6% as the number stood at 77,066 from 72,982.

This brings us to Australia.

Active customers rose from 282,419 in July to 286,789 in August, marking an increase of 1.5%.

For the 12 months, active customers increased by 26%.

Raiz Managing Director/Global CEO George Lucas offered this comment:

‘Raiz is ahead of schedule to reach its $1 billion target of Funds under Management (FUM) by 31 December 2021.

‘Although markets are often volatile in September and October, we remain cautiously optimistic this milestone will be reached, with FUM growth of 6.9% in August (compared with a 1.9% rise for the ASX) to $967.4 million being another important step towards this goal.’

What’s next for RZI Share Price?

Today’s numbers — despite showing growth in key areas — were not enough, it seems, to dispel the cloud hanging over RZI’s management.

The company may trade under some selling pressure until that board issue is resolved.

However, once the air is clear, investors may well refocus on RZI’s fundamentals.

The company reported a 37% increase year-over-year in revenue to $13.4 million in FY21 results and today announced it’s ahead of schedule to reach its $1 billion FUM target.

If you are looking to explore the fintech sector further, then I recommend checking out Money Morning’s 2021 fintech stocks report.

The report outlines the growing fintech industry and also profiles several fintech stocks.

Access your free copy of the report here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here