At time of writing the RAC share price is trading at $2.12 up 7.07%.

Race Oncology Ltd [ASX:RAC] announced the initiation of a breast cancer clinical trial program.

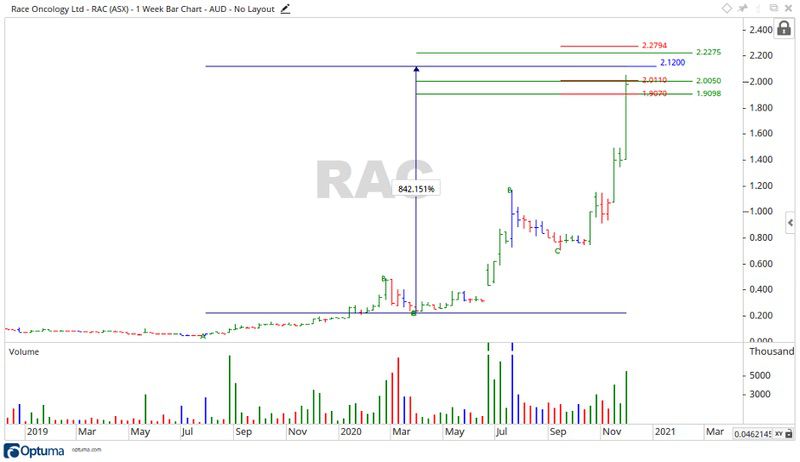

Source: Optuma

The trails at Race Oncology

Breast cancer affects both men and women.

19,807 females were diagnosed in 2020 along with 167 males.

It accounts for an estimated 6.3% of all cancer deaths.

The chance of surviving at least five years is 91%.

It is the other 9% the medical industry would like to eliminate.

In a recent announcement, Race Oncology along with the University of Newcastle released the results of their research program.

The aim of this research program is to identify combinations of current breast cancer drugs that when paired with Bisantrene show equivalent efficacy to existing treatment options, but with significantly reduced serious side effects.

The results showed Bisantrene to be an effective chemotherapeutic agent across a wide range of different genetically defined breast cancer subtypes.

Race Oncology appointed a clinical research organisation, George Clinical.

This is to deliver a scoped and costed clinical proposal in 13 weeks.

The Race Oncology share price

The RAC share price took a minor dip into the March low. The company seemed insulated from the impact of the pandemic.

From the low, the share price moved up more than 840% to the price at time of writing.

Source: Optuma

Increased trading volume is pushing the move up, a sign of confidence.

If this continues, then a new all-time high around the $2.25 level may be set in the future.

Should the share price take a short-term retracement, the levels of $2.00 and $1.90 may be enough to halt the fall.

Source: Optuma

Race Oncology continues to run up in price over the last couple of years. If the new trails are anything to go by then this may continue.

The last seven weeks saw a rapid rise in price so a pull back may be due in the short term.

Long term, Race Oncology may be one to keep an eye on.

Regards,

Carl Wittkopp

For Money Morning