Dear Reader,

And so, we go for another week here at the Daily Reckoning.

All the market is agog with the idea of Quantitative Easing from the Reserve Bank of Australia.

Is it money printing? Will it cause an asset boom?

The answer is…it depends!

Aussie Property Expert’s Bold Prediction for 2026. Discover More.

I know. I know. You want a tidy, no nonsense answer so you can make money and sleep at night.

Unfortunately, the financial world can’t be reduced to one factor.

Anyone who links the market direction to QE and QE only is only telling you one part of the story.

There’s a more troubling factor when it comes to reporting on QE.

Almost no one mentions the importance of private credit creation alongside this.

This is where the mystery of Japan is instructive.

For years the Japanese Central Bank conducted ‘QE’ as part of its monetary operation.

The Japanese economy remained mired in deflation and its stock market languished.

The reason — as far as I know — is that the Japanese banks remained risk averse with their lending.

While Japanese QE was big, total credit creation in Japan remained low.

Such is to say, the QE from the Japanese central bank merely offset — and maybe not even as much as that — the contraction from the Japanese banks.

This is also why the apocalyptic inflation scare stories never happened after 2008.

The Fed’s QE was big…but not inflationary when the US private banks were weak from the subprime crisis and only lending to the already rich.

That brings us to Australia today. The Reserve Bank of Australia recently announced $100 billion in QE to happen over the next six months.

$100 billion sounds like a lot of money. But not in the context of total private debt in Australia…which is around $3 trillion.

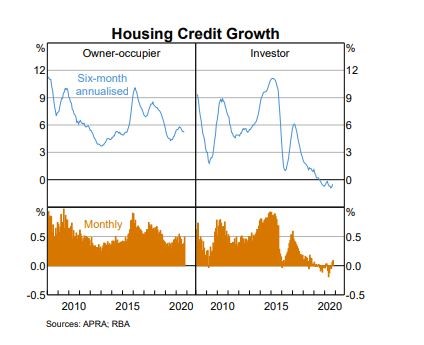

The question is: Is this private debt growing or falling? Right now, I’d say it’s neither here nor there. Credit growth is very low but not quite negative as far as I can tell.

What could crank this back up again?

The property market, of course!

One of the most marked aspects of the Australian economy right now is the collapse in investor loans for property in recent times.

Check out the swan dive here:

|

|

| Source: APRA |

You likely know the reasons. The Banking Royal Commission and COVID-19 have been like a one-two punch.

Perhaps the most amazing thing is how resilient property has been under this scenario (relative to the perception of it being about to burst).

What are the facts? CoreLogic says that, across all metro and non-metro markets, Australian dwelling values dropped by 1.7% between April and September. Real estate is now rising again.

The extent of the next housing boom will be determined by the amount of credit created to invest and speculate in it.

Think about that for a moment. The usual fear of the leveraged investor is that interest rate rises will kick in and make servicing the debt prohibitive or dangerous, or both.

But the RBA has already committed to keeping interest rates suppressed at crazy low levels. They can step in and buy bonds in unlimited quantities to achieve this.

What bigger signal could there be for those with the cash flow and financial muscle to load up on property?

The state and federal governments are running huge deficits to stimulate the economy as well.

The infrastructure spending will juice real estate values in the nearby areas and also keep people employed.

The government is, in one sense, subsidising rental payments to the landlord class.

But is this scenario likely?

I have a pleasant surprise for you. You don’t have to take anything I say on faith.

The share market is telling you.

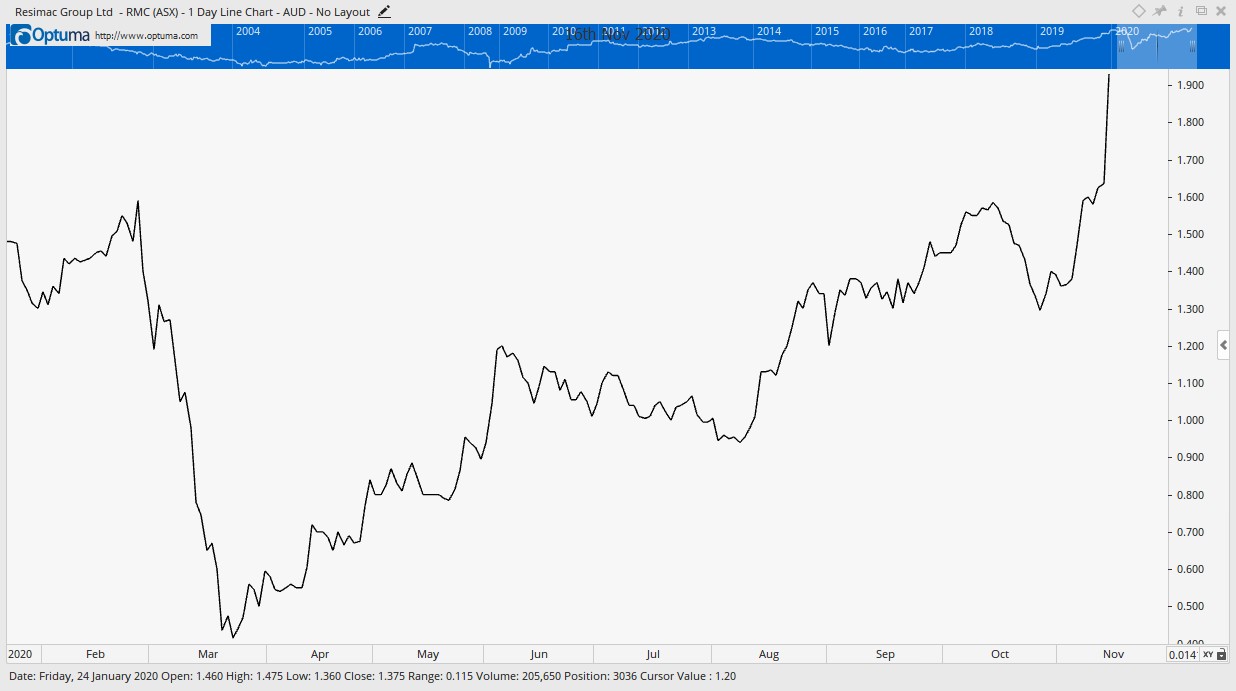

Go and look up real estate stocks. They are rising. I could show you many. But one will do.

Take a look at the chart of non-bank lender Resimac Group Ltd [ASX: RMC] since the March bottom:

|

|

| Source: Optuma |

It’s now higher than it was before the crash.

Hello. Clearly they are making money right now and the future is looking bright.

The informed weight of money in the market is telling us this.

We are nowhere near a property crash. The fuse for the next boom is already lit…and it’s shaping up to be a doozy.

Want to know the best way to cash in on it? Go here.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.

Comments