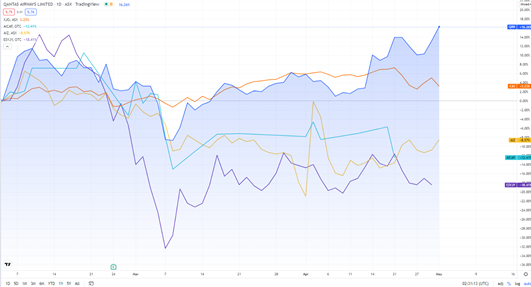

Following a positive profitability forecast for FY23, Qantas’s [ASX:QAN] share price has increased by 2.86% today, trading at $5.76 per share.

QAN shares have risen 9.73% this past month and 16.16% over the last 52-week cycle.

The Australian airline has been performing well in its sector, up 8.68%, and against the broader market is up 12.21%.

Qantas is just short of regaining its 12-month peak despite COVID disruptions causing some expected turbulence in its industry.

Air New Zealand (AIZ), Air China (AICAF), and particularly EasyJet (SYJY) are not faring as well, all sitting considerably low on the ASX 200.

With COVID restrictions easing and countries like Canada removing testing on entry, hasn’t the time come for airlines to flock to the skies once more?

Source: Tradingview.com

Qantas anticipates profitability in FY23

Today’s third-quarter trading announcement from Qantas was uplifting, with the airline expecting to regain profitability in FY23.

Domestic travel was reported to be returning to pre-COVID levels ‘ahead of expectations,’ and demand for international travel increased.

The group expects domestic capacity to rise to pre-COVID levels by Q4 FY22. However, international capacity is still expected to sit under 50% by this time.

For the second quarter of 2022, the airline expects underlying EBITDA to reach around $450–550 million.

At the height of the COVID restrictions, border closures saw Qantas facing a top of $6.4 billion in debt.

However, due to substantial revenue growth during the third quarter, Qantas estimated net debt to drop to around $4.5 billion at the end of April.

Qantas reported a robust recovery in travel demand as Australia adapts to COVID-normal life, reporting that the ‘return of domestic travel demand ahead of expectations, solid international performance, and strong contributions from Qantas Loyalty and Freight drove significant levels of positive free cash flow in the quarter.’

The airline reported that its return to profitability is in part propelled by the company’s $1 billion transformation program.

Qantas still expects capital expenditure to remain at $2.3–2.4 billion in next financial year.

Source: Qantas

Qantas fleet expansion

Today, Qantas also profiled several next-gen fleets that it hopes will generate employment opportunities, assist in delivering substantial shareholder value, and enhance future travel options by 2034.

40 narrow-body jets will be acquired for domestic flights as part of the company’s ‘Project Winton and 12 international airbuses will support non-stop flights to cities like New York and London with ‘Project Sunrise’.

CEO Alan Joyce said:

‘The A350 and Project Sunrise will make any city just one flight away from Australia. It’s the last frontier and the final fix for the tyranny of distance. As you’d expect, the cabin is being specially designed for maximum comfort in all classes for long-haul flying.

‘We have come through the other side of the pandemic a structurally different company. Our domestic market share is higher and the demand for direct international flights is even stronger than it was before COVID.’

Source: Qantas

QAN share price outlook

Qantas reports business travel is returning in force, with small businesses now exceeding pre-COVID levels and corporate travel rising 85%.

Bookings for London, Los Angeles, South Africa, and Bali markets are now above pre-COVID levels, with more than 60% of Asian destinations also opening up.

The world appears to be itching to travel again as international restrictions are eased — does this mean a new era for the airline industry will soon be emerging?

We’ll have to wait and see if the other airlines manage to bounce back in the same way and if these newfound freedoms stick.

However, when there’s uncertainty hanging in the air, it’s usually a prime time to go stock bargain hunting.

You could stumble across some high-quality, powerful stocks that have been discounted to ridiculous prices.

If you’d like to get some tips on where you might find some of these bargains, click here.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia