The Pushpay Holdings Ltd [ASX:PPH] share price is down 16% today as the market digests the fintech’s FY22 half-year results.

Pushpay, a donor and church management platform, saw operating revenue rise 9% but the fintech nonetheless downgraded its EBITDAFI guidance for FY22.

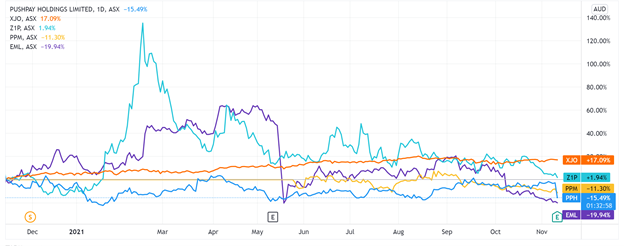

Like many of its ASX fintech peers, the PPH stock is underperforming the ASX 200 this year.

The PPH share price is down 15% over the last 12 months.

But let’s dig deeper into why Pushpay is cratering today.

PPH’s HY22 results: what’s the catch?

Let’s start with the good news.

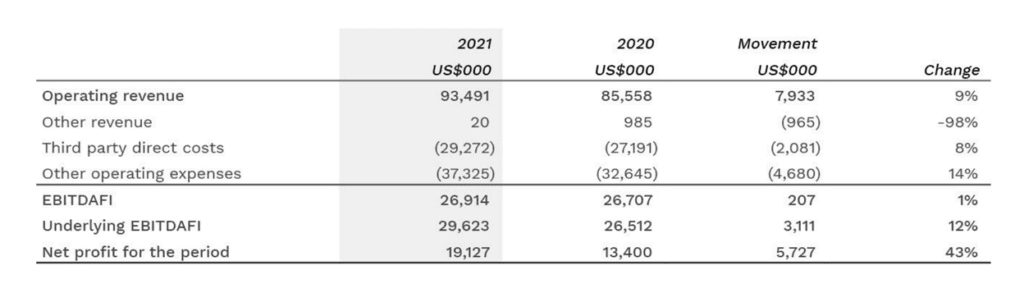

Total revenue was up 8% to $93.52 million.

And total net profit was up a healthy 43% to $19.13 million. This is despite PPH’s operating expenses rising by 14% in the period.

Pushpay’s total processing volume (TPV) also rose, elevating 9% from US$3.2 billion to US$3.5 billion. The rise in TPV corresponded with a rise in total customers.

PPH grew its customer base by 29% and now has 14,095 customers on the books.

These are all solid results in PPH’s key metrics.

So what’s the catch?

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

A softer period and lower than expected TPV growth

Pushpay’s CEO Molly Matthews acknowledged today that PPH saw a ‘softer period to begin the first half of the current financial year.’

That said, Matthews was quick to note PPH’s TPV growth in the second quarter was higher than the first quarter.

However, what likely drew investors’ attention was Pushpay admitting its total processing volume growth was lower than expected.

The fintech flagged ongoing COVID-19 impacts, especially in the US.

Pushpay also said it felt the impact of rising wage pressures, expecting its staff costs to rise more than originally anticipated.

All in all, these developments led PPH to downgrade its underlying EBITDAFI for the year ending 31 March 2022.

EBITDAFI looks like a word salad, but its Pushpay’s favoured financial metric.

EBITDAFI excludes costs such as acquisition expenses, with Pushpay saying EBITDAFI better reflects the firm’s performance.

Pushpay is now expecting to achieve underlying EBITDAFI of between US$60.0 million and US$65.0 million, although it admitted uncertainties surrounding COVID-19 and the broader US economic environment remain.

Matthews commented:

‘Over the period, Pushpay further set the foundation for future growth. We increased the number of Products purchased and welcomed new Customers, while continuing to successfully realize strategic product bundling opportunities within the Customer base.

‘We completed the strategic acquisition of Resi Media and made significant enhancements to our existing product suite.

‘Our performance represents the value that our customers attribute to Pushpay’s differentiated solutions and the meaningful progress achieved as we continue to execute against our strategic goal of being the preferred provider of mission critical software to the US faith sector.’

For more fintech stock ideas, check out our telling report on the niche sector.

The report profiles three companies worth researching.

You can get your free copy of this report, right here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here