Multinational PSC Insurance Group [ASX:PSI] has announced that it has entered into a binding scheme implementation deed to acquire all of the shares of Ensurance [ASX:ENA] for $25.2 million.

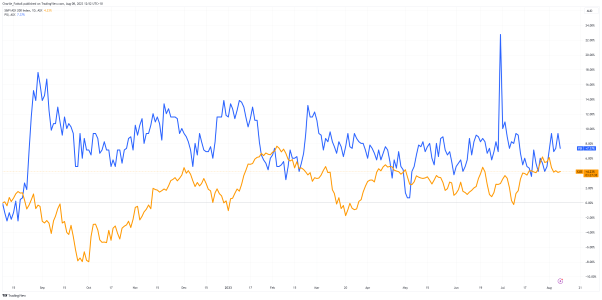

Shares of PSC were down by 1.22% today while Ensurance saw its shares explode in morning trading, with shares up 33.75%, trading at 26.8 cents per share.

PSC Insurance specialises in turnaround acquisitions within the insurance sector, with a long track record of reviving businesses that operate within Australia, the UK, Hong Kong, and NZ.

It has had a slow and steady year of growth with shares of PSC up by 8.04% in the past 12 months.

The only notable shift from its usual trading occurred right before the end of the financial year, which saw a massive jump.

This had some market watchers accusing funds of attempting to take advantage of the relatively low liquidity in PSC to boost their period-end performance.

Source: TradingView

PSC offers $25.2 million for Ensurance

PSC Insurance has issued a bid for Ensurance today. To fund the acquisition, PSC will issue 5 million shares to ENA shareholders and pay any difference in value to the $25.2 million remaining in cash.

The purchase price represents an implied valuation of Ensurance of $18 million plus $7 million in assets, largely represented in cash held by the company.

The valuation represents a 40% premium to ENA’s closing price on Monday of 20 cents a share.

Ensurance operates an Australian-based underwriting business specialising in construction and terrorism & sabotage underwriting across Australia and the UK.

PSC said the acquisition will add a high-growth operation and new product suite to PSC’s Australian Specialty businesses led by PSC’s Adam Burgess.

PSC expects an annualised EBITDA of over $1.5 million in the first year of the acquisition, with stronger growth expectations in the future.

The implementation deed includes the usual exclusivity terms, which include the ‘no shop, no talk’ restrictions and matching rights for PSC in relation to any competing proposals.

The acquisition should be completed without too much drama from either side. However, it would not be the first time this year that PSC has pulled out of discussions.

Back in May, a planned joint venture between PSC and AUB Group [ASX:AUB] was scrapped unexpectedly by PSC without explanation.

At the time, PSC simply stated that:

‘The group has a solid pipeline of acquisitions, and our balance sheet is in a strong position to continue to grow this with our selective and disciplined M&A (mergers and acquisitions) strategy.’

The ENA board has unanimously recommended that shareholders approve the scheme in the absence of a better deal. With company directors holding significant chunks of voting shares, it appears a forgone conclusion.

Outlook for PSC Insurance

This acquisition is a sound strategic move for PSC Insurance as it expands its footprint into construction and financial security for critical infrastructure.

ENA is a well-respected business with a strong track record of growth. Its rather specialised segment of insurance will broaden PSC beyond its existing construction underwriting companies such as Chase Underwriting.

Some market signals could spell trouble on the waters for construction insurance as cost increases, bad weather, and labour shortages have slowed the country’s construction.

The total industry’s pipeline of work sits at a record $224 billion.

Construction insolvencies have surged to 2213 so far this year, the highest in the last decade.

Whether this makes a material difference to ENA remains to be seen — for now, the deal looks promising.

The acquisition is accretive to earnings from the outset, which should make it a great opportunity for PSC Insurance to grow its business and create shareholder value.

PSC expects an EBITDA of approximately $111 million for FY2023 and has issued guidance of $122–127 million for FY24.

I expect that the acquisition of ENA will be a positive development for PSC Insurance and will create a strong player in the construction, plant and equipment insurance industries.

Last day for a big window of opportunity

Before you go, I wanted to show you a recent presentation by our veteran trader, Murray Dawes.

Murray has the experience and patience to know when to pursue great trades.

He has had a 33% average portfolio return since 2018 and is known for waiting for the perfect time to move.

And he’s spotted an opportunity to pick up bargains he thinks don’t come around too often.

He’s dubbed it ‘Window 24’ and today is the last day to join.

Murray isn’t a fast and loose trader but a meticulous reader of charts and manager of risk.

So, when he thinks there are buying opportunities, it’s worthwhile to listen.

You can check out Murray’s ‘Window 24’ presentation here.

Regards,

Charles Ormond,

For The Daily Reckoning Australia