It would be one thing if the US economy were declining while the rest of the world was growing in ways that may help the US. But that’s not the case. The rest of the world is also declining. We’re amid a global recession, a rare state of affairs.

China, the world’s second-largest economy, recently reported second-quarter GDP growth at an annual rate of 0.4%. That’s extremely close to 0%, a far cry from China’s 30-year average of 10% growth and more recent performance of annualised growth in the 5% range.

The fact is, China is certainly in a recession. The Chinese consistently lie about their economic statistics and overstate performance. If they’re willing to admit to 0.4% growth, it’s almost certainly the case that actual growth is negative. At the same time, youth unemployment in China hit 19%, a level associated with economic depression.

The zero-COVID fiasco

This Chinese performance can be attributed in part to the ridiculous zero-COVID policy of Chairman Xi Jinping. The quest for zero outbreaks of COVID might as well be a quest for zero colds and sniffles. It can’t be done. But Xi did lock down Shanghai (26 million people), Beijing (22 million people), and other major cities on a repeated and seemingly random basis in recent months — and continues to do so.

This policy will not be relaxed soon. It will certainly continue at least through the 20th National Party Congress this fall (when Xi will be made de facto president for life) and possibly beyond. [Note: This was originally published in August 2022.] Xi does not want to rock the pandemic or political boats before the party congress.

Still, that’s not the only drag on growth in China. If China is the ‘factory to the world’, it follows that if the world slows down, the factory will slow down. That appears to be happening as slower growth (or recession) in the US and Europe reduces demand for Chinese exports.

The US and China go their separate ways

The final nail in the coffin is that China and the US are in the midst of a historic decoupling. This is globalisation in reverse, or at least a new form of globalisation.

US firms are closing certain operations in China and making new investments in favour of moving capacity back to the US, or at least to friendly countries such as Canada, Australia, and India. This movement goes by the name of ‘friend-shoring’ and will be a major headwind to further growth in China.

Japan, the world’s third-largest economy, is not much better off. Data shows that Japan is entering a new recession — its ninth recession since the super bubble burst in 1990. Central Bank Governor Haruhiko Kuroda will not raise interest rates to fight inflation or defend the yen. He’s leaving office in mid-2023 and looks forward to a comfortable post-official world of board seats, think tank positions, and other remunerative honours. He doesn’t want to jeopardise that scenario with a policy blunder in the home stretch. So he will do nothing.

This leaves Japan facing both inflation and slower growth, a condition called ‘stagflation’, which is also confronting the US. Japan’s bilateral trading relationship with China is as important to Japan as its trading relationship with the US. The Chinese slowdown has a contagion effect in Japan as capital inflows to China dry up.

Russia could turn off Europe’s gas

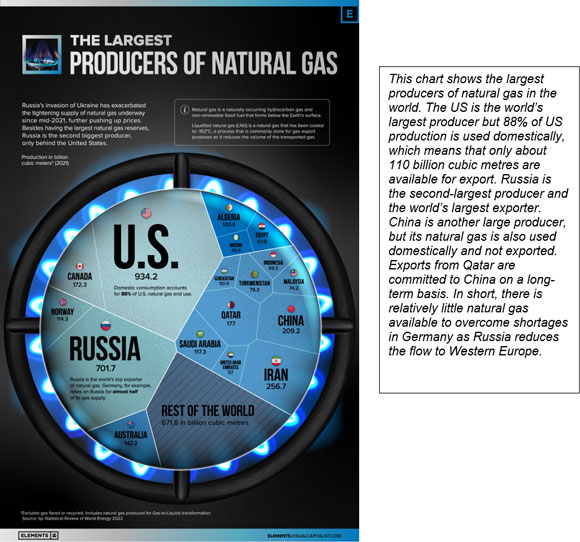

Germany, the world’s fourth-largest economy, may be in worse shape than China and Japan by late this year. In addition to the global slowdown affecting major exporters like Germany, there are negative factors unique to Germany. It’s in the crosshairs of Russia’s efforts to sustain its position in Ukraine by cutting off supplies of natural gas to Western Europe and Germany in particular.

Russia has had little difficulty shifting exports of oil and natural gas to willing buyers, including India and China. There are some logistical challenges, and Russia has resorted to discounted pricing, but the flow of energy from Russia continues, and the flow of hard currency to Russia at a rate of US$21 billion per month also continues.

This gives Russia the option to cut off energy supplies to Western Europe without damaging its economy. Russia has cleverly done this by reducing natural gas flows gradually instead of all at once. It has also offered a series of excuses for reducing gas flows, including ‘maintenance’ on a key turbine/compressor component on the Nord Stream 1 pipeline. (The Nord Stream 2 pipeline is complete but has never received authority to begin operations, which also suits Russia’s plans.)

|

|

|

Source: Visual Capitalist |

Putin’s strategy is to force Germany to deplete its natural gas reserves during good weather. When the cold weather hits, Germany will be out of reserves and will not receive more gas from Russia. At that point, Germany will have to shut down manufacturing, ration what little natural gas may be available, and ask consumers to turn thermostats down. Hot showers will be limited to five minutes or less. Germans will wear fleeces and heavy sweaters indoors. It’s a sad state of affairs for a major economy, but it’s how things turn out when ideologues in office support corrupt regimes such as Ukraine against mega-energy powers such as Russia.

One can wish the Germans well, but from the US’s perspective, the situation in Germany is just one more leg kicked out from under the table supporting global growth. Global contraction is the new normal.

All the best,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia

This content was originally published by Strategic Intelligence Australia, a financial advisory newsletter designed to help you protect your wealth and potentially profit from unseen world events. Learn more here.