At time of writing, the share price of Prospect Resources Ltd [ASX:PSC] is up 22.22%, trading at 22 cents.

A wild ride for investors played out over the course of the last 12 months, as you can see below:

Source: tradingview.com

Intraday trading brought it past resistance at 25 cents briefly, before settling at its current price.

The company announced today that it had signed a seven-year offtake agreement with Belgian company Sibelco for its Arcadia lithium project.

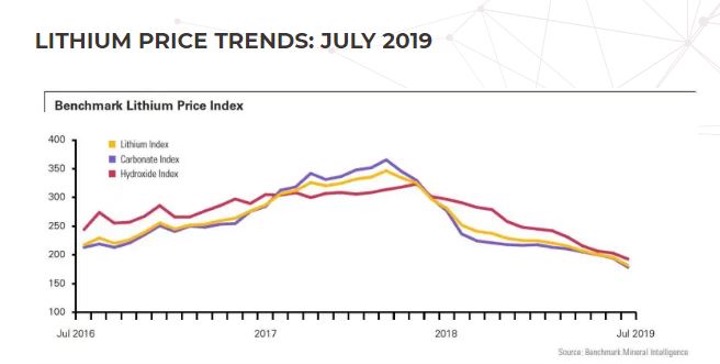

Lithium price is in the doldrums, but PSC’s share price shows importance of offtake agreements

You can see the various lithium prices below:

Source: Benchmark Minerals

And here are the key terms of the offtake agreement for the Arcadia project:

- ‘Term: 7 years from declaration of commercial production

- Annual Supply: Up to 100,000 dmt per annum of ultra-low iron petalite concentrate

- Specification: 4.1% Li2O, 0.05% Fe2O3 ultra-low iron petalite concentrate

- Annual Meetings: The parties will annually agree [on] binding delivery quantities, pricing and end customer contract terms for the following year

- Pricing: Parties to share end-customer sales receipts in agreed proportions after recovery of their respective costs

- Payment: Irrevocable letter of credit

- Termination rights: Prospect may terminate the contract if Sibelco does not purchase at least 10,000 tonnes of Product in each of two successive quarters for any reason other than that the global market price for petalite is below an agreed price level

- Sibelco may terminate the contract if Prospect does not meet the agreed production levels of Product for two successive quarters’

The offtake agreement now provides a layer of certainty for the company, so it’s an important step for PSC.

PSC claims it will be the world leader in ultra-low iron petalite production once Arcadia gets going.

Arcadia’s petalite is aimed at the glass and ceramics industry, and Fior Markets is projecting that the industry will grow by a compound annual growth rate of 5.43%.

Sibelco’s role here could be crucial — with PSC holding $1.698 million in cash as of 30 June.

Outlook for PSC share price

Although the PSC share price took off today, the cash balance could be a concern.

Notwithstanding the US$10 million funding commitment from offtake partner Sinomine, referenced in the most recent quarterly update.

The discussions with Afreximbank remain ongoing.

It is also worth noting that the proposed mine is located in Zimbabwe.

Regards,

Lachlann Tierney,

For Money Morning

PS: Interested in hearing more about lithium? Check out our three favourite lithium stocks in this report.

Comments