My 4-year-old daughter Luna is standing in the GaGa pit at her sister’s primary school yesterday.

It’s 15 minutes before the school bell goes to start the day.

Luna has a ball in her hands, ready to give it a kick. A crowd encircles her.

One of the boys yells out, ‘Luna, kick the ball into someone’s nuts!’

There was an uproar of laughter — including from me.

It reminds me of the markets.

Investors are always waiting for something to hit them hard between the legs.

Today’s Fat Tail Daily shows you two reasons to be positive instead….and why you can keep your hands by your sides!

This is proof you should be using this period to accumulate cheap stocks…especially the small caps!

Let’s take the first one…

1) Car Sales!

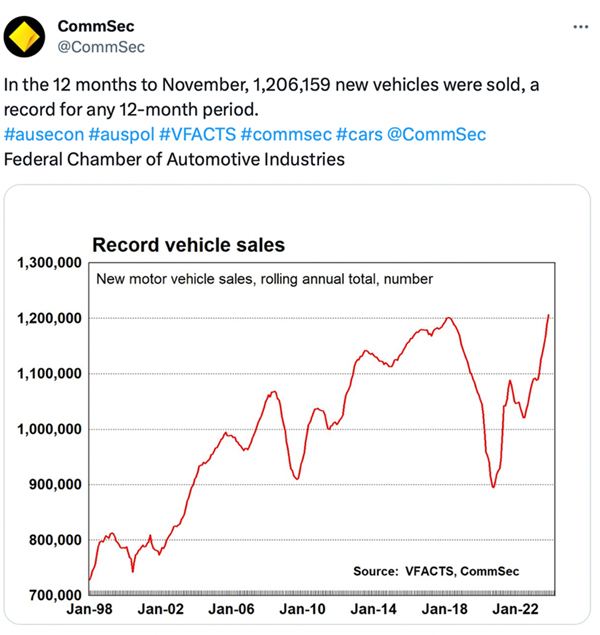

Commsec came out with this post yesterday…

| |

| Source: Commsec |

Step back and think about that for a minute.

We hear all day how interest rate rises are choking spending. They’re also sending consumer confidence to the toilet.

Yet we have record car sales going on?

Ok — granted — we have big immigration too. That must lend the data a bias to keep growing.

Still, I find it hard to believe it’s as bad out there as the mainstream press say.

Perhaps the rate hikes are yet to crimp demand?

Yes — I suppose this could be true. Perhaps car sales slump in 2024.

Can we get any guidance on this?

As it happens, we can…

Peter Warren Automotive Holdings [ASX:PWR] is a dealership group that sells 27 brands across 80 franchises.

Management said they expect revenue growth in 2024 thanks to a ‘strong order book’.

Autosports Group [ASX:ASG] is another related ASX stock. They deal in luxury and prestige cars.

In late November, the Chief executive of the company told his shareholders…

‘Trading conditions in the luxury automotive market remain strong.

‘The overall new vehicle market is predicted to finish the calendar year at record levels exceeding 1.2 million new vehicle deliveries.

‘Within this market, the prestige and luxury market has grown 27% on a calendar year-to-date basis.

‘These strong prestige and luxury vehicle market volumes have been driven by resilient demand and growing customer orderwrite. Luxury customer demand has shown no signs of abating during the first five months of FY24.’

He also guided revenue growth over 20%.

Carsales Group [ASX:CAR] just held their Annual General Meeting.

Management said:

‘Four months into the new financial year we are very pleased with how the company continues to perform, which gives us confidence in the reiteration of the outlook statement provided in August.’

Nothing here suggests screaming caution or a depressed outlook.

Of course, you never know if companies are going to do a 180 on you and drop their previous forecast. We could see that in 2024.

However, right now, the consumer seems to be telling us they’re happy to buy cars even with higher interest rates.

We haven’t gone deep into the statistics here.

It may be that those over 50 and those with high household incomes are driving these car sales.

In other words, the mortgage belt is copping the rate pain.

The low income and unskilled crowd are getting hit with the recent rise in unemployment.

The baby boomers appear to be getting on with the good life regardless.

You and I don’t need to obsess about the distributional effect of the RBA’s antics…at least as far as the stock market goes.

We just need to see if shares on the ASX are making more money or less!

Keep an eye on the three stocks above.

If they start showing an uptrend on their weekly chart, we can assume the market is pricing in ongoing strong car sales.

That would suggest a resilience to the Aussie economy in 2024.

That brings me to point number two…

2) The ABS Credit Statistics!

This week the Australian Bureau of Statistics came out with their monthly lending data.

Here’s an unexpected kick.

The amount of new housing loans going out went up!

This is October numbers — so lagging the last rate rise and recent events.

I take them as a positive anyway.

I made the case earlier in the year for property investors to start chasing the strong rents in the housing market.

Now see this from the Australian Financial Review…

‘Expectations of strong capital growth and robust rental increases fuelled by record migration are enticing a growing pool of property investors like Marc Woolfson back into the market, despite higher interest rates.’

This bit is even more saucy…

‘Judo Bank chief economic adviser Warren Hogan said there has also been signs of speculative activity among investors.

‘There’s a real sense of a speculative element in the market, which I call FOMO on steroids because of the relentless news about undersupply and high migration,’ he said.

‘I think news about high population growth, the housing crisis and Australia’s ability to meet those housing needs had a big impact on people’s motivation to invest.’

In a recent small-cap report, I put down a small broker/lender to take advantage of this dynamic.

It’s up 30% since late October.

I think there’s plenty more coming up. Go here for the full story.

Best wishes,

|

Callum Newman,

Editor, Australian Small-Cap Investigator and Small-Cap Systems

Comments