We’re due for a big day of green today on the ASX, according to the futures market. The timing is notable. Why so?

Back in June, my colleague Greg Canavan pegged September as the month for the stock market to begin rising out of its 2022 funk.

Will he be right? Is the bear market over?

Truth be told, his guess is as good as yours or mine. Nobody knows.

But I do think equity markets are on surer ground than some give them credit for.

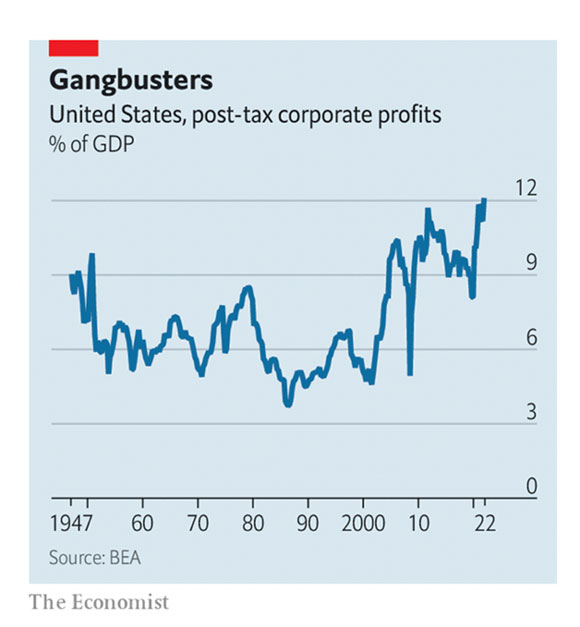

Check out the chart below for one reason why:

|

|

|

Source: The Economist |

The Economist cites statistics that American corporate profits hit their highest level since the 1940s in the second quarter of 2022.

Now, one could reasonably argue they’ve hit a cyclical peak and we’re now on the downslope of that run.

But what if we’re not?

It certainly doesn’t suggest the American economy is on the precipice of massive recession.

Personally, I have been buying shares in the last few weeks for my self-managed super fund.

I have no idea when the market will bottom, or enter a new bull market, and I don’t really care.

I do know from history that the problems pressing the market now will be forgotten in two or three years’ time, just as the issues hitting the market in 2018 and 2019 weren’t the same as they are now.

An individual investor has an advantage over the professional fund manager at times like now. You can take the long view — if you have the patience to hold firm.

A fund manager usually can’t. They’re so hostage to their quarterly and annual performance reports they dare not risk their clients leaving them.

As my friend Gary Norden told me on my podcast the other week, ‘there is no long term if there is no short term’.

Fund managers are hostage to their clients’ expectations and perceptions.

I know from experience I can wax lyrical about an opportunity in a certain sector forever, but if people don’t see results fairly soon, they stop listening or caring. I don’t blame them, either.

Perhaps the only exception to this rule of thumb in the world is Warren Buffett.

Anyway, that’s not our problem, but it does mean you can buy shares on the cheap with an eye to 2024 and 2025 when most participants in the market won’t.

There’s an advantage in that if you want it. Start with the sectors most beaten up.

Gold stocks are interesting on this front. They’ve been a train wreck in 2022. But I’m watching them for clues around the interest rate outlook.

Right now, the market is less concerned about interest rates as it was at the peak-fear moment in June.

But it would be a mistake to think the issue is settled. The pressure in the energy sector means inflation remains a threat.

A rallying gold sector would suggest the market is expecting lower and slower rate rises.

The opposite would be a warning sign.

I’m not buying gold stocks (yet, at least), but they might contain useful information.

What else is beaten up?

Property stocks!

These are a superb contrarian opportunity if you can look out more than 12 months.

Here are two reasons why…

The RBA released the latest credit stats that show credit is still positive:

|

|

|

Source: ABS, APRA, RBA |

Few people understand the importance of this. The housing market is exceedingly unlikely to collapse while this keeps going.

Now we’re getting a boost to immigration…

The Australian Financial Review reported recently:

‘Australia’s permanent migration cap will increase from 160,000 to 195,000 for this financial year, Home Affairs Minister Clare O’Neil has announced.

‘Addressing the Jobs and Skills summit, O’Neil said she hoped the temporary increase meant “thousands more nurses settling in the country this year, thousands more engineers”.’

Also vital is Labor persisting with this policy of tax cuts from 2024. See here:

‘Prime Minister Anthony Albanese is holding the line on keeping the legislated stage three income tax cuts amid confirmation there is sufficient support in the Senate to abolish them.’

This is despite very good reasons not to go ahead with them.

These cuts will be absorbed into the land market and likely be the final push of the cycle as it goes over the top.

In my view, ongoing credit growth, immigration, and the coming tax cuts aren’t priced into property stocks. I see that as a long-term opportunity.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia