In today’s Money Morning…up or down — no one knows…US exit raises more questions than answers…rising Asian demand is the key…and more…

The big story over the past couple of days has been oil.

Energy markets have been rocked by the breakdown of talks within the OPEC+ cartel, as members fail to come to any sort of compromise over oil supply management.

As OilPrice reported earlier this week:

‘OPEC+ much-awaited resumption of talks today has now been delayed, indicating that Saudi Arabia and the UAE have not been able to broker any agreement after the UAE opposed production cut proposals as “unfair” and the Saudis responded with tariff amendments designed to hit out as its political ally and economic rival.’

To say that the group is in crisis, is no stretch of the imagination. With political sniping seemingly overruling any semblance of logic.

But I don’t want to get too bogged down in the history involved between OPEC’s members.

All you need to know is that they share a tenuous acceptance of one another at the best of time. An alliance of necessity rather than friendship.

However, the ego and decisions of these members has far-reaching consequences. As can be seen in the recent volatility of the price of oil…

Up or down — no one knows

See, initially after OPEC’s negotiations broke down, the price of oil was on the up. Rising higher as markets expected, this development meant that no boost to production was on the table.

But then the sentiment suddenly shifted.

The narrative changed to one that suggested this OEPC crisis was bad news for oil prices. Driving both WTI and Brent crude prices lower.

Why? Well, a few reasons.

Some believe that OPEC still has the capacity to resolve their issues. With the cartel unlikely to let the market slip away from their control.

Others seem to think the opposite, and that we could see a new price war. With members of the cartel defying OPEC and ramping up their own production, thus driving down the price for everyone.

Either way, the point is that no one really knows what will happen. Particularly in the short term if OPEC’s internal divisions only grow deeper.

We can only speculate on the actions of this increasingly fragmented cartel.

Long term, however, I think there is a far bigger narrative at work, and it could all revolve around the turbulent situation in Afghanistan…

US exit raises more questions than answers

If you haven’t already heard, after just shy of two decades of involvement in Afghanistan, the US military is set to fully withdraw this September — with 90% of US troops already out of the country.

A move that will likely leave the country in a fragile state with the Taliban all but confirmed as a government in waiting.

Which, if true, will mean the US’s involvement will have done little to change Afghanistan’s political situation. After all, Taliban control was one of the key reasons the US intervened in the first place.

Again, though, I don’t have the time or energy to delve into these complex histories.

All you really need to know is that US troops are leaving, and the Taliban is likely to take back power. Placing Afghanistan in an awkward but perhaps somewhat more stable situation.

The reason any of this matters is because of Afghanistan’s geographical location.

They are practically smack bang in the middle of Asia. Serving as the gateway from the Middle East to the rest of Asia. All thanks to their proximity to China, India, and Russia — as well as a handful of other emerging nations.

So, in terms of energy security, this position makes them an interesting piece of the puzzle — one that could serve as a bridge for the vast amounts of oil and gas produced in the Middle East to these rapidly-growing Asian economies.

In fact, it’s already happening.

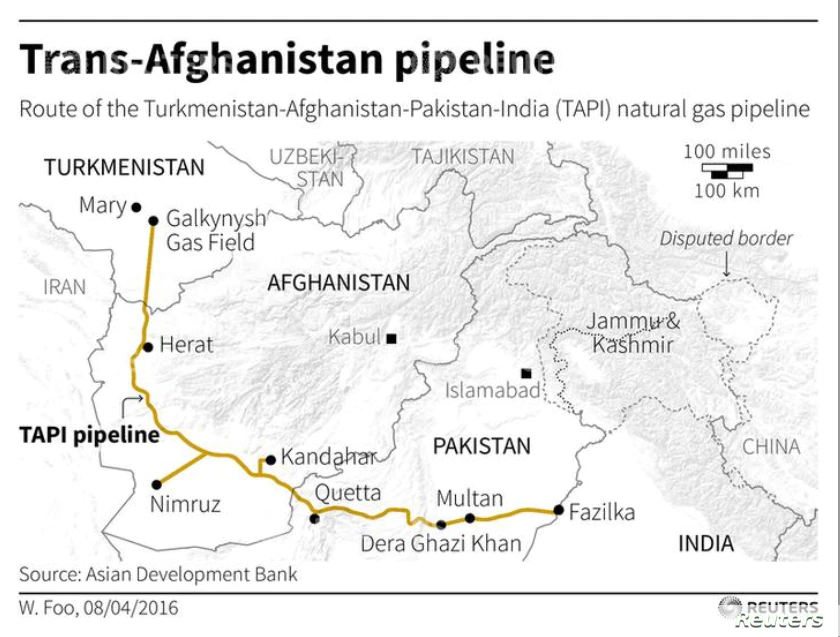

The Turkmenistan-Afghanistan-Pakistan-India Pipeline (TAPI) is one such energy initiative already under works. A natural gas pipeline, that as you can guess from the name, stretches across these four nations.

Take a look at the route for yourself:

|

|

| Source: Voice of America/Asian Development Bank |

This is just one of a few major energy projects with Afghanistan in mind. With TAPI even getting a ‘vow’ from the Taliban that it will not only not interfere but will actively protect this pipeline.

All of which poses some interesting possibilities for oil and gas in the long term.

How to Find Promising Energy Stocks, This Investment Sector Is Ripe for Massive Disruption. Download Your Free Report Now.

Rising Asian demand is the key

It’s no real secret that Asia — particularly China and India — are still extremely reliant on oil and gas. And while this is slowly changing, it isn’t likely to remove the need for oil or gas entirely.

In fact, India in particular is a key focal point. With this emerging economic power set to see the biggest increase in energy demand within the next two decades — a scenario that could drive oil consumption from four million barrels per day, to up to 8.7 million barrels per day by 2040.

However, this forecast from the International Energy Agency did include a caveat that a faster transition to electrification could reduce this estimate to one million or fewer barrels per day.

So it all depends on how quickly the renewables revolution unfolds…

As for gas, though, the outlook is a little more certain, with the IEA adding:

‘As India builds out its gas infrastructure, natural gas can find multiple uses in India’s energy system, including to help meet air quality and near-term emissions goals if supply chains are managed responsibly.’

This investment in infrastructure is expected to lead to a doubling of India’s gas consumption to 2040. Which, while coming off the back of a low base, is still a significant result.

And that, in my view, is why projects like the TAPI pipeline and other energy security ventures across central Asia will become vital. Initiatives that have long been dreamed of as a revival of a ‘New Silk Road’. One that could become the focal point of global energy markets for the foreseeable future.

For that reason, the long-term prognosis for fossil fuels may not be as dire as some think.

Even if the squabbles of OPEC may be putting a dampener on the supply narrative for now…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.