The latest CoreLogic data hit the press this week.

It evidences a slowdown in the rate of decline in median values.

The index fell 1% in January.

This was a slight improvement on the 1.1% decline recorded in December and the smallest month-on-month decline since June last year.

January is a quiet month regardless, with many travelling over the period. The stock on the market in the larger capitals is generally what failed to sell before Christmas and is lingering.

Therefore, the real test of the market will be in February and March.

If the above trend continues, then we’ll know we’re through the worse of the declines.

That being the case, there’s good potential that by the second quarter, prices will have plateaued, and the market could start to see gains by the second half of the year.

Even so — despite budgets getting squashed and buyers getting locked in what has become known as ‘mortgage prison’ — median prices are still ahead of where they were pre-pandemic.

To quote CoreLogic Research Director Tim Lawless:

‘Record declines in home values follow a record upswing, both in magnitude and speed. The national HVI was up a stunning 28.6% in the space of just 19 months…

‘Despite the recent sharp drop in values, every capital city and rest-of-state region is still recording home values above pre-pandemic levels, although Melbourne’s index would only need to fall a further -0.4% before equaling the March 2020 reading.’

Melbourne, of course, was the capital that suffered most during the pandemic, with an exodus of residents fleeing to the northern regions.

That’s now changing.

2023 is set to be the ‘year of migration’.

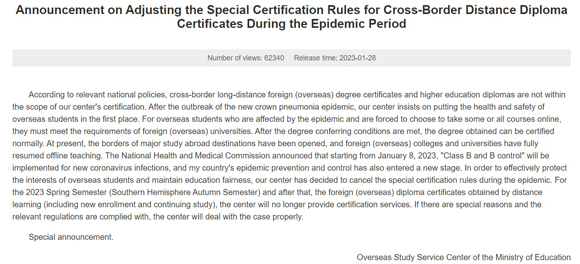

Net overseas migration is already rocketing back toward record levels. But those figures are being led mostly by students.

|

|

| Source: MacroBusiness |

That trend will only be further exacerbated after news earlier this week revealed more than 40,000 university students are scrambling to make it back to Australia in time for the new semester.

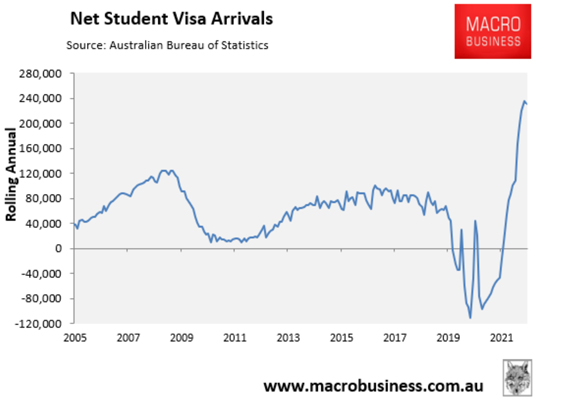

It comes after the Chinese government announced a ‘snap ban’ on recognising online degrees obtained from foreign institutions.

|

| Source: Overseas Study Service Centre of the Ministry of Education |

Therefore, thanks to Chinese policy, things are about to get very tight in inner-city markets.

A little more than 70% of all Chinese students are enrolled at Group of Eight universities, including the University of New South Wales and the University of Melbourne.

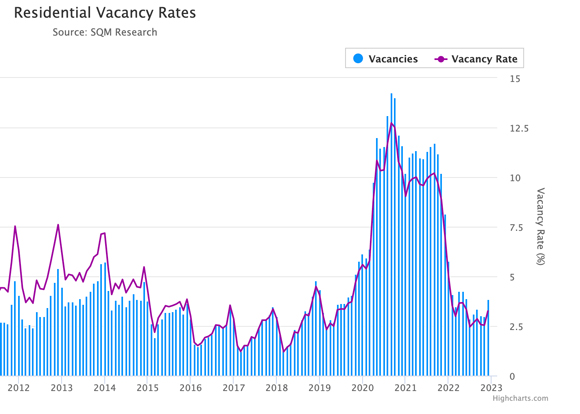

The vacancy rate in Melbourne has plummeted to around 3% (after exploding by more than 12% between 2020 and 2022)

Take a look…

|

|

| Source: SQM Research |

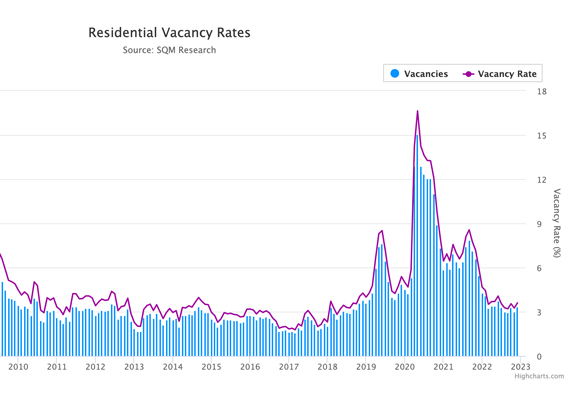

But Sydney is in a dire situation, with the vacancy rate only sitting around 1% (coming down from more than 15% during the COVID-panic).

|

|

| Source: SQM Research |

Simply put, there’s nowhere for the incoming migrants to live.

It goes some way to explaining why we’re seeing stories such as this hit the press.

From The ABC:

‘People who cannot afford to pay their mortgages or sell without taking a loss are increasingly putting their properties onto the heated rental market instead.

‘Numerous real estate agents in Sydney and Melbourne say the trend is becoming more entrenched as mortgage stress escalates…

‘Jazmin Pfluger took ABC News on a tour of a small one-bedroom apartment in Melbourne’s inner west that had been listed for sale for between $310,000 and $325,000.

‘The real estate agent said there had not been “enough interest at that price point… So, a lot of owners are looking to rent, which is a good option at the moment with the [rental] price going up. It’s extremely busy.“

‘Leandro Quirino was one of the many people who inspected the apartment in Footscray that is now listed at $370 per week.

‘He is considering applying for it — despite the constant noise of trains running along nearby tracks…’

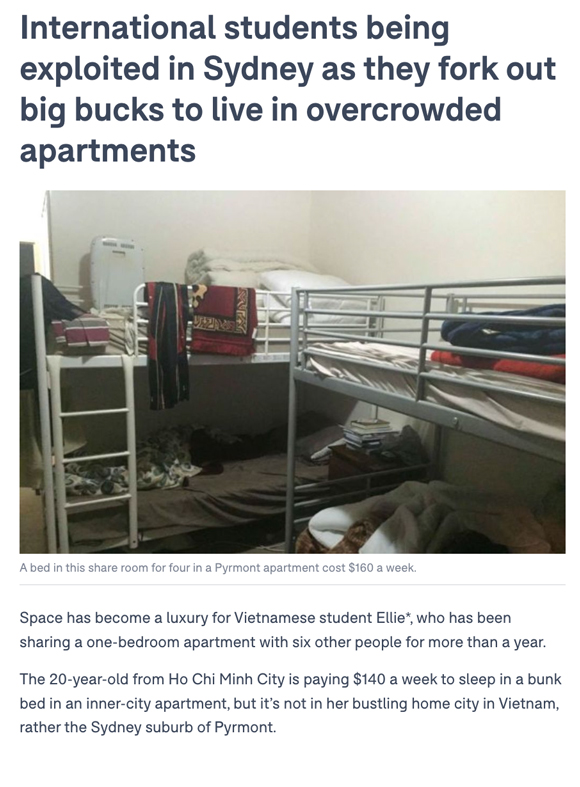

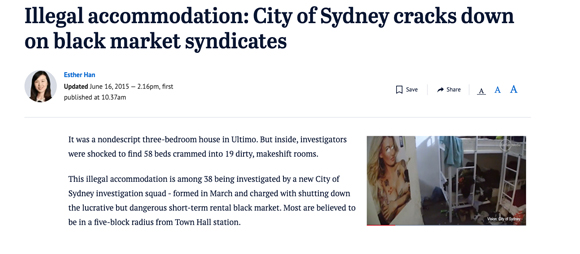

Over the course of this year, we’ll likely hear more and more about overcrowding issues — with illegal subdividing of rooms to fit multiple renters in inner city accommodation.

Still, there’s nothing new under the sun.

The same happened in the first half of this real estate cycle around 2015/2016.

At the time, stories such as this were hitting the press…

|

|

| Source: Domain |

And…

|

|

| Source: Sydney Morning Herald |

At the time, vacancy rates in Sydney were higher than they are now — around 2.5%.

Meaning that right now, the situation we’re facing is unprecedented.

It may leave you thinking that it’s a good time to step into the apartment market and purchase something.

However, student accommodation has never been a good investment for anyone hoping the acquisition will go up in price.

I’ve pointed out previously how apartments are generally poor investments, no matter what the market atmosphere.

Even yield-seeking investors can do better right now — either in the commercial market or by altering the type of property they purchase in a tight rental market, that will appeal to a broader buyer demographic when it’s time to sell.

Needless to say, it’s going to place a lot of stress on inner city councils to approve large development projects to increase accessible accommodation.

I’d go so far as to forecast that we’re on the cusp of another building boom — despite the challenges experienced by the industry through 2020–22.

If I’m right, it will take us into the peak of this cycle, forecasted for 2026, prior to a sharp recession at the end of this decade.

In fact, we’re already seeing it.

In Melbourne, news is out this week that a developer has won approval to create a new ‘mini city’ called ‘New Epping’. From the Australian Financial Review:

‘More than seven years after buying the former Epping quarry in Melbourne’s northern suburbs, developer Riverlee, has won approval from the City of Whittlesea to turn the 51ha site into a $2 billion mixed-use precinct of offices, shops, healthcare facilities, hotels and housing.

‘The family-run developer, founded in 1993 by architect Clement Lee, paid almost $14 million in 2015 for what was then a dormant 46ha site at 215 Cooper Street – next door to the Northern Hospital and the Pacific Epping shopping centre.

‘Since then, Riverlee has acquired adjoining parcels to expand the site to 51ha, laying the foundations for the development of a “mini city” about 18 km north of the Melbourne CBD to be called New Epping…’

|

|

| Source: Australian Financial Review |

And we’re seeing similar in Sydney. For example, there are plans for buildings up to 28 storeys to be constructed on 10 hectares of railway land near Redfern station in central Sydney for a new residential, entertainment and technology hub.

From the Sydney Morning Herald:

‘We’re transforming the old rail yards by restoring and protecting their heritage value, building new homes and offices while creating more than 14,000 square metres of public space, including a new town square and public parkland,”…

‘Under the draft plans, 15 per cent of the apartments in the area will be deemed affordable or social housing, while a further 15 per cent are earmarked for so-called diverse housing ranging from student to build-to-rent accommodation…’

|

|

| Source: Sydney Morning Herald |

There is nothing here to indicate Australia is on the cusp of recession, as many are advocating.

Overall, it’s bullish for capital city land values.

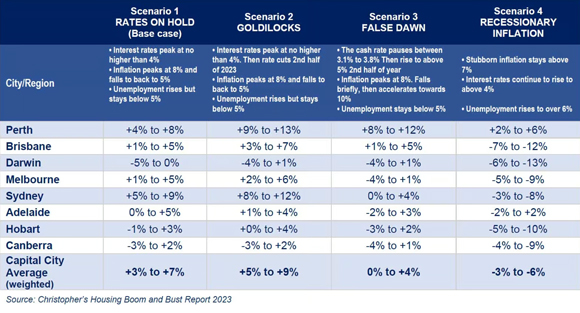

And if, as markets suggest, we’re at the peak of the current rate hiking cycle, I’d say SQM Research founder Louis Christopher has a good chance of seeing his scenario 1 or 2 play out.

|

|

| Source: SQM Research. |

It’s too early to call at this stage, but right now, everything is indicating this 18-year cycle will continue to play out as forecast.

Best wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments