What’s the chance we’ll be in a recession this year?

Are we in a recession already?

How deep will the recession be?

These are questions dominating news headlines and social gatherings.

It comes off the back of another 0.25% rate rise by the Reserve Bank of Australia (RBA) on Tuesday. This takes the 24-hour cash rate to 3.35%.

Just think how, this time last year, it was sitting at 0.1% — an all-time historical low.

For savers, it was simply absurd. Borrowers likely wouldn’t have complained. The insanity was in their favour.

How the tables have turned in a year!

If 2022 was a year that made your head spin with so many unexpected events, then 2023 could make your stomach weak if you’re not prepared.

Don’t dismiss me as a doomsday preacher, though. I know that some of us at Fat Tail Investment Research appear to be on the wrong side of history warning about market crashes, governments collapsing, and the world burning down.

And perhaps these things haven’t happened…not yet at least. It might be good that we’ve been wrong so far.

But do you really think that we’re back in the ’80s and ’90s when there was so much to look forward to?

There was more sanity back then — governments weren’t openly declaring war on their citizens over national security, the global economy wasn’t awash with trillions of dollars of debt (OK…maybe a couple of trillion less than what we’ve got today), and the media was reporting some semblance of reality rather than spouting government or corporate propaganda.

Oh, and pop culture was better back then too. That’s why remixes of past classics appear on the charts.

They’re even remaking movies and cartoons of that era, though, with adaptations to fit the latest woke ideology. Think Ghost Busters, The Little Mermaid, Wonder Woman, Lightyear…and many more. Most of them bellyflop when they hit the screens, unlike the original version.

I’m sure you’re familiar with the statements ‘go woke, go broke’ and ‘everything woke turns to sh!t’.

Well, there’s more things that could turn to sh!t this year. And you don’t want it to be your life.

Rate rises, markets levitate as Main Street despairs

One of the tell-tale signs that things aren’t right in the economy is when the official narrative doesn’t match up with what the majority are experiencing.

Most of us have experienced rising costs in the supermarkets, the petrol pumps, utility bills, and when we’re travelling. The official inflation rate according to the RBA is now at 7.8% based on the latest quarterly figures. The last time it was this high was in 1988.

That’s the official figure, complete with adjustments and smoothing out by economists who have a political agenda to fulfil.

I’m confident that most of us have seen our monthly bills surge, placing greater pressure on our ability to balance our budget.

We’ve been told to bite our lip and endure it.

Cast your mind back to lockdowns to ‘flatten the curve’ because ‘we are in this together’ (except for the jet-setting government officials, celebrities, sportspeople, and members of the World Economic Forum).

They’ve upped the ante now, telling you why you shouldn’t complain about rising food prices. You can always substitute your favourite meat with crunchy cricket snacks!

You shouldn’t just roll over and accept it.

Don’t forget that many households have a mortgage, car loan, and credit card loan.

In the news recently, there have been stories about the plight that many are feeling, not just from the interest rate rise but the expiration of the fixed interest rate mortgages later this year.

Take News.com.au, which covers three individuals who have to devise ways to stump up the cash as they face an increase in their monthly mortgage repayments of hundreds of dollars due to the ‘mortgage cliff’.

As dire as their situation may be, at least these individuals have a job.

What about those who find themselves jobless because businesses face rising costs, causing them to trim their headcount?

Things can go downhill, and very quickly.

What’s sad is that Australian households were lulled into complacency by the RBA telling them as recently as 2021 that it didn’t foresee a need to raise rates until 2024. Less than two years later, we’ve seen nine rate rises, with more to come.

There’s been some relief in the past year amidst the rate rises and the pressure it brings upon those weighed down by debt. At least those who own energy, lithium, and bank stocks were able to experience some gains to offset the pain.

Will this last? And is it enough to help people through this year?

Safeguard your wealth now to avoid the pain

Australians could be in a world of hurt as 2023 rolls on. We’ve been royally played by the government, central banks, and the lying media.

Believe me or not, this is part of ‘The Great Reset’ agenda — weigh people down with debt, topple the economy through a pandemic, supply chain destruction, and armed conflict, then usher in a completely different societal structure and financial system.

Don’t believe me? The World Economic Forum’s Founder Klaus Schwab and Monthly Barometer founder Thierry Malleret wrote a book detailing this.

People will want any solution during a crisis. But don’t trust that these people are going to do that, even if their words bewitch and tantalise the unassuming population.

These are people who fly (likely by unvaccinated pilots) in their corporate jets to Davos, Switzerland, to gather and discuss plans to change the world. Joining them this year was a massive cadre of prostitutes and escorts to entertain the delegates outside their plenary sessions.

Most of us who are long-time readers at The Daily Reckoning Australia may be feeling a pang of smugness right now because we see through these schemes.

But we’re still a minority. When the majority trips and falls, they can drag us down.

This year, we’ve seen markets get off to a good start. The ASX 200 Index was almost a whisker away from its all-time highs in August 2021.

But something tells me that we could be at a tipping point.

For one, the US Dollar Index [DXY] is rising once again after three months of easing. This could cause market indices to turn bearish.

Another is the price of crude oil is rallying, even as the US dollar’s rising. Recall what happened last year as oil pushed past US$100 a barrel?

Even gold, one of the best-performing assets in the last year, has recently retreated US$100 an ounce within days.

Are you seeing a potential market correction, or something worse?

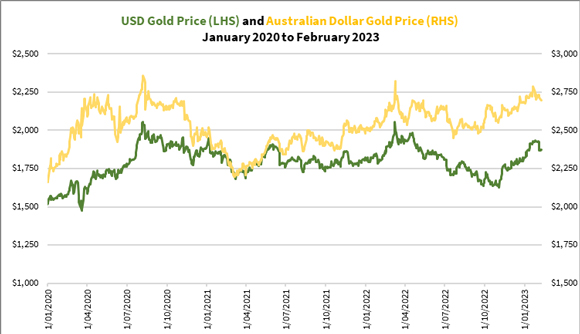

Speaking of gold, you might be worried about whether it holds value given what it went through last year. Let me tell you, though, it may’ve been volatile, but the figure below shows it’s held its ground over the past three years:

|

|

| Source: Thomson Reuters Datastream |

Not to mention central banks were buying gold at record levels last year, raising the attention of even the mainstream media outlets like CNBC.

I sense something ominous is coming, so I’m protecting my wealth with some gold and silver bullion. It’s been something I’ve done since 2015, adding more over time to create a buffer against difficult times.

Perhaps you want to do the same.

And if you’re adventurous and want to capitalise on gold’s gains, I’ve got an offer for you.

Stay tuned, I’ll tell you more about it soon!

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

Comments