Last Friday, the Fat Tail Investment Research crew gathered in our South Melbourne office for our annual Christmas party.

We enjoyed light conversations, karaoke singing and thank-you speeches over sushi, fried chicken, snacks, beers and other drinks. As night fell, we headed to The Pirate Life Brewery a block away.

The music was quite loud, as is the case with pubs and lounges. I never understood why they do that. It wasn’t a venue for dancing. Most patrons came to mingle and would likely have enjoyed a quieter environment, not having to compete with the music by raising their voice.

After adjusting to the background commotion, Murray Dawes and I got stuck into a good chat.

No doubt you’d know Murray. He’s likely the most esteemed editor on the team, both within Fat Tail and our newsletter readers. His track record of investment returns says it all. Moreover, he is a man of many interests and genuinely loves what he does.

One topic we covered was investing in microcaps and the challenges we faced this year.

If you’ve invested in this space in 2024, you’d probably be wondering if it’s just you having a bad run picking companies that make new lows. There were a few big winners this year like Appen [ASX:APX], Polymetals [ASX:POL], Larvotto Resources [ASX:LRV] and Labyrinth Resources [ASX:LRL]. You just didn’t pick them.

Let me assure you this: Murray and I believe 2024 was a tough year. Our investment styles differ — he is a momentum trader, and I am a fundamentals investor.

We mightn’t cover all the investment styles, but you get the idea.

It wasn’t just you. It WAS a tough year if you were searching tiny companies seeking winners.

Despite the challenges faced this year, I can see significant opportunities.

That’s what I want to write about today…

An alluring dream that disappoints many who pursue it

Speculators love the idea of buying a company that transforms from less than $50 million worth to billions of dollars.

You may’ve heard of gold mining companies like Northern Star Resources [ASX:NST], Capricorn Metals [ASX:CMM], and Gold Road Resources [ASX:GOR]. Or pharmaceutical and biotech companies like Mesoblast [ASX:MSB] and Neuren Pharmaceuticals [ASX:NEU].

These companies were once minnows that experienced a breakthrough, growing from strength to strength.

But make no mistake, these companies are one in a hundred, maybe more. Many companies will remain a value trap, disappointing their shareholders.

In short, investing in small and microcaps is like pursuing a dream of making a big windfall. Few manage to see this dream turn into reality. Yet they pursue nonetheless.

No matter what investment experts claim, there’s no hard and fast way to find winners in this space.

You can increase your odds of success. One is to chase the momentum of the industries that are currently in favour. Or you identify companies with quality assets that the market hasn’t noticed yet.

Nonetheless, much of it comes down to luck.

Your opportunity awaits as gold mining companies consolidate

Right now, there’s one industry where the stars are aligning.

You may’ve heard last week about leading gold producer Northern Star Resources [ASX:NST] offering to acquire gold developer De Grey Mining [ASX:DEG] for around $5 billion.

It may not be the first major deal struck among gold miners. Several transactions have occurred already. There have been several transactions since last year, including the biggest-ever merger in the gold space with Newmont Corporation [ASX:NEM] buying our largest gold producer, Newcrest Mining.

Others include Evolution Mining [ASX:EVN], Genesis Minerals [ASX:GMD], Ramelius Resources [ASX:RMS], Vault Minerals [ASX:VAU], and Westgold Resources [ASX:WGX].

But the latest deal with De Grey Mining is big news because of the size of the transaction. Moreover, gold broke new record highs this year. Add to that the US Federal Reserve and other central banks are in a rate-cutting cycle, which continues to favour the price of gold.

Among the smaller companies, there have been several consolidations too.

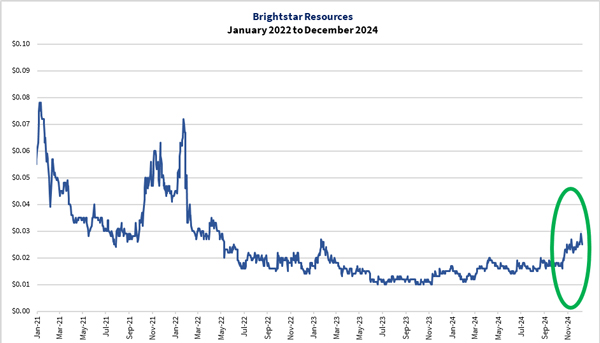

For example, Brightstar Resources [ASX:BTR], Horizon Minerals [ASX:HRZ], and Patronus Resources [ASX:PTN] have acquired companies and mine deposits. They moved while their share price was depressed, but their board and management focused on the major growth potential when they decided to act.

Incidentally, these companies were on my Gold Stock Pro list before these companies expanded.

Brightstar Resources shares have taken off recently, as you can see below:

| |

| Source: Refinitiv Eikon |

I expect the others should do the same next year as they develop their projects and generate revenues when their mines start producing.

Meanwhile, several explorers and early-stage developers may be flying under the radar for the investors, as they quietly drill and develop their projects. Their peers may already be running a ruler over them or even in negotiations.

Which company is next to make the headlines, sparking a wave of buying and delivering opportunities for their shareholders?

If you want to potentially enjoy such prospects, why not move ahead of the others by acting now?

Murray’s Retirement Trader newsletter service is designed help you time your trades.

Or you can sign up for my premium newsletter, Gold Stock Pro, and consider accumulating gold explorers and early-stage developers.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments