Medical products developer PolyNovo [ASX:PNV] announced an FDA clearance update for one of its latest medical products NovoSorb MTX.

The FDA 510(k) clearance sent PNV shares 7% higher.

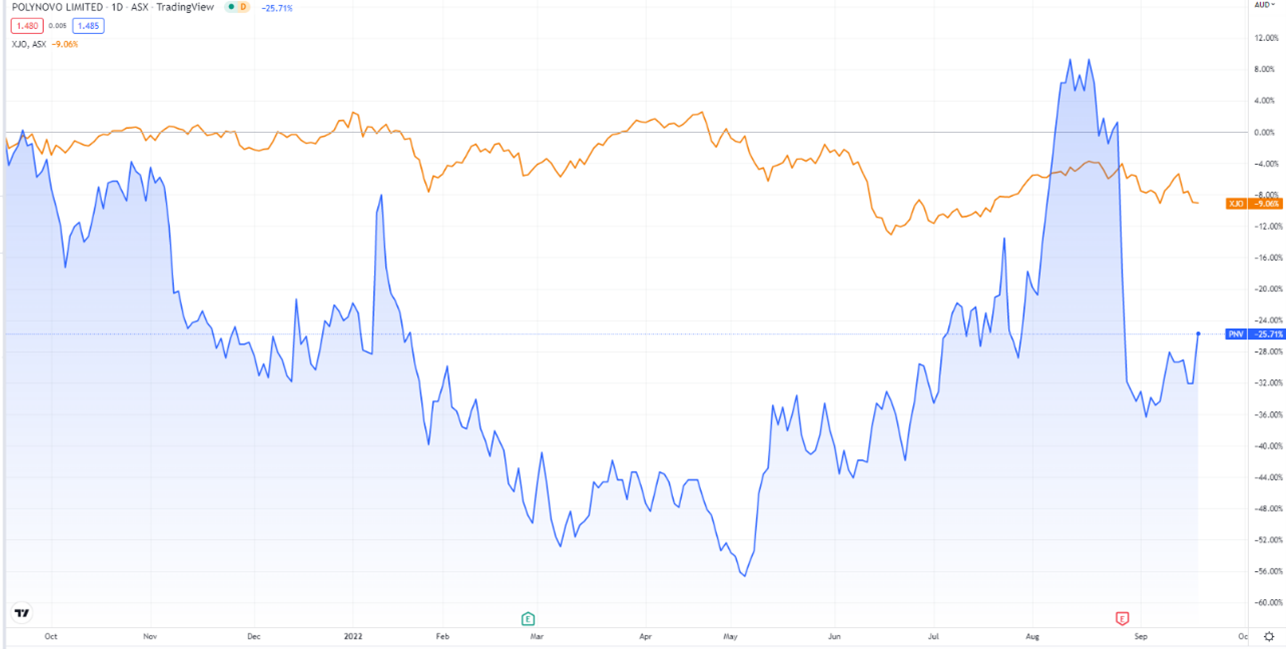

Despite Monday’s spike, PNV shares are still down 5% year to date.

Source: tradingview.com

PolyNovo’s NovoSorb gets FDA clearance

On Monday PolyNovo announced the receipt of FDA 510(k) approval for NovoSorb MTX, its latest product assisting soft tissue regeneration in complex wounds.

From the FDA:

‘A 510(k) is a premarket submission made to FDA to demonstrate that the device to be marketed is as safe and effective, that is, substantially equivalent, to a legally marketed device (section 513(i)(1)(A) FD&C Act). Submitters must compare their device to one or more similar legally marketed devices and make and support their substantial equivalence claims.’

PolyNovo claims its MTX product uses a technology that is the foundation for clinical breakthroughs in BTM, all without closing membranes:

‘Development of MTX was informed by clinical experience with NovoSorb BTM, where early removal of the sealing membrane is followed by rapid formation of granulation tissue and wound closure.

‘With MTX, the wound can be closed either with a skin graft or allowed to heal by contraction and formation of an epithelial layer. This can simplify wound management and presents wider applications for common wound healing problems.’

MTX was developed for medical experts who were in high need for a product which can heal patients without having to close membranes during treatment.

The product works with NovoSorb’s BTM product, extending the company’s portfolio in wound treatments.

PNV said MTX is indicated for use in ‘partial and full thickness wounds, pressure ulcers, venous ulcers, chronic and vascular ulcers, diabetic ulcers, and surgical and trauma wounds.’

CEO of PolyNovo, Swami Raote, offered his thoughts on the company’s latest product, and the new milestone achieved:

‘The creation of MTX is an exciting example of surgeon led product development that opens a significant new market for us. We are proud to bring MTX to U.S. surgeons and patients, and believe a product specifically designed for use in a single-stage procedure will leverage and expand our penetration of the advanced wound care space. We expect clinicians to carry BTM and MTX and provide them a richer tool kit for patient care. We aim to quickly put MTX in the hands of Key Opinion Leader surgeons.’

PolyNovo Medical Director and Plastic Surgeon, Associate Professor Marcus Wagstaff, added:

‘MTX is a synthetic dermal substitute comprised of NovoSorb foam providing a scaffold for wound healing across deep, complex structures such as bone and tendon. For wounds that do not require temporising or protection from contraction, there is a clear clinical need for MTX. It is best suited in cases where wound contraction and reduced time to healing are preferred, such as diabetic and venous ulcers, and smaller traumatic or post-surgical wounds (for example after excision of skin cancer). MTX promises clinicians ease of use and simplicity as a one-step procedure.’

Is it looking up for PolyNovo?

Today’s news provided some relief for investors disheartened by PNV’s annual earnings report released last month.

The medical supplier then revealed only $800,000 was earned, substantially short of predictions set at $1.6 million.

PolyNovo is looking at launching its third product, a foot and leg product called SynPath, in the US next year.

CBDC warning: How you could lose control

Central banks all over the world — including the Reserve Bank of Australia — are looking into adopting Central Bank Digital Currencies (CBDCs).

And China has already rolled out its e-CNY.

We think CBDCs are something you should know about.

Our Editorial Director Greg Canavan says this ‘could fundamentally change how and where you spend your money and your life’, as those choices could be taken away.

So, if you want to learn more about CBDCs and their implications, I recommend checking out our latest briefing that breaks down all things CBDCs.

To watch the presentation, click here.

Regards,

Kiryll Prakapenka,

For Money Morning