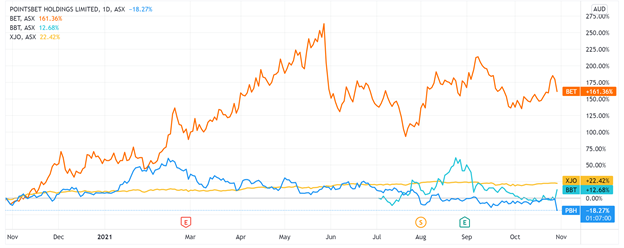

PointsBet Holdings Ltd’s [ASX:PBH] share price sunk today as strong growth in the key US market was not enough to offset losses.

PBH was quick to quell potential concerns, noting the seasonal nature of the sports betting industry means quarterly results should not be taken to represent its likely full-year performance.

However, while both PBH and BetMakers Technology Group Ltd [ASX:BET] are down today, rival BlueBet Holdings Ltd [ASX:BBT] is currently up 15% after a strong September quarter.

After peaking at $17.60, the growth stock is cooling off, currently exchanging hands for $8.69 a share.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

PointsBet continues to grow — but at what cost?

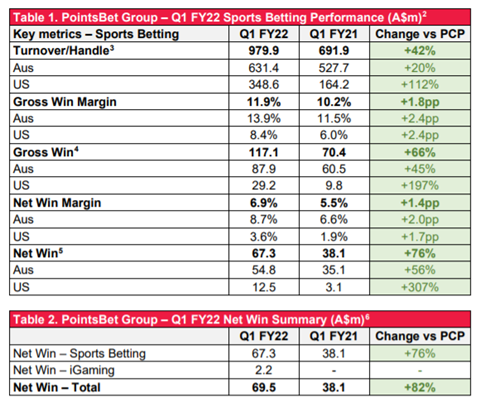

PBH reported total turnover (dollar amount wagered before any winnings are paid out or losses incurred) of $979.9 million — a jump of 42% on the prior corresponding period (Q1 FY21).

PointsBet’s gross win came in at $117.1 million. Gross win refers to the dollar amount received by PBH from clients who placed losing bets minus the dollar amount paid to clients who made winning bets, excluding promotion costs.

The gross win margin rose from 10.2% in Q1 FY21 to 11.9%, while the net win margin stood at 6.9% compared to 5.5%.

PointsBet’s net win margin factors in promotional and marketing costs, often the company’s larger expense item.

The total net win stood at $69.5 million, of which $67.3 million came from sports betting and $2.2 million was generated from iGaming.

Source: PointsBet presentation

Source: PointsBet presentation

PBH’s cash active clients in Australia rose 79% to 222,622, while this number surged 367% to 185,880 in the US.

PBH noted that the company’s quarterly marketing expense of $22.1 million for the Australia segment and US$27.6 million for the US segment, assisted in cash active clients.

Despite the growth in clients and volume, PBH posted an operating cash loss from operating activities worth $26.56 million.

Now, as our market expert Murray Dawes pointed out, investing in small-caps can be ‘an incredibly rewarding experience if done properly.’

Murray, alongside fellow market analyst Ryan Clarkson-Ledward, runs a small-cap advisory that focuses on scouring the market for stocks that are ‘nearing their inflection point for growth and cash flows.’

So if you’re interested in reading about their work further, read on here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here