The PointsBet Holdings Ltd’s [ASX:PBH] subsidiary gains approval to commence iGaming operations in Michigan and launches its iGaming platform.

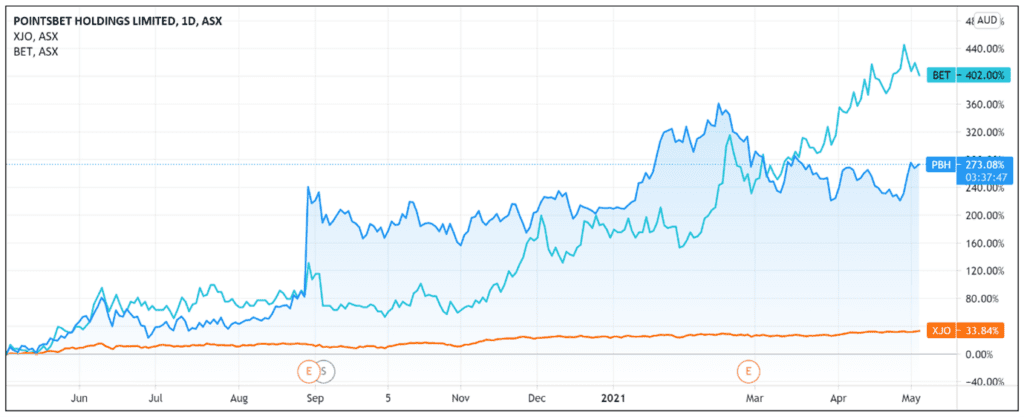

The PointsBet share price moved up 2.5% on the announcement, capping off a solid week for the wagering business.

PointsBet gained 12% in the last seven days and is up 235% over the last 12 months. Source: Tradingview.com

Source: Tradingview.com

PointsBet to launch iGaming in Michigan

The corporate bookmaker today revealed that the Michigan Gaming Control Board authorised PBH’s subsidiary, PointsBet Michigan to commence iGaming operations.

Acting quickly upon the approval, PBH has already launched its proprietary iGaming platform in Michigan.

The launch of iGaming in the state follows PBH debuting sports wagering in Michigan on 22 January 2021.

The bookmaker plans to launch further iGaming operations in New Jersey next month.

PointsBet and iGaming

iGaming is any activity that involves betting online.

One could bet on all sorts of live events or game outcomes and is carried out through sports betting, online casino gambling and other games like Poker and Blackjack.

But technological advances backed by interconnectivity mean the iGaming industry continues to evolve.

As Forbes reported, online slots are ‘coming out every week and gather a massive public following’ all the while games like roulette and blackjack ‘maintain a steady base of players.’

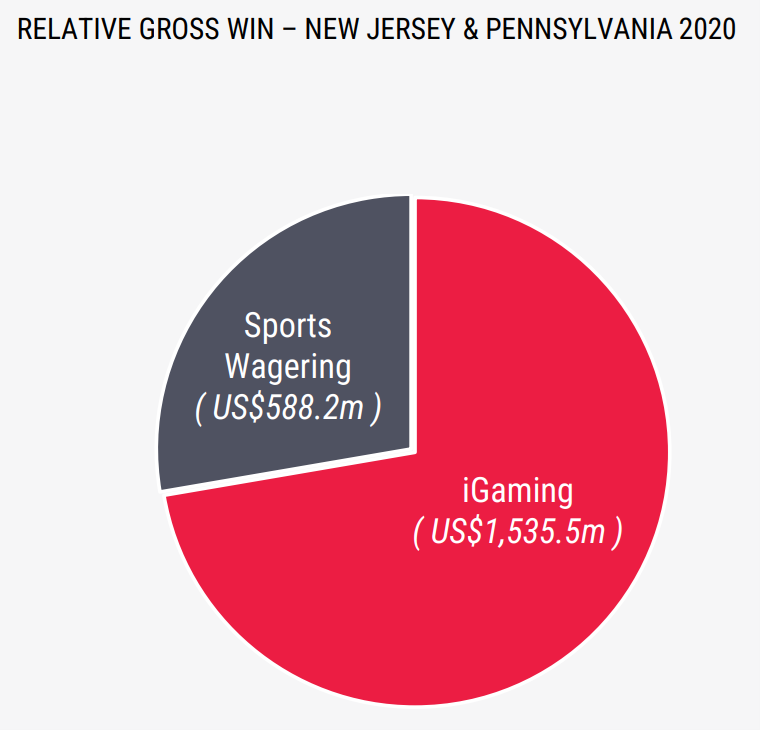

In its latest quarterly presentation, PointsBet noted that iGaming has the ‘potential to represent a significantly larger opportunity than sports wagering.’

PointsBet also pointed out that US iGaming revenues grew ‘exponentially’ since the repeal of the Professional and Amateur Sports Protection Act in 2018.

PBH cited figures suggesting iGaming revenues across New Jersey, Pennsylvania, Michigan, and West Virginia exceeded US$770 million in the March 2021 quarter.

If this windfall were annualised, the revenue from these four states would total more than US$3 billion per annum.

PointsBet didn’t miss the opportunity to emphasise that it has iGaming market access in each of those states.

The company also cited research from BofA Securities, estimating that the iGaming revenue opportunity in the US and Canada could be US$7.6 billion by 2025.

PointsBet CEO and managing director Sam Swanell was upbeat about the announcement:

‘The launch of iGaming not only complements our existing sports wagering products, but also removes the disadvantage we have had with customer acquisition, retention and cross sell compared to those operators with iGaming.’

Outlook for the PBH Share Price

According to PBH, its proprietary iGaming platform ‘will become an increasingly important strategic advantage’ as it owns and controls its in-house technology stack.

PointsBet thinks its complete control over its product roadmap differentiates PBH from some competitors reliant on B2B services.

Its iGaming venture coupled with its in-play wagering expansion led by the acquisition of Banach could position PBH to take advantage of the boom in wagering and iGaming.

PointsBet’s 3Q 2021 results certainly showed strong growth.

For instance, for the three months ended 31 March, the bookmaker reported $905.2 million in wager turnover, a 236% increase on the previous corresponding period.

Australia segment turnover jumped 137% to $423.2 million, with the US segment soaring 431% to $482 million.

Nonetheless, while receipts from customers totalled $64.94 million for the March quarter, marketing and operating costs saw PointsBet post a net cash loss from operating activities worth $27.41 million.

Year to date (nine months), PBH spent $116.93 million on advertising and marketing on operating inflows of $147.64 million, contributing to a year-to-date cash loss from operating activities of $76.18 million.

A capital raise last September helped absorb the cash outflows, with the bookmaker ending the March quarter with $356.63 million in cash.

The high marketing expenses reflect PointsBet’s growth push but may also suggest the company is aware the lucrative US market is enticing competitors.

For instance, Reuters reported that BetMGM, a US sports betting joint venture between MGM Resorts and Entain, was targeting net revenue of US$1 billion in 2022.

And BetMGM’s rival DraftKings, the official sports betting partner of the NFL in the US, raised its 2021 revenue target to US$900 million to US$1 billion from $750 million to $850 million after a strong quarter.

If you’re excited by technology, algorithms, and proprietary machine learning programs, then I think you may also enjoy reading our free report on new small-cap fintech stocks.

The report will go through three innovative Aussie fintech stocks with exciting growth potential. Check it out if you’re interested.

Regards,

Lachlann Tierney,

For Money Morning