Bookmaker PointsBet Holdings [ASX:PBH] released its Q1 FY23 results, recording a fall in gross win and net win margins on Q1 FY22.

While PBH’s Q1 FY23 wagering turnover rose 18% on the prior corresponding quarter to $1.16 billion, the net win margin fell from 6.9% to 6.1%.

PBH shares were flat on the announced results. The share price is down 70% year to date:

Source: Tradingview.com

PointsBet Q1 FY23 results

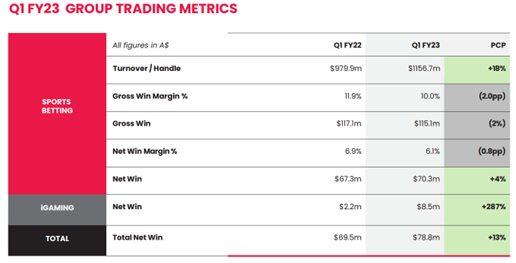

Here are PBH’s key trading metrics for the first quarter of the new financial year:

- Wagering turnover was up 18% on the prior corresponding quarter to $1.16 billion

- Gross win margin was down 2% to 10%

- Gross win total was down 2% to $115.1 million

- Net win margin was down 0.8% to 6.1%

- Net win total was up 13% (including iGaming) to $78.8 million

- Receipts from customers was up 13% to $81.6 million

For context, PointsBet categorises the net win as the dollar amount received from bettors who placed losing bets less the dollar amount paid to bettors who placed winning bets, less any promotional costs.

PointsBet continued to burn cash, ending the quarter with net cash outflows from operating activities of $44.9 million.

While customer receipts grew 13% on Q1 FY22, the operating cash burn increased 69%.

Sales and marketing spend was $54.7 million for the quarter, 67% of the cash it received from customers.

The cost of sales was also elevated, at $40.9 million.

PBH saw its cash balance decrease $60.7 million to sit at $474.9 million at the end of the quarter.

Source: PBH

Worrying signs for PointsBet in the US?

PointsBet has staked a lot of its growth on the US market.

But the bookmaker reported that while its turnover rose 50% on Q1 FY22 to $523.8 million, it fell 24% QoQ.

The US net win margin was a slim 4.3%, with the US sports betting segment yielding a total net win of $22.3 million, down 6% QoQ (up 78% YoY).

PointsBet did not explain the big QoQ dip in turnover in today’s release.

PBH’s Australian segment didn’t fare as badly QoQ, but the Australian segment’s turnover did dip 3% YoY to $611.9 million.

Australian turnover did rise a modest 2% QoQ.

PBH said its Australian segment’s gross win (which fell 17% YoY to $87.9 million) was affected by an increased weighting to ‘sports turnover vs racing turnover in the quarter and short-term negative variance in multi’s and racing margins.’

Trend-breaking stocks

Many shareholders have been thrown into anxiety watching markets topple as 2022 fell deeper into harsh territory.

But what if there was a way to peer through that overriding chaos and see those hidden stocks that — somehow — manage to thrive?

Fat Tail’s small-cap trader Callum Newman has been co-working on a special kind of algorithm that can assist in discerning the true potential behind ASX stocks.

You can view this AI-trading system’s unveiling in a free webinar right here.

Regards,

Kiryll Prakapenka,

For Money Morning