PointsBet Holdings Ltd [ASX:PBH] recently announced its quarterly figures for Q1 FY21.

The online gambling company shrugged off the COVID-19 pandemic pretty quickly to record an incredible year.

The announcement saw the PBH share price fall 3.64% to trade at $10.58 at the time of writing.

This on a day when the broader market is shedding points.

Source: Optuma

What’s happening at PointsBet?

Last month, we looked over PointsBet and the expansion plans the company was pursuing.

At the time, the company had recently inked a five-year agreement with NBC Universal, which gave exclusive access to the likes of Chicago Bulls, along with the easing of laws surrounding online gambling in the US state of Illinois.

The company recently announced a quarterly cash flow report for the period including up to the end of September 2020.

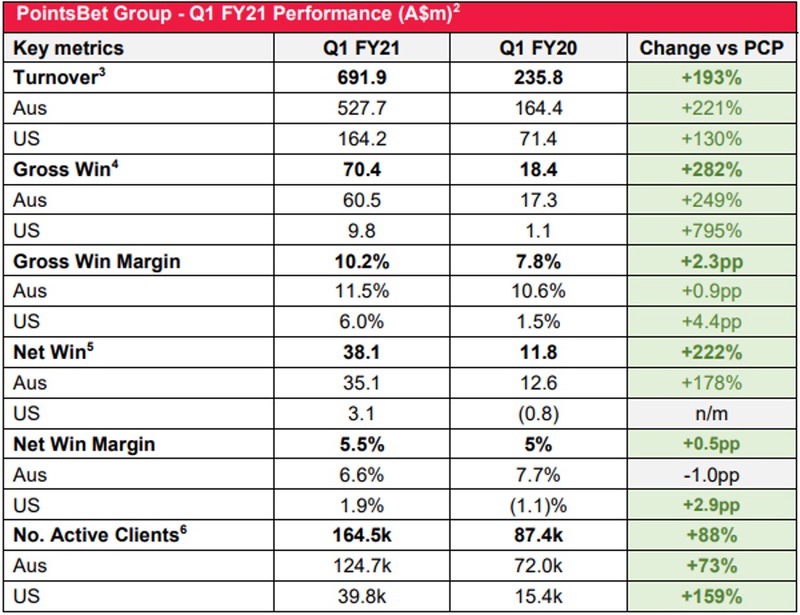

The results are strong, to say the least:

Source: newswire.iguana2.com

The company also announced key marketing ad sponsorship deals with the likes of Denver Nuggets, Indiana Pacers and Detroit Tigers.

Where to from here for PointsBet?

From the March low, PointsBet rose over 934% to where it sits at the time of writing, giving the company a $1.9 billion market cap.

But there are risks out there as well, despite the rise.

With the AFL and NRL seasons recently finishing up for the year, along with the NBA closing out the season with a Lakers win, there may be less sport to bet on at the end of this year. As COVID-19 rages on in America and Europe, it is yet to be seen which competitions will and will not continue.

More lockdowns across the globe can’t be ruled out.

Source: Optuma

The PBH share price fell over the last few days. If this continues, the level of $10 may be enough to halt a further decline.

If not, then the price may come back to ‘fill the gap’ and, in that case, the price may fall back to the $7.30 level.

On the upside, if the PBH share price can turn and gain some momentum, moving through the level of $12.41, this may prove to be a bullish signal.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four well-positioned small-cap stocks: These innovative Aussie companies are well-placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments