Australian bookmaker Pointsbet Holdings [ASX:PBH] saw both revenues and net losses rise in FY22 as PBH shares sank on Wednesday.

Year to date, Pointsbet shares are down 55%.

Other wagering stocks have copped a similar sell-down.

BetMakers Technology Group [ASX:BET] and Bluebet Holdings [ASX:BBT] are down 50% and 65%, respectively, year to date.

Source: www.tradingview.com

Pointsbet’s annual trading metrics

The bookmaker today released its 2022 annual report, having rolled out sports betting operations in four US states, and iGaming operations in three states and Ontario, Canada.

Revenue from ordinary activities was up 52% from $194.7 million in 2021 to $296.5 million in FY22.

Net loss after tax also increased 43% from $188 million to $268 million.

Total operating expenses climbed from $244.1 million to $365.6 million.

While revenue grew 52% YoY (year-on-year), gross profit grew 38%.

The gross profit margin fell from 45% in FY21 to 41% in FY22.

Importantly, PBH’s gross profit was dwarfed by its marketing expense, which came in at $236.8 million in FY22.

Operational metrics

- Sports betting turnover/handle improved 32%, coming in at $5 million ($3,781.4 million in 2021)

- Sports gross wins as a percentage went up to 9.9%, from 9.3% in 2021

- iGaming net wins moved from 5.5% in 2021 to 5.8% in 2022

- Total net wins went up 48% from $208.5 million to $309.4 million

Results by region

Australia

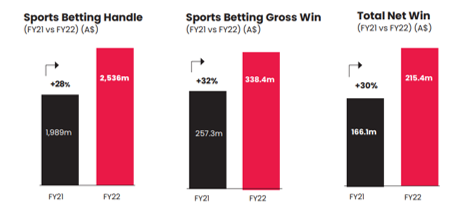

- Turnover/handle increase 28%, from $1,989.0 million in 2021 to $2,536.4 million in 2022

- Gross wins improved 32% from $257.3 million to $338.4 million

- Total net win went up 30% from $166.1 million to $215.4 million

- Cash active clients were 239,121 — up 22% on 2021

- The Australian marketing expense for FY22 was AU$61.5 million

Source: PBH

US

- Turnover/handle rose 37% from $1,792.4 million to $2,454.0 million

- Gross win went up 66% from $95.8 million to $158.7 million

- Total net win ballooned 122% from $42.3 million to $93.9 million

- Cash Active Clients were 266,882 — up 67% on 2021

- The US marketing expense for FY22 was AU$162.6 million

Source: PBH

Shares outlook for PBH

PHB’s Chairman Brett Paton said the Australian segment achieved 30% year-on-year Net Revenue growth.

He believes this performance demonstrates the company’s ‘capability to disrupt and grow market share in an advanced market’.

Mr Paton said:

‘Following the completion of the successful capital raise in August 2021 (raising $400 million) and the strategic placement of $94.2 million to SIG Sports Investments Corp in June 2022, the Company is adequately funded to execute our strategy in the near term, with a corporate cash balance at 30 June 2022 of $472.7 million.

‘Further, as we look to capitalize on the substantive opportunity in North America, the Deferred Bonus Equity Option instrument announced in June 2022 also provides the Company with the flexibility to access additional capital of $149.9 million as needed.’

Betting on an EV future

An industry betting on an EV future is battery tech, especially the metals required to assemble the metal-hungry electric vehicles.

Lithium is one such metal. And it was at the forefront of investors’ minds when junior lithium stocks surged in 2021.

But the lithium sector is cooling off somewhat this year, with many juniors well off their highs.

But lithium isn’t the only battery metal required for an EV future.

Whether that be lithium, graphite, cobalt, nickel, or copper, the race to for critical battery tech metals is on.

And our small caps expert Callum Newman has found three battery material stocks he believes are flying under the mainstream’s radar.

Find out more about ‘Elon’s Chosen Ones’ here.

Regards,

Kiryll Prakapenka