The Pilbara Minerals Ltd [ASX:PLS] announced a significant increase in its ore reserve at its flagship Pilgangoora Lithium-Tantalum Project.

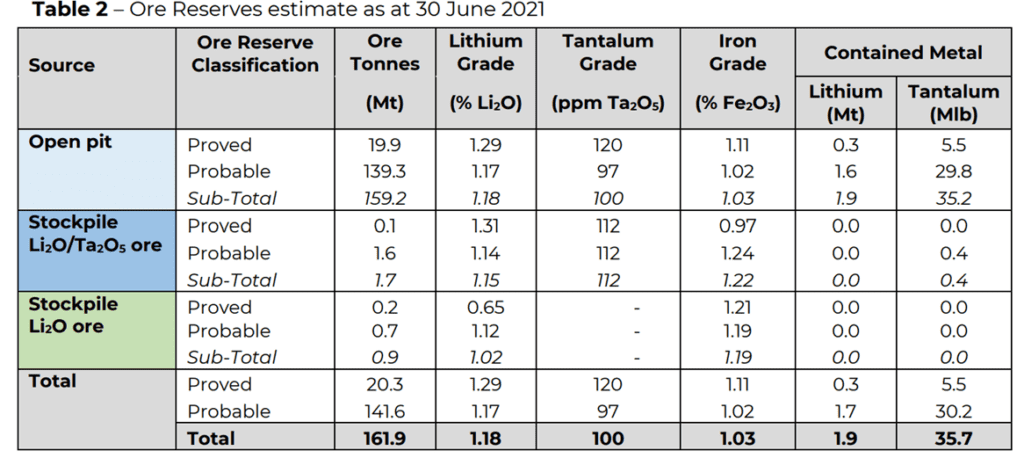

The ore reserve now comprises 1.9Mt of contained lithium oxide, a 47% increase from an ore reserve reading in 2020.

Pilbara Minerals Ltd [ASX:PLS] share price jumped 5.3% in early morning trade before pulling back in the afternoon.

PLS shares are currently trading at $1.89 per share, up slightly by 0.53%.

PLS announces material increase in ore reserve

Pilbara today announced a significant increase in the ore reserve at its 100%-owned Pilgangoora project in Western Australia.

PLS said the increased reserve reinforces its belief Pilgangoora can become ‘one of the world’s premier hard rock lithium operations.’

The increase was led by a discovery of new pegmatite domains together with the integration of the Ngungaju Resource.

The Pilgangoora ore reserve contains an estimated 1.9 million tonnes of contained Li2O and 36 million pounds of Ta2O5, extending the mine life to approximately 26 years based on the combined 6.3Mtpa operations.

The updated ore reserve is based on a pit shell selected at a flat, forward commodity price of US$588 per tonne of spodumene concentrate and a long-term price projection of US$700 per tonne for smaller pits (comprising 6% of ore reserve) scheduled for later in the mine life.

Pilbara Minerals’s Managing Director and CEO Ken Brinsden said:

‘The continued growth in Ore Reserves reflected the successful integration of the Ngungaju project area and the highly successful development drilling program undertaken this year.

‘The quality and scale of the Pilgangoora project confirms Pilbara Minerals as a leading hard rock lithium producer and truly sets the scene for our expansion to 6.3 Mtpa and continued growth beyond that.’

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

PLS share price outlook

Pilbara flagged the potential for further ore reserve upgrades, noting:

‘Significant opportunities exist to further expand the Mineral Resources and Ore Reserves, with further drilling campaigns expected during FY22.’

This comes after Pilbara reported a productive September quarter, with final shipments exceeding prior guidance.

We are witnessing a paradigm shift in the energy sector as environmental conscientiousness spurs adoption of green energy.

Now, while Churchill said never to let a good crisis go to waste, we should also hasten not to waste a paradigm shift of the magnitude presented by clean energy.

So, if you want more resources on this topic — and more interesting investing ideas — I suggest checking out this lithium report from our energy expert.

Coincidentally, this report also evaluates three promising ASX lithium stocks.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here