Ukraine is the spider in the spider web. It affects geoeconomics, energy shortages, the supply chain, and the desire of many countries to escape US dollar hegemony.

Russian success in Ukraine presages a new international monetary system through its allies in the BRICS+, the Shanghai Cooperation Organisation, and the Eurasian Economic Union. Likewise, Russian failure in Ukraine points the way to a strengthened world economic order with the US firmly in charge. Either outcome is possible. Nothing is more important.

First, a note on sourcing. Winston Churchill famously said, ‘In wartime, truth is so precious that she should always be attended by a bodyguard of lies’. That was true in the Second World War, and it’s no less true today. The US, UK, and EU will lie. So will Ukraine. So will Russia. That’s our starting place in any analysis. If I read something in The New York Times, I can be quite certain it’s a lie.

Lies can tell the truth

They reveal what the sources are really concerned about. If you weren’t concerned about something, why bother to lie about it? Based on the lie, you can know what matters.

From there, you can infer that the lie’s topic is important, and the opposite of the lie is probably true. You can update your inference with what’s called all-source fusion, basically using other intelligence sources, some of which might appear quite minor, to tweak the initial inference in one direction or another.

If enough evidence accumulates, you quickly reach a point where you can give a high probability to a certain state of affairs, even if it’s quite different from what the media tells you.

The war has lasted nine months already and will last at least six more, if not longer. That’s enough time to assemble trusted sources and make timely forecasts.

What follows is the best available analysis.

The status of the war in Ukraine is best understood as a competition between the narrative and reality.

The narrative consists of what you hear from mainstream media, the White House, the Pentagon, and official sources in the UK, France, Germany, and both EU and NATO headquarters in Brussels. The reality consists of what’s actually going on based on the best available sources.

Let’s consider the narrative first

According to the White House, EU, and NATO, things are going relatively well for Ukraine. The Armed Forces of Ukraine (AFU) have advanced in Eastern Ukraine along a line parallel to the Russian fortified lines between Donetsk and Luhansk. Ukraine has also reoccupied the regional capital of Kherson, which lies strategically on the Dnieper River, which is Kyiv’s main access to the Black Sea and international trade.

Based on these advances, the narrative says that Russia is in retreat, Russian troops are demoralised, Putin is in jeopardy of being replaced, and complete victory for Ukraine is just a matter of time.

The narrative is then used as a basis for increased financial aid from the United States (more than US$60 billion and growing) and increased weapons shipments from NATO members. President Volodymyr Zelensky touts these accomplishments in his customary green T-shirt on video presentations to the UN, G20, and other international audiences.

Here’s the reality

The actual situation on the battlefield is almost completely at odds with the narrative. Ukraine did make advances in the east, but they were against lightly defended Russian positions on or near open terrain. The Russians organised an orderly retreat to fortified lines and let the Ukrainians have the open land, which will become a killing field for Russian artillery.

Russia regarded Kherson as a non-strategic salient. They withdrew to the east bank of the Dnieper River while allowing Ukrainian troops to reoccupy the centre of Kherson. Russia avoided a fight over a city of little strategic value while retaining a chokehold on river traffic from the east bank.

In the meantime, Russia has completed its 300,000-person mobilisation. More than 180,000 of those troops are now deployed behind Russian lines in combat formations. The remaining 120,000 troops will arrive soon. This brings total Russian strength up to about 30 divisions.

|

|

| Source: EPA |

AFU strength has been greatly diminished due to high casualty rates. Many so-called Ukrainian troops are actually Polish forces in Ukrainian uniforms. Russian forces are well-rested and well-supplied. They are being supplemented with Iranian drones, a major force multiplier.

Russia is now preparing to launch a massive counteroffensive

The major objectives are Kharkiv in the northeast, Odesa in the southwest, and Zaporizhzhia in the centre part of the country on the Dnieper River.

Completing these missions will give Russia control of the entire coast from the Sea of Azov to the Black Sea. It will also give Russia control of the Dnieper River and Europe’s largest nuclear power plant.

Russia will incorporate this territory into the Russian Federation and will likely move further into Moldova to reunite with a pro-Russian corridor called Transnistria, with its capital in Tiraspol. At that point, Russian strategic objectives will be complete.

Ukraine will be left as a rump State between Kyiv and Lviv. Almost all of the industrial, technological, and natural resource capacity of former Ukraine is in the Donbas, now under Russian control.

The economic impact of these developments is momentous

Biden has vowed that the sanctions will not be lifted until Russia leaves Ukraine, but Russia is not leaving. This implies that sanctions will continue indefinitely.

|

|

| Source: International Energy Agency |

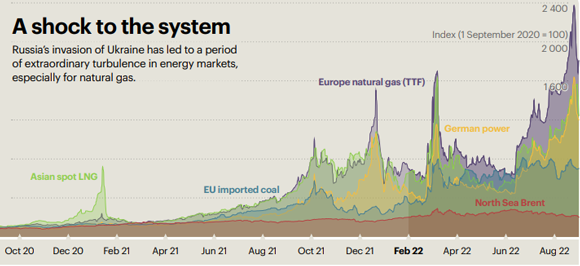

The sanctions have had little economic impact on Russia, but the effect on Europe and the US has been devastating, including energy shortages, inflation, and supply chain disruption. These effects will persist and cause the EU and US to fall into a severe recession in the first half of 2023.

All the best,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia