No gold investor could’ve wished for better. Lockdowns, epic fiscal and monetary stimulus, outright monetary financing by central banks, inflation, recession, stagflation, central banks so far behind the curve they’re unlikely ever to catch up, extreme negative real interest rates, a crash in other safe-haven assets like bonds, and the prospect of nuclear war. What could possibly be better for the gold price?

And yet, the gold price is right back to where it was when the whole pandemic kicked off with a cough…

Gold price’s performance has been especially bad this year, with the price falling from US$1,800 to US$1,630.

At least, that’s the state of things in US dollar terms…

Now I don’t know about you, but I don’t think of my stocks in US dollar terms. Nor did I pay for my house in US dollars.

The ATO doesn’t adjust my capital gains into US dollars, and it certainly wouldn’t accept paying my taxes in US dollars, either.

The ASX 200 isn’t redenominated into US dollars when they read its closing level on the news each evening. And yet, the gold price is…

But when I sell my gold, I don’t get US dollars. I get Australian dollars.

What gives?

While it’s important to remember the role the US dollar plays, and to make international comparisons in a common currency like the US dollar, this can be misleading for what investors actually experience and care about.

We measure our other investment returns in Australian dollars, right? So why not apply this to gold too?

Well, in Aussie dollar terms, the gold price has been flat since the pandemic began. And it hasn’t gone up or down much during 2022, either.

This isn’t very exciting until you compare it to the alternatives that crashed over the same time period. The ASX 200 is down about 10%, for example. That’s in Australian dollar terms. But nobody is out there decrying the Aussie stock market’s severe bear market in US dollar terms.

Gold is supposed to outperform during crises. And it has. I’ll admit it didn’t go up either, but it hasn’t plunged. Not in Aussie dollar terms.

Now you may think this is a bit shifty. If this stability in the Aussie dollar gold price didn’t come from gold’s return, but from the Aussie dollar’s plunge, isn’t it a bit disingenuous to declare that we were right about gold?

Well, not if gold’s ability to profit from a plunging Aussie dollar was one of the reasons we recommended it in the first place.

Here’s an excerpt from the Australian bonus chapter I wrote for Jim Rickards’ book, The New Great Depression, which explains:

***

The Aussie dollar’s value

Australia is a highly developed country. But our economy is built on commodities. And commodities are risky bets. They fluctuate heavily in price. Put the two together and you’ll understand why our currency has big swings too.

Our currency is what’s known as a ‘risk-on’ bet. We do well in the world economy’s good times, and our currency goes up in value. We do badly during poor times, and our currency falls fast.

This currency instability, combined with Australia’s legal and political stability, means Aussie investors are best placed globally to benefit from owning gold.

Why? Gold is priced in US dollars. The Aussie gold price is the US dollar gold price, converted to the exchange rate to Aussie dollars. In other words, the exchange rate is half the equation determining the price of gold in Australia. This creates a uniquely beneficially position for Aussie investors.

Let me explain using a model I call…

The Gold Quadrants

Yes, the name is a bit obscure. But stick with me. You need to understand this if you want to understand just how beneficial gold is to the Aussie investor.

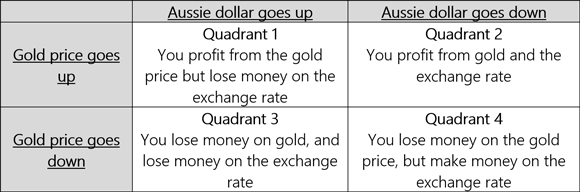

The Aussie Gold Quadrants are the four possible outcomes when you invest in gold. The gold price in US dollars can go up or down. And the exchange rate, which gives you the Aussie dollar gold price, can go up or down too.

Two variables give you four possible outcomes.

Say the gold price in US dollars goes up 5% and the Aussie dollar goes up 5% too. That leaves the Aussie dollar gold price with no change. That’s because the gains in gold are cancelled out by the exchange rate.

You can see how a collapse the US dollar would not necessarily mean profits for Aussie gold investors, right? The exchange rate move could cancel out the gains.

But this is only one of four possibilities.

I’ve put all four possibilities in this table — the Aussie Gold Quadrants Table.

It shows all four possible outcomes for Aussie gold investors. What I call ‘the four quadrants’.

|

|

The thing to understand is that these four quadrants are not equally likely to occur. Especially in a long-COVID world. Here’s why…

Gold and the Aussie dollar tend to move together or in opposite directions depending on the economic environment the world is in. They react differently to different forces in a way that benefits you.

The Aussie dollar is a risk currency. That means investors buy Aussie dollars when they want to invest in risky assets, and sell when they want to protect their wealth.

Gold is considered a safe haven. It spikes when risks in the economy rise, and is sidelined when the economy is considered stable.

This combination of characteristics makes gold a brilliant investment for Australians looking to protect their wealth from long COVID because it changes the probabilities for each of the four quadrants in your favour.

To see how, let’s take a look at the sort of environment that gives you each of the four quadrants…

Bigger gains, less volatility, better probability

In an economic crisis like the one we’re in, Quadrant 2 is more likely to occur…

The Aussie dollar tumbles as investors flee the risk currency. The gold price surges because gold is considered a safe haven. An Aussie gold investor would make money on both moves. Your gold is worth more in US dollars, and even more in Aussie dollars.

This happens to be the action on the very day I write this. Australia’s latest outbreak is wreaking havoc and so the Aussie dollar is falling while the gold price rises. It’s up 1.15% in US dollar terms, but 1.69% in Aussie dollar terms. That’s just one morning’s price action, but it gives you an idea how the divergence could build over time.

That’s the long-COVID quadrant. What about the other three remaining quadrants?

These are less important to gold investors, as it’s during a crisis that gold really shines. That’s why people own it. But they’re still important because crises only happen occasionally.

Quadrant 3 is the only quadrant where Aussie gold investors will definitely lose money. The gold price moves against you, as does the exchange rate. But the environment which would make this happen is very unlikely to occur.

The Aussie dollar would have to rally while the gold price falls. This implies deflation during a ‘risk-on’ investment cycle. That probably hasn’t happened for a sustained period since the Industrial Revolution. The gold price is influenced by inflation, which tends to go along with economic growth. And economic growth is good for risky investment assets, like the Aussie dollar.

To be clear though, such a move could happen in the short term, as both gold and the Aussie dollar are volatile.

Quadrant 1 and 4 don’t offer a clear outcome. Your gains in the currency will offset your losses in gold, or vice versa, to some extent. You might lose or make money as gold or the exchange rate outpace each other.

The point is that your investment is naturally held stable by the different directions of the currency and gold. Your gold investment experiences less price volatility than an American’s, for example. That’s great for an asset which is waiting for a crisis to show its metal.

Historically, we’ve tended to be in these two quadrants, where the price of gold and the Aussie dollar are positively correlated, i.e. they move together and balance out each other’s volatility. Nothing much happens. Until that crisis comes along.

So now you know the four quadrants — the four possible outcomes for Aussie gold investors.

In short, the gold price for Australian investors is supercharged by the exchange rate during a crisis, held stable by exchange rates the rest of the time, and the double whammy of the gold price and exchange rates moving against you is very unlikely to happen for a sustained period of time.

***

While US gold investors suffer a lower gold price (largely brought on by their higher US dollar), Australians have experienced a stable gold price. Aussies are yet again waiting for gold to prove its metal in a coming crisis.

Regards,

|

Nickolai Hubble,

Editor, The Daily Reckoning Australia Weekend<