At time of writing, the share price of Pilot Energy Ltd [ASX:PGY] is up more than 7%, trading at 3 cents.

The microcap energy company announced a twist in the plot today — selling off a large portion of one of its permits.

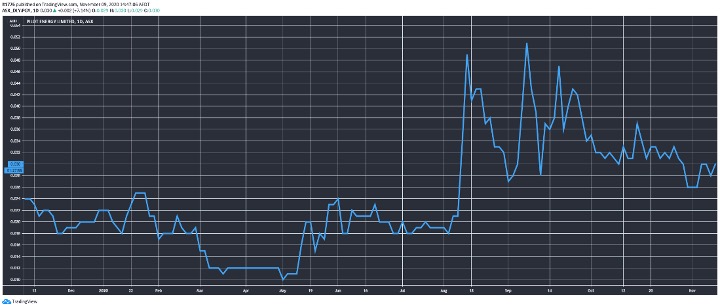

The PGY share price spiked in early August, as you can see below:

Source: Tradingview.com

Here’s a quick overview of the deal.

Details of the PGY deal

It’s a relatively extensive announcement, but it could be the start of trend in the oil and gas space on the ASX.

Just as some lithium players are pivoting to gold on their tenements, oil and gas companies may pursue more lucrative opportunities with the land they have available.

Here are the main bullet points from the PGY announcement:

- Pilot to sell a 78.75% interest in and transfer operatorship of offshore Perth Basin exploration permit WA-481-P to Triangle Energy

- Triangle to pay Pilot $300,000 and free carry Pilot through completion of Permit Year 3 work programme commitments of $5.5 million

- Sale of interest in and operatorship aligns WA-481-P exploration permit with existing Cliff Head Oil Field JV and ownership

- Cliff Head Oil Field is owned by Triangle (78.75%) and Royal Energy (21.25%) which subject to shareholder approval is to be acquired by Pilot

- Pilot and Triangle to also form Wind & Solar Project Joint Venture with Pilot 80% owner and operator and Triangle 20%

- Joint Venture to assess feasibility of development of large-scale wind and solar project centred on Cliff Head Oil Field Facilities

- Pilot to carry Triangle on cost of Wind & Solar Project feasibility study

From PGY chairman Brad Lingo:

‘This is exactly the type of development that demonstrates the ability to substantially redefine how the Australian offshore oil and gas industry can, in parallel with existing operations, participate in a low carbon future through offshore renewable energy projects delivering substantial low cost energy to Western Australia. The substantial nature of the offshore opportunity in Western Australian also presents the option to supply renewable hydrogen to international markets.’

Outlook for PGY share price

A lot will depend on factors emanating from both state and federal government, of course.

I’ve recently documented the huge number of batteries popping up in states across the country.

It’s a massive trend, to be sure.

Long term there are hurdles internal to the company to scale, as with any project.

But the big picture favours renewables — money is flowing into the sector at a rapid pace.

The PGY share price may have ups and downs.

But if the company can execute its strategy over the next few years, it may capitalise on the renewables trend in a big way.

Regards,

Lachlann Tierney,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.