Australian lithium producer Pilbara Minerals [ASX:PLS] has secured a pre-auction bid for its spodumene concentrate of US$7,830/dmt.

PLS said the pre-auction bid reflects ‘strong demand conditions’.

This comes after lithium prices in China touched all-time highs last week, with the price of Chinese battery-grade lithium carbonate hitting a record high of US$74,475 a tonne, according to Benchmark Minerals.

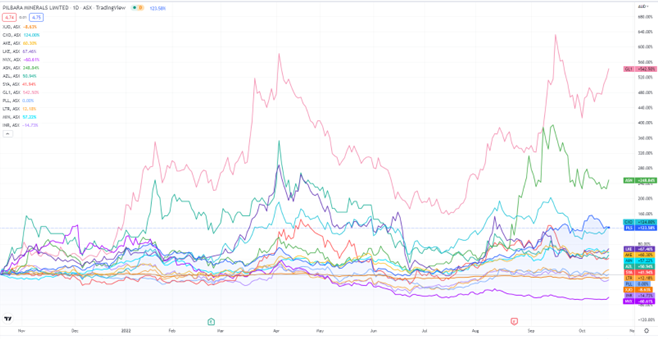

PLS shares are up 125% in the past 12 months:

Source: tradingview.com

Pilbara secures pre-auction sale

Pilbara has secured a pre-auction sale for its spodumene cargo ahead of its 10th scheduled digital auction on the Battery Material Exchange (BMX).

5,000dmt on a 5.5% lithia basis was put forth for bids to a group of select BMX-registered participants ahead of the BMX auction scheduled for today.

Pilbara commented:

‘The Company is pleased with the strong responses received from participants and has accepted a pre-auction offer of US$7,100/dmt (SC5.5, FOB Port Hedland basis) with a 10% deposit due shortly.

‘This offer of US$7,100/dmt equates to an approximate price of US$7,830/dmt on a SC6.0 CIF China equivalent basis after adjusting for lithia content on a pro rata basis and freight costs. Shipment is expected from mid-November.’

Pilbara stated that a sales contract had already been completed. The company is now awaiting a letter of credit due at the end of the month.

This was the lithium seller’s 10th time on the exchange. In July, the lithium producer accepted US$6,841/dmt for its spodumene, then declared ‘strong interest in both participation and bidding by a broad range of qualified buyers’.

This was somewhat less than the pre-auction bid of more than US$7,000/dmt the seller accepted the month before.

Overlooked ASX lithium stocks

In 2021, junior lithium stocks like Sayona Mining [ASX:SYA] and Lake Resources [ASX:LKE] were some of the top performers on the All Ords.

The juniors benefited greatly from a bull run in the lithium sector, but many — Like LKE and SYA — are now well down from their 52-week highs, despite lithium prices remaining elevated.

Is it too late to tap into the lithium sector as we approach 2023?

Money Morning has recently published a research report which may answer such questions.

The research report also profiles three overlooked ASX lithium stocks.

Access the research report here.

Regards,

Kiryll Prakapenka,

For Money Morning