Pilbara Minerals Ltd [ASX:PLS] and Calix Ltd [ASX:CXL] execute MOU for a joint venture project to develop a midstream lithium chemicals refinery.

Pilbara and Calix will undertake a scoping study using CXL’s calcination technology to assess a new refining process, with the goal to produce concentrated lithium salt midstream materials for lithium batteries.

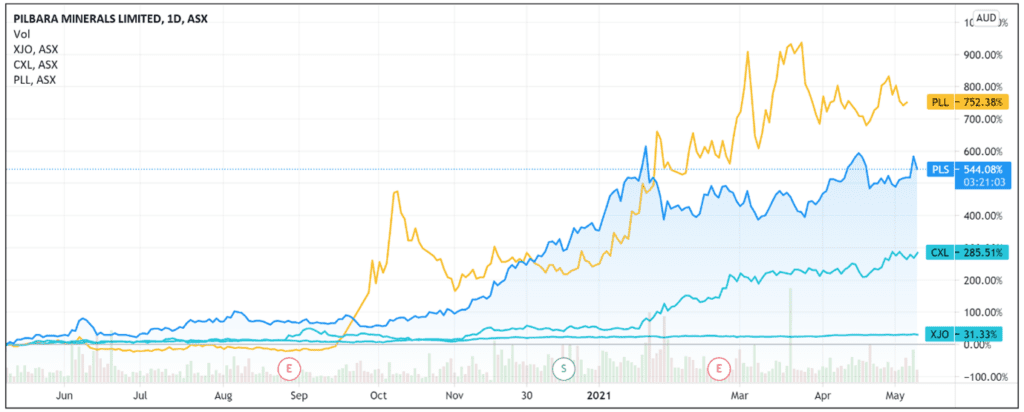

While announced as a joint venture, the stocks didn’t move in unison.

At the time of writing, the Pilbara Minerals [ASX:PLS] share price was down 5.3% while the CXL share price was up 7.4%.

Despite today’s fall, Pilbara share price is still up 43% year-to-date and up 500% over the last 12 months.

Pilbara and Calix background

CXL develops patented technology to address global sustainability challenges on an industrial scale.

Calix’s core technology is used to develop sustainable solutions for advanced batteries, crop protection, aquaculture, wastewater, and carbon reduction.

It aims to become a ‘global innovator of industrial solutions for the environment.’

CXL has a market capitalisation of $422 million. In FY20 it reported $25 million in net assets and zero debt with $24.4 million in total revenue.

Pilbara is a pure-play lithium company who owns 100% of the ‘world’s largest, independent hard-rock lithium operation’ located in Western Australia’s Pilbara region.

Pilbara has partnered with the likes of Ganfeng Lithium, General Lithium, POSCO, CATL, and Yibin Tianyi.

PLS seeks to become a sustainable, low-cost lithium producer and a fully-integrated lithium raw materials supplier.

In its March 2021 quarterly, Pilbara reported a record production of 77,820 dry metric tonnes of spodumene concentrate, up from 63,712 dmt in the December 2020 quarter.

Across the months of February and March 2021, PLS posted an annualised production capacity of about 330,000 tpa of dry spodumene concentrate.

During the quarter, Pilbara received $37.3 million from customer sales on top of a $15 million prepayment from Yibin Tianyi.

However, Pilbara did report $33.8 million in operating costs at its Pilgangoora project.

The lithium producer’s quarter-end cash balance totalled $112.1 million.

Pilbara and Calix sign memorandum

Pilbara and Calix today signed a memorandum of understanding (MOU) to complete a demonstration plant scoping study with a further agreement to develop a demonstration plant and commercialisation pathway.

After initial testwork, the MOU was signed with the aim to use CXL’s calcination technology to produce a concentrated lithium salt for downstream lithium raw material demand.

Pilbara and Calix stated the proposed demonstration plant will likely use fine particle, lower-grade spodumene concentrate from the Pilgangoora project, processing it on site.

The aim is to create a low-carbon, concentrated lithium salt which ‘could be further refined into lithium battery materials or potentially used as a direct feedstock for lithium iron phosphate cathode manufacture.’

Pilot scale testwork at CXL’s Bacchus Marsh facility purportedly showed Calix technology was able to achieve over 95% conversion of the spodumene ore to an extractable lithium.

How can this joint venture benefit Pilbara?

Explaining the rationale, PLS Managing Director and CEO Ken Brinsden said:

‘At the mine, if we can efficiently calcine a lower-grade spodumene concentrate we should also be able to achieve a higher recovery from the ore body, meaning less mine wastage and lower cost.

‘The opportunity to produce a higher-value product in Australia should also allow us to capture more of the overall value in the new-energy industry as it develops.’

Outlook for Pilbara Share Price

PLS and CXL revealed the scoping study will run until ‘late 2021’.

If the results are judged as positive by the pair, a joint venture to build and own a small commercial scale demonstration plant may be negotiated.

In terms of commercialisation possibilities, Pilbara expects the contemplated refining facility to produce ‘up to several thousand tonnes of lithium salt annually’.

Investors may have expected more production potential, and some may be wondering what the joint venture will cost relative to what it can bring in sales.

Another reason for Pilbara’s slide but Calix’s gain could be the fact CXL will hold the licence to the refining technology if proven to be commercially viable.

As Calix’s release noted, the refining process will be ‘marketed by the JV to Pilbara Minerals and other spodumene producers under licensing arrangements.’

Pilbara indicated it could independently operate its own lithium phosphate operation, but it will have to use ‘technology licensed from the JV.’

While the processing technology could end up improving lithium’s midstream supply chain, the benefits will not accrue solely to Pilbara.

Rivals could become licensees of Calix’s technology without incurring the costs of erecting demonstration plants.

Pilbara’s slump today could also reflect a broader slowing of momentum for ASX lithium stocks.

For instance, Lake Resources NL [ASX:LKE] is currently down 9%, Novonix Ltd [ASX:NVX] is down 7.6%, and high flyer Vulcan Energy Resources Ltd [ASX:VUL] is down 5%.

If you’re interested by the potential of the lithium sector but unsure where to start in your research — with so many ASX lithium stocks out there right now — then I suggest reading our free 2021 lithium report.

Regards,

Lachlann Tierney,

For Money Morning