At time of writing, Pilbara Minerals Ltd [ASX:PLS] shares are in a trading halt as the company makes a big move to expand its resource.

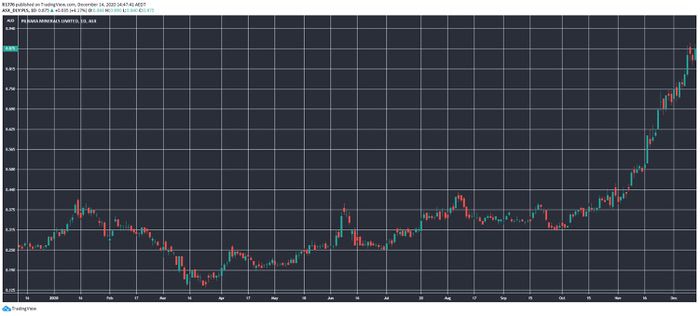

Prior to today, the PLS share price went on a big run as chatter grew over the proposed move, as you can see in the chart below:

Source: tradingview.com

We look at the details of the move and the equity raising.

Pilbara aims to grab neighbouring Altura Project

Here are a few important things to know about the move:

- Proposed purchase price of US$175 million

- Funded via equity raise totalling $240 million

- Equity raising comprised of $119 million cornerstone placement, which is complete, and a non-renounceable entitlement offer of $121 million

- Both parts of the equity raise taking part at a fixed price of 36 cents a share

Given the two projects are 30 minutes by road a part, Pilbara’s move makes sense.

Especially when you consider the Altura Project was on care and maintenance since 26 October.

The consolidated project would be one of the few operating spodumene projects that are 100% by the same company.

Outlook for PLS share price

Back in late October, Pilbara Minerals boss Ken Brinsden was quoted in the Australian Financial Review as saying:

‘There are those that are going to survive and there are those that aren’t, and that is the truth because it has been punishing. My view is that we have bottomed out and I say that because the whole supply chain margin has been compressed to zero or less. I honestly don’t think that prices can fall too much further.’

Altura seems to be succumbing to these pressures and Pilbara looks to be benefitting (if you take a long-term view).

That being said, the PLS share price entered the trading halt at 87.5 cents.

Compared to the price of shares in the equity raise (36 cents), that’s a significant discount.

Regards,

Lachlann Tierney

For Money Morning

PS: Energy expert Selva Freigedo reveals three ways you can capitalise on the $95 trillion renewable energy boom. Download your free report now.