In today’s Money Morning…will a reckoning with the global debt complex happen this year?…here’s a tool to get a gauge on market sentiment…three massive investment themes for 2022…and more…

Although it’s 2021, it’s never too early to start thinking about how to invest in 2022.

Hell, as an investor, your only job is to think ahead.

If you aren’t doing that, you’ll quickly fall behind or get caught out.

That’s why I want to share with you what’s happening right now in 2021, and what happens next year in terms of investing thematics.

Right now, for instance, there’s the Evergrande mess, a China-led crypto sell-off, and regulators threatening to put the brakes on home lending largesse in Australia.

That’s a trio of big, nasty, bearish stories.

And they can’t be discounted out of hand.

Media narratives always have an immediacy about them.

‘You must pay attention to this now’ is the usual modus operandi. You can’t let the media profit motive reduce your ability to make a profit as an investor, though.

So here’s what’s happening right now, a tool for gauging sentiment, and then I’ll finish with the big investing themes that need to be on your radar going into next year.

Will a reckoning with the global debt complex happen this year?

All of these stories have a common thread running through them — a potential unwinding of the global debt complex.

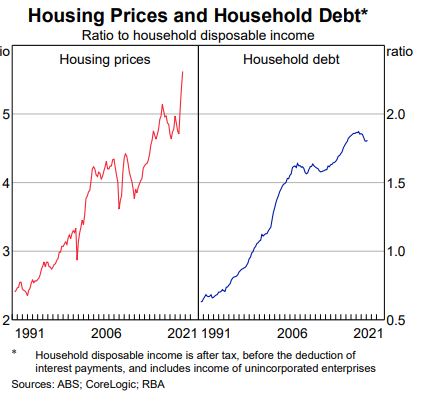

Evergrande is the world’s most-indebted property developer, China has to manage its immense debt somehow, so it’s crypto out and the Chinese digital yuan in, while Australia’s financial-property complex is built on mountains of cheap loans and a ballooning household debt to disposable income ratio:

|

|

|

Source: RBA |

Add it all up, and a reckoning with our global debt problem must occur at some point.

Personally, I don’t think it will happen this year. Maybe in 2022, though.

Which is why this particular trader’s recent bet makes sense to me.

Here’s a rundown of that bet in a nutshell:

‘One trader just took on a huge bet that US stocks will rally into the end of this year.

‘The flurry of trades with the SPDR S&P 500 ETF Trust (SPY) — which took place between 10.34am and 10.41am New York time on Wednesday — involved call spreads maturing in each of the next three months. The total cost was about $US50 million ($69 million).

‘Should all the contracts be in the money by their respective expiration dates, they would be worth $US136 million — for a profit of roughly 70 per cent, according to an estimate from Chris Murphy, co-head of derivatives strategy at Susquehanna.

‘“These trades all share very similar footprint,” said Murphy. “It could be someone who is underweight equities and says, ‘if this thing explodes to the upside by the end of the year, then I’m going to be in trouble. So why don’t I put on a couple of these call spreads just to cover myself?’ That’s one situation. Or it could be someone who’s bullish getting more bullish.”’

Now, understanding the motivations behind options bets is hard.

As in, how do you pierce the veil on this one?

It could be a hedge on a big, bearish position that could get blown up if the market makes a big run up the charts.

Or as Chris Murphy surmises, it’s just a straight-up bull bet.

Who knows? And maybe it doesn’t matter.

What you can do, though, is try and penetrate the smokescreens that the media is throwing up at the moment.

Which is where this next tool comes in.

How to Capitalise on the Potential Commodity Boom in 2021. Learn More.

Here’s a tool to get a gauge on market sentiment

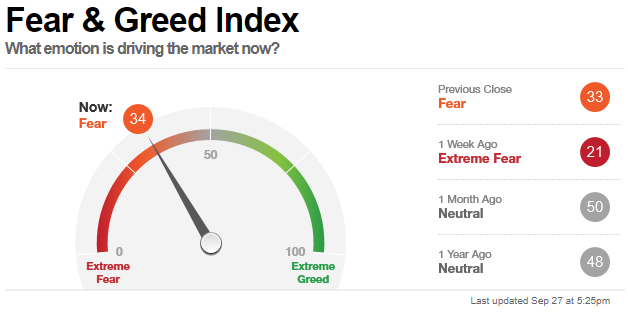

Our Editorial Director Greg Canavan likes to check up on the CNN Fear & Greed Index, for example:

|

|

|

Source: CNN |

A reading of 34, representing a strong fear reading, makes sense given the three bearish stories circulating at the moment.

I think it’s a good tool for traders, as the index pulls in a lot of data.

This includes:

• ‘Stock Price Momentum: The S&P 500 (SPX) versus its 125-day moving average

• ‘Stock Price Strength: The number of stocks hitting 52-week highs and lows on the New York Stock Exchange

• ‘Stock Price Breadth: The volume of shares trading in stocks on the rise versus those declining.

• ‘Put and Call Options: The put/call ratio, which compares the trading volume of bullish call options relative to the trading volume of bearish put options

• ‘Junk Bond Demand: The spread between yields on investment grade bonds and junk bonds

• ‘Market Volatility: The VIX (VIX), which measures volatility

• ‘Safe Haven Demand: The difference in returns for stocks versus Treasuries’

All really important things to have a grip on.

But as for investing over a longer time frame — particularly that 2–3-year period that Ryan Dinse discussed yesterday — that’s a different matter.

So here’s where I’ll be looking for the next big thing for investors in 2022.

Three massive investment themes for 2022

If you’re a regular Money Morning reader, these won’t be new for you, and these three investment themes are what I’m most excited about right now.

- Cryptocurrencies and ‘new money’ — fundamentally, crypto’s existence is predicated on a rejection of the global debt complex. Knowing what to do here if that reckoning happens in 2022 could be absolutely crucial.

- Synthetic biology — you’ve seen what the mRNA vaccines are capable of. What about a vaccine for cancer? It’s called cancer immunotherapy, it’s real, and you should know about it.

- The health revolution — after the pandemic, there’s a huge backlog of problems built up in the global healthcare system. Efficiency gains are no longer just good, they are required. Companies working on unique solutions, whether that’s via AI/automation or digital platforms — these need to be on your radar.

If any of these three things I outlined resonate with you, I’ve got great news.

We’ve got services that cover them.

For instance, there’s New Money Investor, which covers all the big, macro moves in the world of crypto and what governments are up to as the concept of money changes.

Finally, there’s Exponential Stock Investor, which is all about disruptive exponential change — covering synthetic biology and innovation in healthcare amongst a large range of other exciting themes.

Tomorrow, I’ll have a fresh podcast for you where I interview the CEO of a very cool company bringing telehealth and new efficiencies to healthcare in the UK, Europe, and Australia.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.