Piedmont Lithium Ltd [ASX:PLL] shares rose on Friday as the lithium developer closed its public stock offering.

PLL shares were up 9.5% in late afternoon trade, extending its recent run up in price.

In the last month, the PLL stock gained nearly 50%.

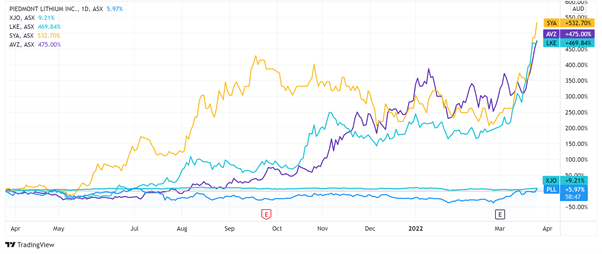

Piedmont isn’t the only ASX lithium stock surging lately, although it is underperforming peers like Lake Resources NL [ASX:LKE] over the last 12 months.

LKE reached its all-time high this week rising 85%, and more than 500% in the last year.

Piedmont, meanwhile — hit with some worries regarding permits and unhappy locals — is relatively flat this year, up only 5% in the last 12 months.

The big gains of the likes of Lake Resources beg the question: How long can this ASX lithium boom last?

Source: Tradingview.com

PLL’s public offering

Today, Piedmont announced the closing of its public offering of common stocks.

2.01 million PLL shares were under offer, including the full exercise of the underwriters’ option to purchase 262,500 shares.

Gross proceeds totalled $130.8 million — which will be critical in funding PLL’s ongoing lithium projects.

Specifically, Piedmont intends to use the funds to restart operations at North American Lithium in Quebec.

The lithium developer also wants to use the capital to fund exploration and feasibility studies in Ghana and advance the lucrative lithium hydroxide plant in the US.

Outlook for PLL shares

Lithium developers are capital intensive.

There’s no revenue but money must nonetheless be spent on labour, exploration, and equipment.

Securing funds — via favourable debt facilities or equity raisings — is crucial for companies like Piedmont.

Especially when the lithium sector is so hot right now that firms can raise equity at elevated prices, minimising dilution.

You can’t say the same for the ASX BNPL stocks, whose depressed shares will make it harder for BNPL firms to raise much-needed funds.

Now we’ve all heard that the age of EVs is coming.

But Piedmont isn’t the only lithium stock aiming to herald the EV age.

There are many other contenders in the lithium sector.

Our experts have recently identified three overlooked lithium stocks that have likely been flying under a lot of folks’ radar.

You can get acquainted with these in ‘Three Overlooked ASX Lithium Stocks That Could Soon Rocket Higher on the Fast-Growing EV Revolution’ — a free report that could inform your future in lithium stock trading.

Regards,

Kiryll Prakapenka