The Piedmont Lithium Inc [ASX:PLL] shares dipped today as Gaston County passed a 60-day moratorium for mining and quarrying activities.

PLL shares were down 3% at the time of writing.

Today’s update comes after Piedmont suffered selling pressure last month following Reuters reporting that Piedmont was yet to apply for crucial permits amid local pushback in Gaston County.

PLL shares fell as low as 68 cents late last month, a level not seen since February.

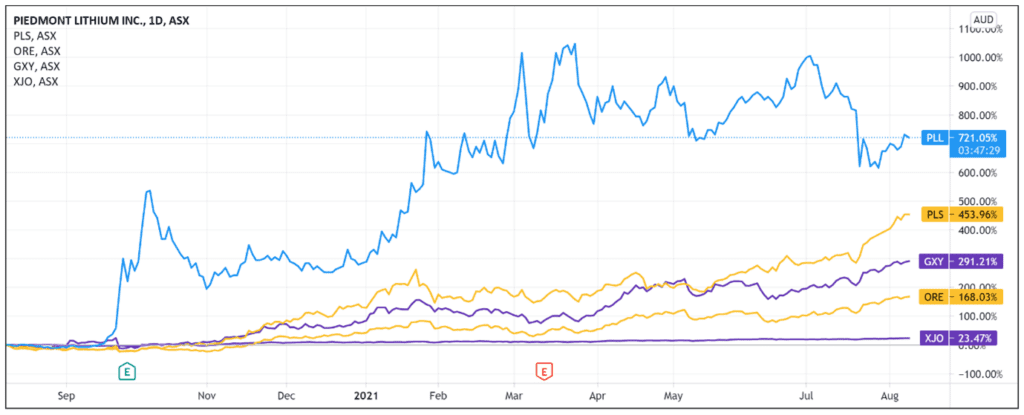

Despite the recent slump — PLL is down 13% over a month — the lithium stock is still up 115% year to date, gaining 700% over the last 12 months.

Crucial county approves 60-day mining moratorium

In a short announcement, Piedmont today reported that during a special meeting of the Gaston County Board of Commissioners on 6 August, the board decided on a 60-day moratorium in ‘new approvals for mining and quarrying activities.’

Commissioners approved the temporary break in these activities to review the county’s current industry regulations and their ‘potential impact on future operations.’

Local publication Gaston Gazette reported the commissioners opted for the moratorium to gain time to place regulations before considering rezoning the land for mining purposes.

Reuters reported that the unanimous moratorium resolution stated that Piedmont ‘cannot be trusted without adequate local controls to protect the health, safety and welfare of citizens.’

Piedmont chose to remain upbeat.

The company said it will look forward to ‘constructive engagement with the county commissioners and staff on the many important matters subject to their review.’

Today’s release did not elaborate nor outline what these important matters are.

‘We wholeheartedly agree’

Piedmont Lithium CEO Keith Phillips thanked the Gaston County Board of Commissioners, citing their leadership in creating a review structure where the county and Piedmont can ‘move forward together.’

‘We wholeheartedly agree,’ continued Phillips, ‘that it’s important for the commissioners to have the time to review existing state and county regulations and how they may apply to plans for the Caroline Lithium Project.’

How did Gaston County report on the moratorium?

Local outlet the Gaston Gazette reported that the timeline provided in the moratorium indicates county officials will spend the next two months ‘learning more about lithium mining, reviewing zoning ordinances in other municipalities where mining occurs and developing better mining regulations for Gaston County.’

The county also hired Tom Terrell — a zoning and environmental attorney — to advise.

Mr Terrell was quoted as saying during Friday’s meeting that:

‘After having worked with you to conduct substantial research of how lithium mining is conducted, compared with the regulations in place in your current development ordinance, it is abundantly clear that a mine of this size, of this magnitude, of this depth, and with these impacts was never anticipated.’

What next for the PLL Share Price?

Piedmont ended today’s update by noting that Gaston County supports growth and development in the region, as it made clear it in a statement during the special meeting.

Piedmont also said the moratorium isn’t ‘intended to stop mining but rather to give the county time to perform their due diligence.’

PLL concluded by saying it will engage with the county regarding its commitment to ‘environmental stewardship and economic prosperity for the county.’

Balancing sustainability and economic prosperity — and their trade-offs — could well determine how Gaston County commissioners approach Piedmont’s permit application.

On the one hand, Piedmont has said it intends to engage in blasting — a common practice for open-pit mines — multiple times a day.

Some worry Piedmont will blast during night-time hours, with Reuters reporting this could potentially affect 500 homes near the mine site.

On the other hand, the company said county residents could benefit from 500+ new Piedmont jobs paying over US$90,000 a year, with ‘100s of jobs created by and for neighbouring businesses.’

If you’re looking for more lithium investment ideas, I’d recommend checking out Money Morning’s free 2021 lithium report.

It details what’s happening in the sector right now, and how investors can make the most out of this lithium boom — including three lithium plays to take note of.

Regards,

Lachlann Tierney,

For Money Morning

PS: This free report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.