The Piedmont Lithium Ltd [ASX:PLL] share price is up 6% at 2 pm today after raising $159 million from its US public offering.

The proceeds will go towards Piedmont’s lithium project and funding the project’s feasibility studies, test work, permitting, exploration drilling, mineral resource estimate updates, and land consolidation.

Parts of the equity raise will also fund strategic investments in Sayona Mining and Sayona Quebec.

The PLL share price rose as much as 6% on the news at 2 pm today.

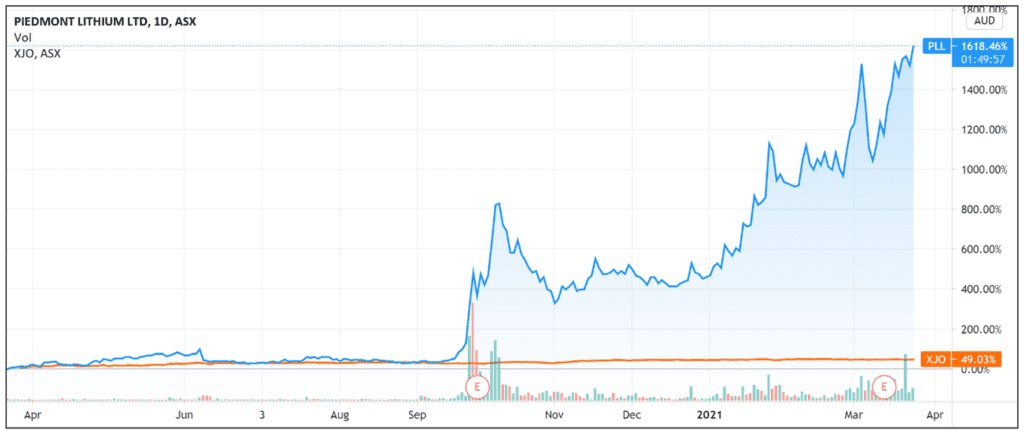

This continues the recent share price trend for Piedmont.

The stock is up 50% over the last month and up 200% YTD.

Source: Tradingview.com

Source: Tradingview.com

Piedmont completes US public offering

After announcing the underwritten public offering yesterday, the ASX and NASDAQ listed lithium company today reported further details.

Three Ways to Invest in the Renewable Energy Boom

Piedmont successfully completed an underwritten offering of 1.75 million of its American Depositary Shares (ADSs).

Each ADS represented 100 PLL ordinary shares at an issue price of US$70 per ADS.

Piedmont granted its underwriters a 30-day option to purchase up to an additional 262,500 ADSs at the public offering issue price.

Additionally, the ADSs will also be issued under ASX listing rules.

Piedmont expects to issue these on 25 March (this Thursday).

The issue price of US$70 per ADS — which translates to 90.9 Australian cents per ordinary share — represents a 3% discount to the 20-day VWAP (volume weighted average price) on ASX of 93.3 Australian cents.

PLL share price outlook

Piedmont is developing its lithium business in the US.

Specifically, the location is in the Carolina Tin-Spodumene Belt of North Carolina, which Piedmont describes as ‘the cradle of the lithium industry.’

The company believes its strategic location will allow it to serve the growing US electric vehicle supply chain.

Location is important for lithium companies as lithium-ion batteries are dangerous to transport over long distances.

Therefore, a lithium company being located within transport distance from major producers, manufactures, and automakers is an advantage.

This is similar to another ASX-listed lithium stock — Hawkstone Mining Ltd [ASX:HWK].

Hawkstone operates a lithium project in Arizona, a state the company labelled ‘the battery corridor’.

What this shows is that lithium companies are very much seeing the market opportunity.

Lithium prices are rising.

Governments are shifting towards cleaner energy sources and automakers like Tesla and Volkswagen are setting ambitious electric vehicle targets.

But not every lithium business will succeed, let alone become a dominant market leader.

With Piedmont’s latest equity raise, investors will no doubt be watching how effectively the capital is used.

Lithium stocks are on a lot of investors’ minds. But with so many news items coming out almost daily, it is hard to keep up and know where to look for lithium investment ideas.

I think this free report on ASX lithium stocks is a great place for anyone who wants further information and ideas.

Highly recommend.

Regards,

Lachlann Tierney,

For Money Morning

Comments