The Piedmont Lithium Ltd [ASX:PLL] share price tumbled today after PLL released its activities report for the March quarter.

At time of writing, the Piedmont share price was down 7.1%, exchanging hands for 91 cents.

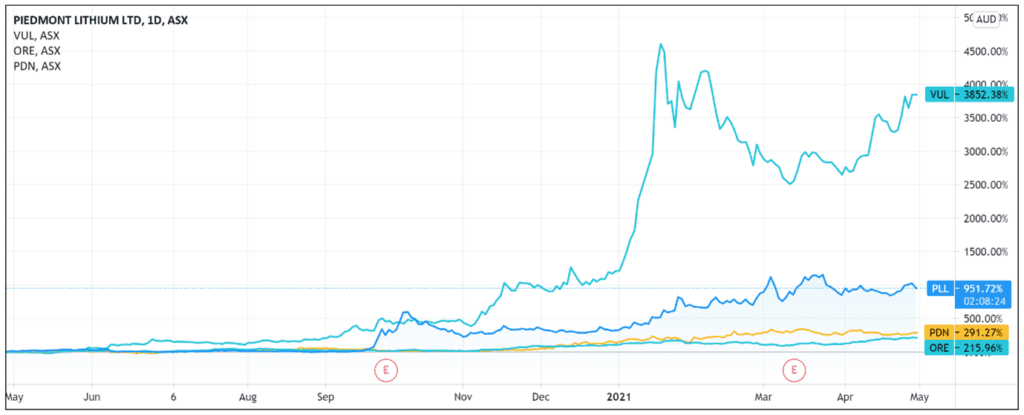

Despite today’s slide, PLL shares are still up 150% year-to-date and up 840% over the last 12 months.

What did Piedmont report?

One of the biggest developments in the March quarter was Piedmont’s successful capital raise.

The company raised gross proceeds of US$122.5 million via an underwritten public offering of 1.75 million of its American Depositary Shares (ADSs).

Each ADS represented 100 ordinary shares, with an issue price of US$70 per ADS.

The capital raise contributed to Piedmont finishing the quarter with a cash balance of US$167.2 million.

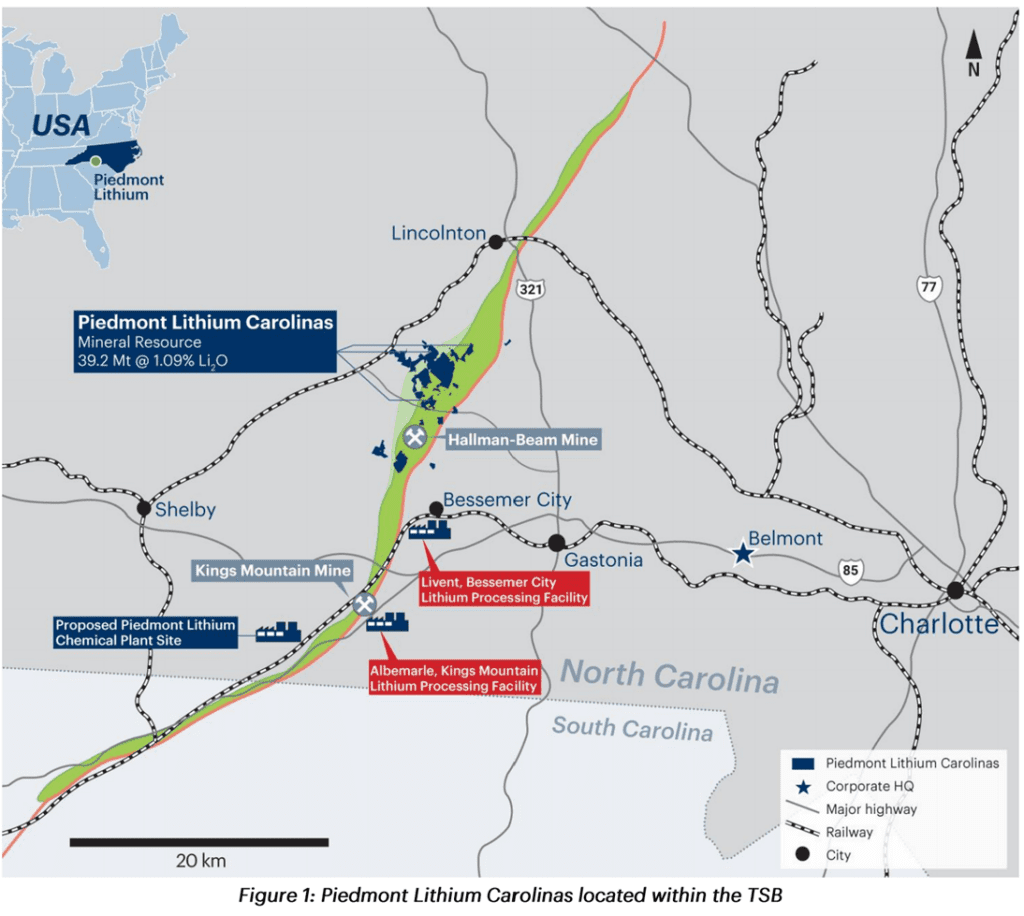

Piedmont also ‘meaningfully increased’ its mineral resources estimate, according to CEO and President Keith D Phillips.

The estimate was upgraded by 40% to total 39.2 million tonnes at a grade of 1.09% Li2O.

55% of PLL’s mineral resources are in the Indicated category, the rest in the Inferred.

Aiming to become a diversified, multi-asset company, Piedmont also invested in Sayona Mining Ltd [ASX:SYA].

With this investment, Piedmont now has a footprint in the ‘important’ lithium hub of Quebec, Canada.

PLL acquired a 19.9% interest in Sayona through shares and convertible notes and will purchase a further 25% stake in Sayona subsidiary Sayona Quebec for US$5 million in cash.

Piedmont and Sayona Quebec entered a binding spodumene concentrate supply agreement where Sayona Quebec will supply Piedmont the greater of 60,000 tonnes per year or 50% of Sayone Quebec’s SC6 production on a life-of-mine basis.

Piedmont re-domiciles to the United States

PLL revealed that it ‘substantially progressed’ its proposed re-domicile from Australia to the United States during the quarter via a scheme of arrangement.

Piedmont’s shareholders ended up approving the scheme on Thursday.

This means Piedmont will now move its primary listing from the ASX to the Nasdaq.

The company will still retain an ASX listing via CHESS Depositary Interests (CDIs).

As the ASX explained, CDIs allow investors to obtain ‘all the economic benefits of foreign financial products without actually holding legal title to those financial products.’

Amcor used the method to re-domicile in 2019 and Afterpay Ltd [ASX:APT] recently flagged it may consider the same to align its interests closer to its biggest market.

Under Piedmont’s scheme, holders of Piedmont ordinary shares will be entitled to receive 1 CDI in Piedmont USA for each ordinary share held in Piedmont.

Importantly, each CDI will represent 1/100 of a share of common stock in Piedmont USA.

Yesterday, the company released an indicative timetable stating that the last date of trading of PLL shares on the ASX will be 6 May.

Piedmont US CDIs will be admitted on the ASX the following day, 7 May.

What’s the outlook for the PLL share prrice?

The activities outlined by Piedmont today would not be new to investors.

The stock steadily rose during the quarter when the announcements were first made, so what explains today’s slump?

The one thing investors did not have access to during the quarter until now was Piedmont’s cash flow report.

Could the company’s financial performance for the quarter explain the investor sell-off?

As would be expected for a company still undergoing definitive feasibility studies, Piedmont tallied no receipts from customers for the quarter ended 31 March 2021.

It did, however, record net cash outflows from operating activities of US$4.8 million.

The largest operating expense was payments for exploration and evaluation, totalling US$1.92 million.

Staff costs came a close second, totalling US$1.6 million.

Year-to-date (nine months) Piedmont posted a net cash loss from operating activities of US$8.2 million.

As part of its investing activities, PLL also spent US$5.3 million during the quarter to acquire tenements.

Overall, thanks to the capital raise, cash and cash equivalents at the end of the quarter totalled US$167.2 million.

This cash cushion means Piedmont has available funds to last 35 quarters at current total cash outgoings.

While the net cash loss for the quarter may sting some investors, Piedmont’s recent capital raise should provide enough runway for the medium term as PLL progresses with its feasibility studies.

It is possible that today’s share price slide reflects negative uncertainty regarding Piedmont’s re-domicile to the US.

It could be the case that some existing Australian investors in Piedmont unsure about the new CHESS CDI arrangements are cashing out their profits before the new arrangement takes place.

While there may be uncertainty surrounding Piedmont’s re-domicile to the US, there is no doubt lithium is enjoying a resurgence as automakers shift their focus to electric vehicles and governments embrace green energy.

This likely means that interest in lithium stocks is set to intensify in 2021.

So, if you want more information on the lithium sector, then I recommend reading our free lithium 2021 report.

Regards,

Lachlann Tierney,

For Money Morning

Comments