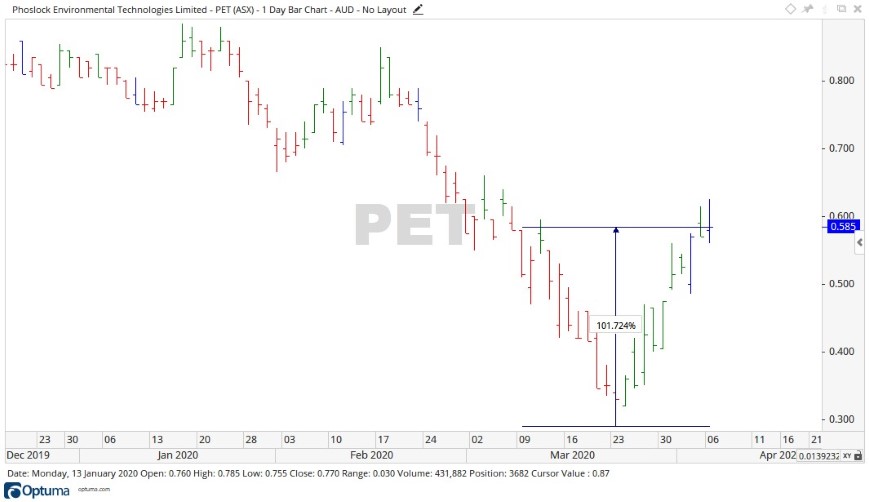

Water solutions company Phoslock Environmental Technologies Ltd [ASX:PET] is in the limelight once again, after the PET share price recorded massive gains since the end of March to close at 58 cents (at the time of writing).

Source: Optuma

Phoslock presents an interesting case as the company has been operating in and around the city of Wuhan, China.

Here’s How to Survive An Upcoming Currency Crisis. Claim your Free Guide

Then to now, What happened with PET?

We discussed in a previous article back in 2019 details of their work in Wuhan.

Phoslock has now been approved to start working on China’s second biggest downtown lake, East Lake, located in Wuhan city. What’s significant about this sign on is that it opens opportunities to treat other lakes in the same area.

Wuhan City has 68 lakes that are greater than 100 hectares in size. What’s more, most of them ‘are grade 5 (very poor) or worse in water quality’ and as these lakes are part of the Yangtze River Basin, its integral their water is restored to acceptable quality.

The Yangtze River Basin is a vital piece of the Chinese government’s South-North Water Transfer Project, which involves channelling Yangtze River water northward.

This is all to restore China’s extreme water scarcity. Eight Chinese provinces have absolute water scarcity, meaning there is less than 500 cubic meters of water per person.

As such, PET Chairman Laurence Freedman believes ‘this province alone is likely to provide the Group with many years of Phoslock remediation works.’

Since the release of our previous look into Phoslock, an enormous amount has changed. Namely, the emergence of the COVID-19 pandemic across the globe, which reports claim started in Wuhan.

Looking forward

In early April 2020, Phoslock went into a trading halt for a very short time while completing a capital raising of some $12 million. All Directors, the CEO, and a significant number of senior executives will contribute an additional $3 million subject to shareholder approval, demonstrating great confidence in the future of the company.

Chairman Laurence Freedman stated:

‘In ordinary circumstances this would be an outstanding result, in the present global market it is even more so. I am of course delighted to illustrate to our shareholders and the public in general, the complete confidence of directors, management and staff in the company’s future. We are now able to tackle Very Large Projects without concerns for working capital requirements.’

Source: Optuma

With a completed capital raising and new projects in place in both China and Brazil, Phoslock’s share price is moving. If this trend were to continue, historical resistance levels of 66 cents, 77 cents, and 84 cents may come into focus.

Regards

Carl Wittkopp,

For Money Morning

PS: In this free report, Money Morning analyst Lachlann Tierney reveals two assets set to benefit as the ‘corona crisis’ worsens. Click here to claim your copy today.