In today’s Money Morning…asset bubbles, business investment, and struggling productivity…the future of productivity is artificial…a sector that is still worth looking at…and more…

Invest. Invest. Invest.

That is the takeaway I took from Philip Lowe’s latest comments at the AFR Business Summit. As well as an accompanying opinion piece from the RBA governor himself.

Points that were clearly meant to ease the market’s recent worries over bond yields and inflation. While also spurring the business sector into action.

Again though, it was Dr Lowe’s commitment and reaffirmation to no interest rate hikes before 2024 that was the centrepiece of his argument. Stating that any chance of a change in the cash rate is ‘unlikely’ within the next three years…

It’s a bold claim to make and could end up being the hill that he dies on.

Especially when his actions appear so tunnel visioned.

In Lowe’s own words:

‘The Reserve Bank is committed to continuing to provide the necessary assistance and will maintain stimulatory monetary conditions for as long as is necessary. We want to see a return to full employment in Australia and inflation sustainably within the 2 to 3 per cent target range.

‘For inflation to be sustainably within the 2 to 3 per cent range, it is likely that wages growth will need to be sustainably above 3 per cent.’

It seems everything else (for now, anyway) is irrelevant.

All that Lowe cares about is getting our stubbornly low wage growth — currently sitting at 1.4% — to more than double in the next few years.

Three Undervalued Aussie Pot Stocks to Watch. Click Here to Learn More.

Asset bubbles, business investment, and struggling productivity

Now, as I’ve said before, this commitment to low rates for longer is huge for investors. It will almost certainly lead to dramatic asset price rises. Just like we’ve seen in recent times not only in Australia, but also abroad.

Dr Lowe doesn’t seem to care about that though. Even as the property market is already heating up.

No, like I stated, he has a one-track mind at the moment, focusing purely on growing our stubbornly low wages higher.

And if his comments over the past few days are any indication, he clearly believes business investment is the solution. Which is precisely why he is happy to facilitate this asset price rise, in the hopes that it will lead to a stronger labour market.

Theoretically, this obviously makes perfect sense.

Cheaper access to debt should lead to more business borrowing, which in turn should lead to more employment. But, like most variables within the economy, it is far more complicated in reality…

To play devil’s advocate for a moment, I think the real problem Lowe has on his hands is productivity.

Sure, flooding the economy with cheap cash may lead to further business investment. But unless it leads to more productivity from workers, it won’t be a good investment.

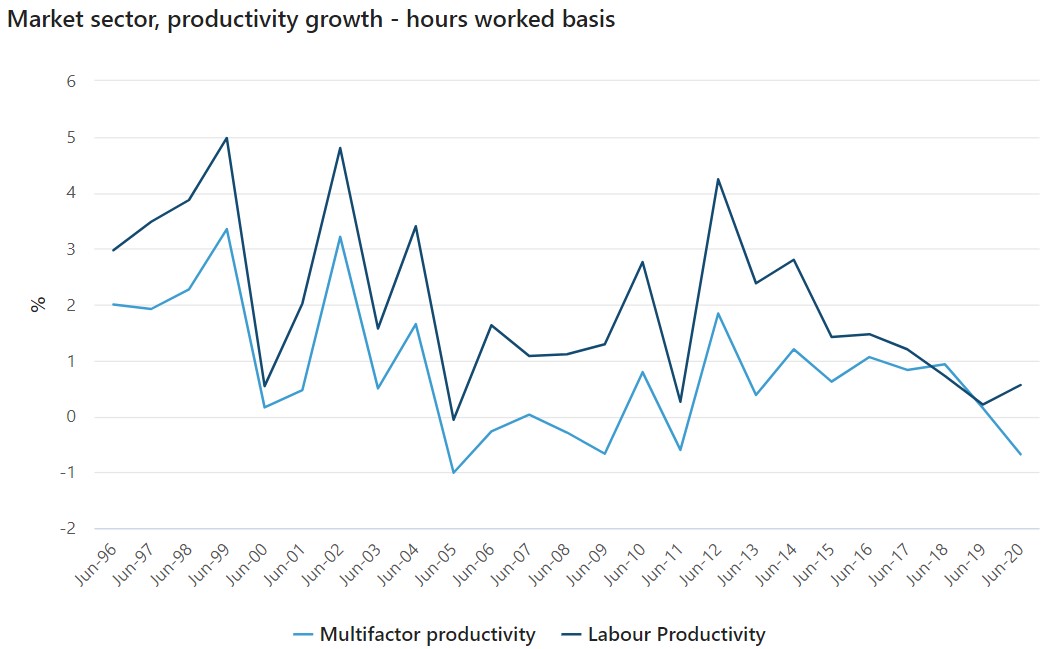

Trouble is, as the following ABS chart shows, productivity has been steadily declining since 2012:

|

|

|

Source: ABS |

A metric that is far more concerning and far tougher to move than wage growth.

Which is precisely why, as an investor, you need to be looking at the whole picture. Because despite what Lowe hopes to achieve, I suspect his ‘low rates for longer’ policy will benefit some sectors far more than others…

The future of productivity is artificial

Let me begin by restating an opinion I shared previously. I firmly believe the RBA will keep the share market humming for these next three years or so.

Until the RBA finds a solution for productivity, and consequently wage growth, it seems they won’t budge on interest rates. Granted, I would never fully trust what central bankers have to say.

If history is any guide, they are prone to issue policy backflips swiftly when things blow up in their faces.

However, for the foreseeable future at least, it seems low rates are here to stay. And that means cheap access to cash for growing businesses. Which in turn should eventually see growth stocks come back into favour. Even if they have been heavily punished by the market over the past week or so.

After all, Lowe is crying out for business investment.

He is pleading for growth in order to meet his inflationary targets.

Again though, I don’t think we’ll achieve that until productivity budges. And while I think we could see a slight improvement on this front in terms of labour productivity, I think the real progress will be made within digital productivity.

The rise of artificial intelligence, robotics, and automated systems is what I suspect will be the biggest driver of productivity in developed nations like Australia. Solutions that offer businesses a far cheaper way to sell a variety of goods and services.

After all, an AI doesn’t need a wage, it just needs to be invented. And right now, the RBA is providing plenty of cheap cash for companies to spend on developing these kinds of digital solutions.

An environment that will continue to benefit tech and forward-looking companies in the months and years ahead. Which is precisely why, despite some highly-inflated valuations, it is a sector that is still worth looking at, in my view.

Especially in the wake of the recent (and perhaps ongoing) sell-off.

Because if bond yields and inflation are their only concerns, I’d be far more worried about Lowe’s ambitious wage growth agenda than tech stocks right now.

An agenda that relies on businesses investing in growth…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.