It’s a done deal.

Perseus Mining Ltd [ASX:PRU] has acquired Exore Resources Ltd [ASX:ERX]. A major agreement that has seen the latter’s share price climb 37.1% higher today.

What it means is that Perseus will gain full control and rights to Exore’s key Côte d’Ivoire (Ivory Coast) projects. Promising gold fields that neighbour Perseus’ own sites.

Thanks to this timely deal, those sites now look set to have much brighter future.

Scramble for African gold

Up until now Exore was purely a prospective gold miner. Working on scoping out their sites for future drilling potential.

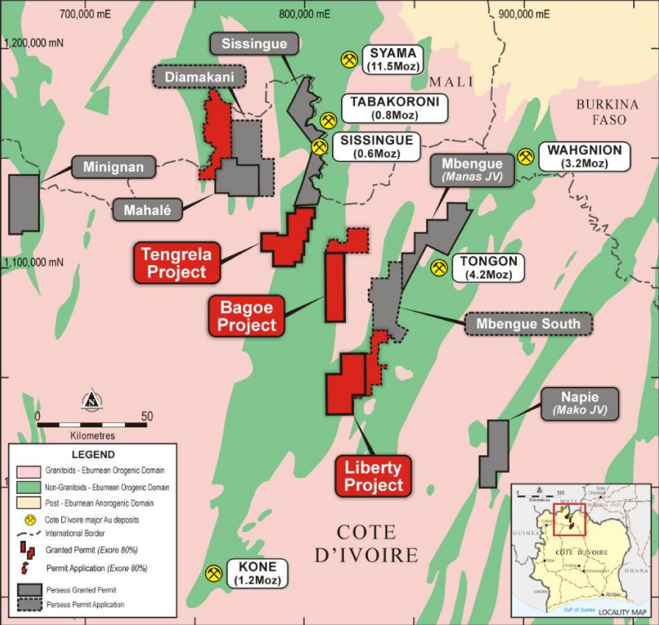

However, they are in a prime location. Surrounded by several other mines, including one owned by Perseus. As the company shows:

Source: Exore Resources

The highlighted red sites (Tengrela, Bagoe and Liberty) are the three Exore projects. Land that Perseus will now have full reign over to explore.

That’s on top of their already operational Sissingue site, which you can also see on the map.

As Perseus’ CEO, Jeff Quartermaine comments, this will be highly synergistic for the miner:

‘The acqusition of Exore results in Perseus gaining ownership of approximately 2,000 square kilometres of geologically prospective land in northern Côte d’Ivoire, close to our operating Sissingué Gold Mine.

‘Sissingué currently has a mine life of three years from 1 July 2020, and with the acquistion of Exore’s land package, including defined Mineral Resources at the Bagoe Project, we have the option of developing the Bagoe Project into a new gold mine potentially using the Sissingué infrastructure, or alternatively, delineating further Mineral Resources that can be economically mined and trucked to our Sissingué plant for processing.’

In other words, it has given Perseus a much need extension for their site and plant. Ensuring that mining should continue well beyond 2023.

As for Exore shareholders, well they’ll be pleased too. Under the terms of the deal they’ll walk away with a fresh stake in Perseus. Of which they’ll receive a tidy 69% premium compared to the company’s recent share price.

All in all, it seems everyone should walk away a winner.

Glittering gains

As for the rest of us, well this merger is a strong indicator of the gold sector right now.

2020 has been a big year for the precious metal so far. And there could be even bigger things to come.

Jim Rickards, our resident gold expert, would certainly agree. He believes that owning gold may be the single most important decision investors could make right now. A tried and true way to protect your wealth in these uncertain times.

Don’t take my word for it though, you can read Jim’s thoughts in full in his latest report. Get your free copy, in full, right here.

Regards,

Ryan Clarkson-Ledward,

For The Daily Reckoning Australia