Pepper Money Ltd’s [ASX:PPM] IPO was the largest this year, but the non-bank lender’s shares now trade below its offer price.

The non-bank lender issued 173 million new shares at an offer price of $2.89 per share, hoping to raise cash proceeds of $500 million.

Following the IPO, the company had 439.5 million shares on issue in what would have been a market capitalisation of about $1.3 billion at the offer price.

Alas, Pepper Money’s debut landed flat.

PPM share price is exchanging hands for $2.41, 15% down from the IPO price.

How come?

Pepper Money: an overview

While debuting on the ASX this week, Pepper Money has been around for years as a private firm.

Since 2000, PPM has originated $32.3 billion in loans ranging from home, asset finance, and commercial real estate loans.

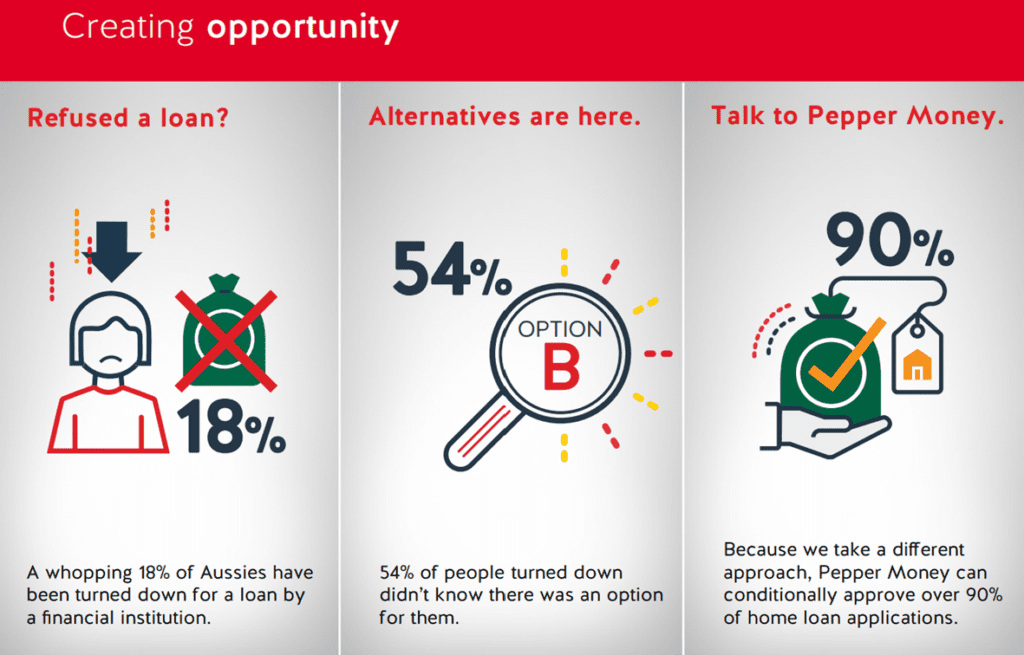

As the company writes on its website, it’s ‘not like a bank’ and believes that ‘perfectly good people don’t always have perfect credit histories.’

That’s why Pepper Money provides a variety of loan solutions, including some that banks don’t offer.

That said, in recent years PPM has branched out to offer more traditional ‘higher credit quality’ home loans, launching its Near Prime and Prime residential mortgage products in 2012 and 2014 respectively.

Pepper Money’s IPO ambitions

The IPO funds were earmarked for growth opportunities as well as partially paying off an existing bridge facility and shareholder loan.

The growth opportunities lie in the fact that Pepper Money’s market share of the $2.16 trillion Australian and New Zealand mortgage market is about 0.5%.

Its share of the $52 billion Australian motor vehicle and equipment finance market is 5.1%.

So, PPM essentially banked on investors buying into its ability to eat away at market share.

After all, if Pepper Money has only ‘cornered’ 0.5% of a market worth over $2 trillion, what will the company look like if it corners 5%, or even 10%?

According to the lender, key to its growth will be its in-house data analytics and technology capabilities.

These in-house capacities are expected to inform credit decisioning and convert more applications.

Fintech fatigue?

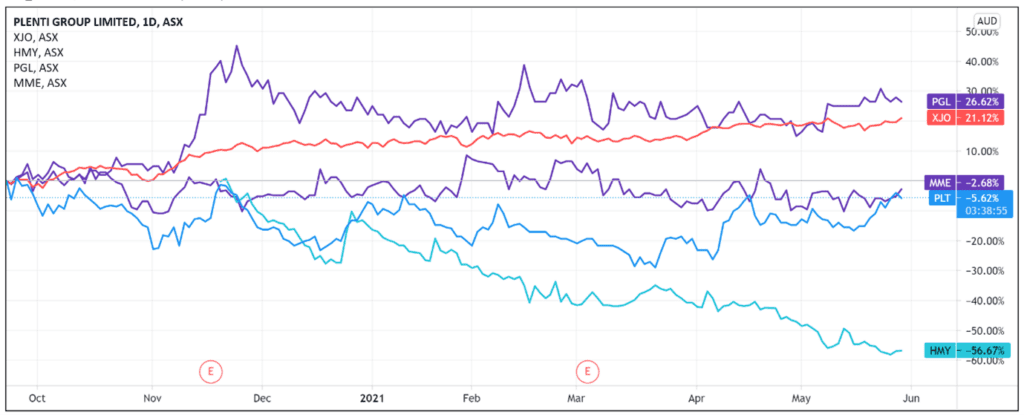

As I’ve covered this week, non-bank lenders are not exactly soaring this year.

As the above graph shows, out of the charted non-bank lenders only Prospa Group Ltd [ASX:PGL] is outperforming the ASX 200 benchmark.

Another recent ASX debutant and non-bank lender — Latitude Group Holdings Ltd [ASX:LFS] — is down 6% from its IPO price.

All Big Four banks, in the meantime, are enjoying strong outperformance, with the Commonwealth Bank of Australia [ASX:CBA] share price breaching $100 for the first time ever this week.

Australia’s Big Four banks are frequently brought up when discussing fintechs and non-bank lenders.

And that’s understandable. Pepper Money itself refers to banks in its growth strategy.

But here’s a question.

Are fintechs expected to ‘take over’ the big banks?

For instance, The Australian’s James Kirby wrote this week that ‘if non-banks are really going to challenge the “big four” incumbents in the financial system they have a long way to go as an investment class.’

If the wider market is pricing these non-bank lenders as challengers to the incumbents, then it is easy to find reasonable explanations for their underperformance.

As we’ve covered recently, the banking incumbents posted strong interim results in recent weeks.

Take, for instance, CBA’s March quarter results.

The bank posted cash NPAT from continuing operations of $2.4 billion, up 24% from the 1H21 quarterly average.

In comparison, Pepper Money’s most recent available financial documents showed the lender made a net loss after tax of $29.96 million for the year ended 31 December 2020.

This was down from a net profit after tax of $49.85 million in 2019, with the fall attributed to a $129 million loss from discontinued operations in 2020.

PPM did record $446 million in net cash from operating activities in FY 2020, with cash and cash equivalents totalling $1.89 billion.

But, contra The Australian’s Mr Kirby, do fintechs like Pepper Money need to challenge the Big Four?

Can the financial ecosystem reach an equilibrium where players like Pepper Money and Latitude have their niche and the big banks carry on doing what they’ve been doing for decades?

It is interesting to ponder whether the recent slump for non-bank lenders is due to the market pricing the stocks as failing challengers to the big banks, or whether the stocks should be priced relative to their standing as niche lenders servicing a customer base neglected by the Big Four.

After all, the chief executive of Pepper Money Mario Rehayem told the Australian Financial Review that major banks are getting more selective about the mortgage customers they take on.

Mr Rehayem thinks the major banks were ‘too big to conduct bespoke assessments on borrowers who fell outside the standard cookie-cutter, while constant changes to credit policies were frustrating mortgage brokers who were not sure if non-prime customers would be accepted.’

This situation sounds less like a challenge to the big banks and more like a division of labour on comparative advantage grounds, with the fintechs rushing in to fill demand for services the banks would rather avoid.

However, what could challenge the banks and the non-bank lenders alike is the revolution brewing with blockchain technology.

I’m not going to wade into the crypto pricing debate here.

What I’m referring to is DeFi — decentralised finance.

Take the first ‘real world’ loan development via MakerDAO.

Then there’s the fact that at a fundamental level, the DeFi movement could be the last great hope for reform of a broken financial system that will face the threat of CBDCs like the digital yuan.

If shares of banks and other lenders are on your mind, then I suggest viewing our special briefing on what we call a ‘New Game’ playing out worldwide.

It discusses ideas on the cutting edge, so I recommend you check it out.

Regards,

Lachlann Tierney,

For Money Morning

PS: The Next Afterpay? Discover three promising Aussie fintechs that are currently trading below $1. Click here to learn more.