Wife: ‘You remember how in season one of The Walking Dead, it was all about the zombies?’

Me: ‘Yeeeeahh?’

Wife: ‘Well, tell me who was everyone scared of in every other season after that?’

Me: ‘Who?’

Wife: ‘Other humans, that’s who!’

This was the enlightening conversation my wife and I had while in lockdown yesterday.

I was busy telling her how it was the long-term political and economic effects I was more scared of, rather than the temporary nature of the virus, when she came out with this corker.

It encapsulates the situation perfectly.

Is the virus something to worry about?

Of course it is.

But like Rick Grimes and crew got to grips with the zombies in season one of The Walking Dead, we’ll work our way through this too.

After that though…

It’s pretty plain to see how woefully unprepared governments — as well as big businesses — have been for such an outbreak.

‘But this is unprecedented…’ they’ll stammer in response.

No, it isn’t.

Bill Gates was warning about the huge risks of such a global pandemic here in a Ted talk way back in 2015.

Even a pleb like me could imagine the possibility of it…

I wrote in a Christmas note to our Alliance members in December when asked to make a big prediction for 2020:

‘I did have an idea that a massive global flu pandemic is long overdue for 2020. And, as an investment angle, you could look into certain biotech and vaccine related companies.

‘But it’s a somewhat grim notion for a Christmas holiday piece!’

(Editor’s note: In the note I eventually settled on the idea that bitcoin would become a central bank asset as my big prediction for 2020. Not such a crazy notion now, it would seem, in a world of QE infinity…)

The short answer is, this event was entirely predictable. Our authorities and political class have no excuses.

And as I’ll show you in a moment, it’s happened numerous times before!

But what I really want to show you today, is just how fast the market can bounce back.

Right now, people are forgetting the resilience of humanity.

We’re approaching a peak of panic.

Notwithstanding the ‘this time is different’ argument and the potential economic damage brought on us by poorly thought out responses to the crisis (remember, after season one, it’s the humans you should be scared of!), history tells us that if you have a strategy in such times, you can make great long-term returns.

Some people even turn into legends…

The wisdom of John Templeton

Before I get into some really interesting charts on how previous epidemics and markets have reacted over time, I first want to very briefly tell you a story about investment legend John Templeton.

Because it’s understanding the psyche of people like this that will give you the courage to think differently yourself.

Sir John Templeton was above all an optimist and a contrarian. He thought for himself and didn’t let the emotions of the market sway his decisions.

He once advised:

‘Tell your readers to use it or lose it. If you don’t use your muscles, they get weak. If you don’t use your mind it begins to fail.’

It’s a point I’d encourage you to take…

He also had this pertinent piece of advice:

‘Don’t panic. The time to sell is before the crash, not after.’

Given many people are probably regretting not getting out of the market sooner, this is a timely piece of wisdom. Sometimes you just have to ride it out.

But if you want to get to the ‘next level’ of investing, you have to have the courage and wisdom to do what Templeton did.

And that was to think for himself; to be willing to go against the herd.

Take this famous example…

Templeton played one of his biggest trades ever on the outbreak of the Second World War. It was a time when everyone else was panicking. Naturally enough I suppose…

But as the John Templeton Foundation reports, Templeton saw opportunity in the fear:

‘He took the strategy of “buy low, sell high” to an extreme, picking nations, industries, and companies hitting rock-bottom, what he called “points of maximum pessimism.”

‘When war began in Europe in 1939, he borrowed money to buy 100 shares each in 104 companies selling at one dollar per share or less, including 34 companies that were in bankruptcy. Only four turned out to be worthless, and he turned large profits on the others.’

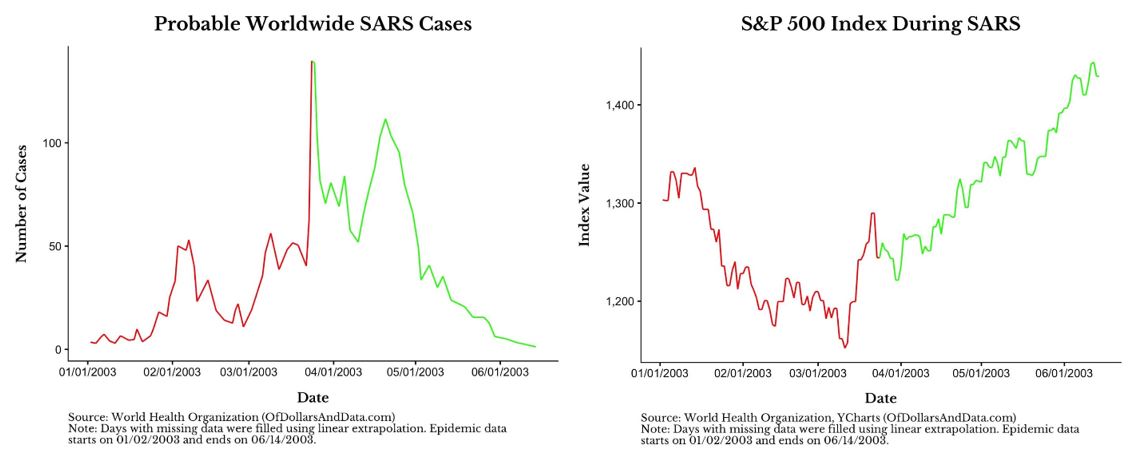

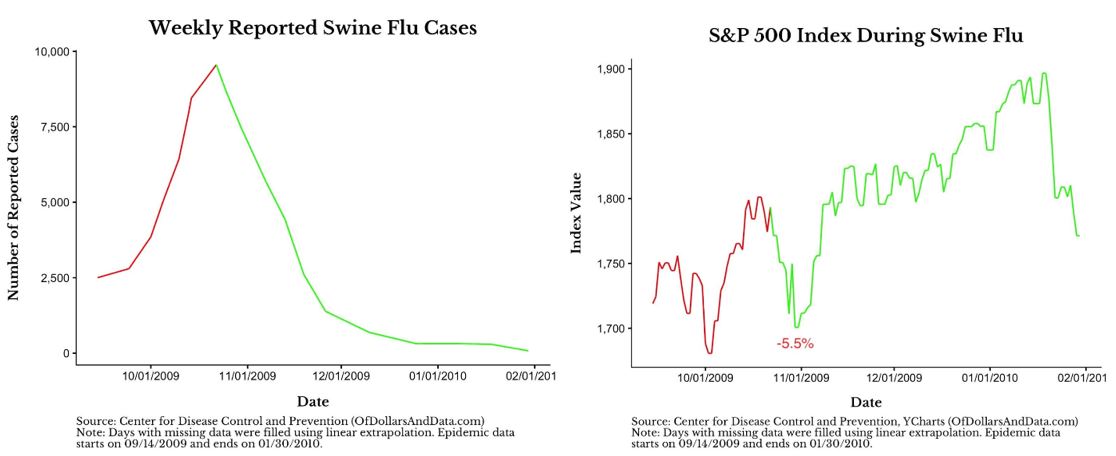

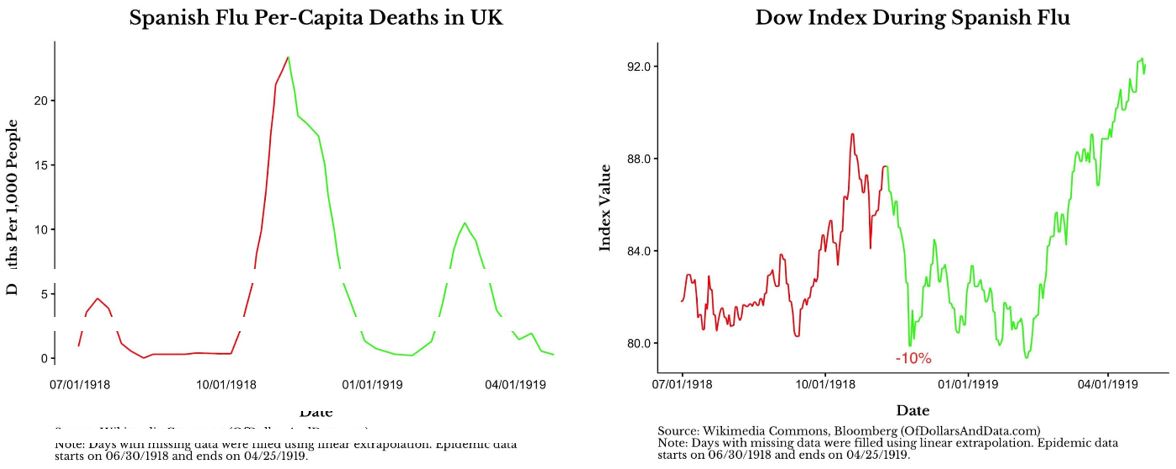

I want to finish with a few charts of previous pandemics and the behaviour of the market. They’ll be provided without much comment.

I think you’ll be able to see what’s going on easily enough…

Markets, flus, and fear

Like I said, we’ve had these types of health pandemics in the past. Though this one is probably more widespread than others, it’s definitely less deadly than some too.

Take a look at these examples. The left-hand chart shows the total cases for each virus, and the right-hand chart is the S&P 500 Index. The red lines show the ‘pre-peak’ cases and the green lines the ‘post-peak’.

|

|

|

Source: Of Dollars and Data |

|

|

|

Source: Of Dollars and Data |

|

|

|

Source: Of Dollars and Data |

You can see that the Spanish Flu of 1918–19 probably had the longest lasting effect on the economy when compared to the two modern outbreaks which recovered fairly fast.

Maybe this time is more like that time?

No one knows for sure yet…

No need to rush, but start thinking

To be clear, I’m not saying today is the time to dive head first into markets.

I’m not saying this won’t get worse before it gets better. It almost certainly will from a health perspective, both here and in the US (though there’s signs countries in Asia and even Italy are getting this under control).

Picking a market bottom is nigh on impossible.

But here’s the thing…

Things will get better.

And if we can avoid the worst economic consequences, the markets will be ready to rebound at some point.

Now is the time to think, strategise, and have your plan ready. I’m sure that’s what John Templeton would be doing…

Good investing,

Ryan Dinse,

Editor, Money Morning