Human capital management and payroll firm PayGroup [ASX:PYG] soared on Thursday after global payroll platform Deel made a $119 million offer.

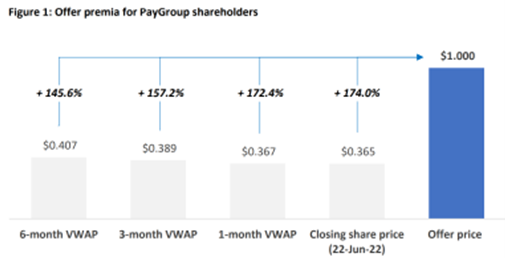

The scheme of arrangement values PayGroup at a 174% premium to its last traded price of 36.5 cents a share.

Deel is offering to acquire 100% of PYG shares for a cash offer price of $1 per share.

Unsurprisingly, PYG has dubbed Deel’s offer as a ‘substantial premium’ to PayGroup’s recent and historical trading.

PYG has traded largely flat at around 40 cents for the past 12 months prior to Deel’s bid.

PayGroup’s all-time high was 93 cents a share notched in June 2018.

Source: Tradingview.com

Deel’s $119 million PayGroup offer

Deel has entered a scheme implementation agreement with PayGroup to acquire 100% of PYG’s ordinary shares for a total cash consideration of $119.8 million.

Source: PYG

PayGroup’s board unanimously recommended that shareholders vote in favour of the scheme.

Each PYG director intends to vote all their PYG shares in favour of the deal in the absence of a superior proposal.

PayGroup described Deel as a leading global payroll solutions business:

‘Founded in 2019, Deel is a leading global compliance and payroll solution that helps businesses hire anyone, anywhere. Using a tech-enabled self-serve process, Deel’s customers can hire independent contractors and full-time employees in over 150 countries, compliantly and in minutes. The company serves more than 8,000 customers, including Coinbase, Lyre’s, Zoomo, Intercom, and Shopify.’

PYG share price outlook

PYG Chairman, Ian Basser, commented on the offer:

‘The PayGroup Board is unanimous in its view that this transaction is in the best interests of PayGroup shareholders. In making this assessment, the Board, including the independent directors, have carefully considered a range of matters including its view of the instinsic value of PayGroup and the certainty for shareholders of this all-cash offer. We believe this transaction is a very good outcome for PayGroup shareholders, and for PayGroup’s stakeholders more broadly, including our employees, customers and suppliers.’

Mark Samlal, PYG Managing Director, added:

‘We are delighted by this proposed transaction with Deel. The value offered is testament to the strength of the PayGroup business we have grown over the last 4 years since listing on the ASX in 2018. We have built a high-quality business with strong, recurring revenues from blue-chip customers across Asia-Pacific and beyond.

‘We are immensely proud of the achievements of the PayGroup team and we look forward to continuing to build this together as part of Deel, one of the world’s fastest growing and leading global compliance and payroll solution companies.”

In turn, Deel’s CFO Philippe Bouaziz added his thoughts on why Deel is going after PYG:

‘Together we will build the first truly global solution in the payroll industry, giving businesses around the world the ability to hire, pay, and manage the best talent, no matter where they’re located. PayGroup’s strong presence in countries like Australia, India, Singapore, and Japan will expand our customer base and reinforce our leadership in the global payroll space.’

Clearly, a 150% jump in one day is unusual.

It’s not every day that a stock treading water receives an offer at a hefty premium to its historic trading price.

But it does show that stock market activity isn’t moribund…despite the interest rate hikes, persistent inflation, and daily predictions of a coming recession.

Some stocks are still making moves, making deals…some stocks still offer opportunities.

The trick is being grounded and switched on enough to find them.

How to do that?

Our small-cap expert, Callum Newman, has a strategy for picking out ‘left-for-dead’ stocks most likely to bounce back.

You can find out how he does it, ‘grave-dancer’ style, here.

Regards,

Kiryll Prakapenka,

For Money Morning