Mineral exploration company Patriot Battery Metals Inc [ASX:PMT] announced today that its preliminary heavy liquid separation (HLS) tests of its core samples indicate the potential for high lithium recovery from its Corvette Property in Quebec, Canada.

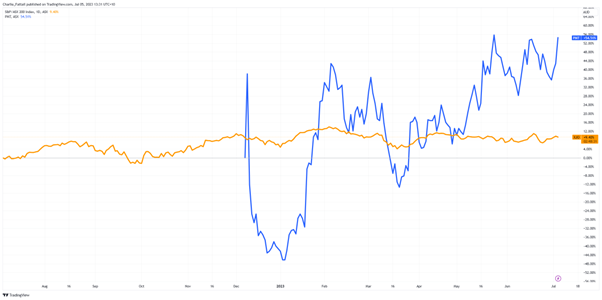

Shares of PMT are up by 8.24% this afternoon, trading at $1.97 per share as the company continues its meteoric rise in the past year. A steady trickle of hopeful news continues from the exploration and sampling of its 100% owned 213 km2 tenement within the James Bay Region of Quebec.

With shares up 236.67% in the past 12 months, the company has garnered a significant following and a US$13 million war chest to expand drilling.

Source: TradingView

James Bay heats up as lithium hotspot

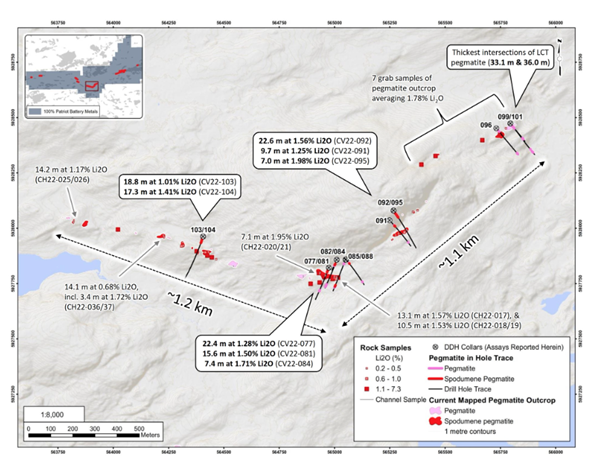

Today, Patriot Battery Metals announced the completion of preliminary HLS test work of Pegmatite samples from the Corvette Property CV13 site in James Bay, Quebec.

Early results indicate a strong recovery through a simple Dense Media Separation (DMS) of 6% plus Lithium spodumene concentrate (Li2O) at over 70% recovery.

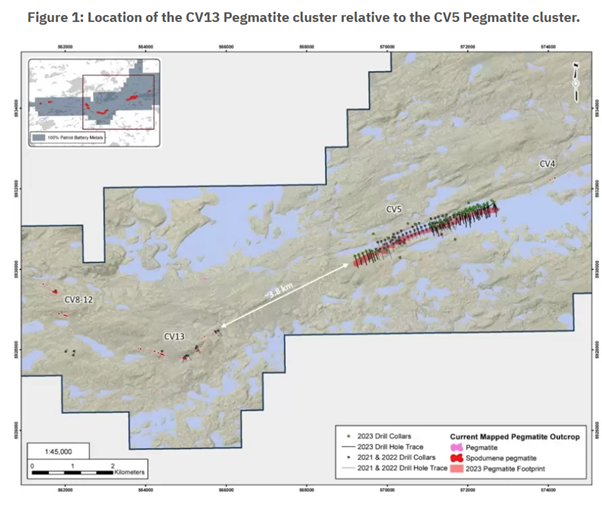

Tests also revealed low Iron oxide content of 0.60% (Fe2O3) in sampling, allowing for magnetic separation and a strong indication of the possibility of joint processing of materials from the nearby CV5 site.

Mineral Process Consultant and Project Steering Group member Brett Grosvenor remarked on the tests, saying:

‘The results of this HLS testwork at CV13 are very positive and indicate strongly that joint processing with CV5 Pegmatite material is practical and viable. From a Project development, risk mitigation, and flowsheet perspective, it is difficult to ask for a better result.’

Further, the data suggest that both pegmatites could be jointly crushed and fed to the same process plant while maintaining reasonably high recoveries into a marketable spodumene concentrate of plus 5.5% Li2O.

As a next step, the company intends to collect a sizable, composite drill core sample over the summer-fall of 2023 in order to feed a DMS pilot plant.

Source: Patriot Battery Metals

The reputation of the James Bay area is rising with several big names involved in projects in the area posting similar bullish results.

Currently, the project sits beside:

- Oceana Lithium [ASX:OCN] – James Bay

- Allkem [ASX:AKE] – James Bay

- Winsome Resources [ASX:WR1] – Adina and Cancet

- Rio Tinto [ASX:RIO] – Midland

- Loyal Lithium [ASX:LLI] – Hidden Lake

‘Recent outstanding exploration results announced by Patriot Battery Metals, Winsome Resources and Allkem, in similar geological settings in James Bay demonstrate the potential for additional world class lithium discoveries in the district,’ said Oceana Chairman, Gino Vitale.

Patriot Battey Metals Outlook

The metallurgical data collected from the CV5 and CV13 pegmatites is highly encouraging and demonstrates that a DMS-only flowsheet is possible at both clusters.

The positive results of the HLS test work are a significant step forward for the development of the Corvette Property CV lithium trend — an emerging district that spans more than 25 kilometres across the area.

Source: Patriot Battery Metals

To date, six distinct clusters of pegmatite have been discovered across that district, giving PMT a clear runway to establish joint processing plants to flow into nearby markets.

The Company is confident that the CV5 and CV13 pegmatites have the potential to be significant sources of lithium, and that the joint processing of these pegmatites could be a cost-effective and efficient way to produce a high-quality spodumene concentrate.

Globally mine production of spodumene is forecast to rise from 3.1 million tones in 2022–23 to 4 million tonnes in 2024–25, with ongoing expansion and exploration of projects worldwide.

This is forecast to boost global lithium production to 304kt by 2030 to meet the rising demands from EVs and lithium batteries.

However, forecasts for spodumene prices are set to decline in 2024 off the back of a lagging Chinese economy and output surges.

PMT earnings are forecast to decline by an average of 13% per year for the next three years as a result and the company remains unprofitable.

With a price-to-book ratio of 22 times, it’s well above its peer’s average of five times and indicates that investors may have gotten ahead of themselves despite very promising early results.

For some, this could be seen as a longer-term play as the James Bay region continues to gain attention.

While short-term price forecasts for battery metals look gloomy, market analysts agree that the future paints a picture of growing global demand for these critical metals.

One, in particular, is critical for our electric future — and that’s copper.

The Red Drought

The world is facing a critical copper shortage. This is because copper is a key metal in the production of almost all energy technologies, including renewables.

Demand for these technologies is skyrocketing as we race to address climate change.

As a result, copper prices could rise to meet this future.

If you’re looking to position yourself in a smart way, Fat Tail Commodities can help.

We’re offering access to our latest insider report on the copper market, written by resources expert James Cooper.

Click here today to learn more and claim your report.

Regards,

Fat Tail Commodities