Pantoro [ASX:PNR] has poured its first gold bar from its Norseman Gold Project.

About eight kilograms were poured on 13 October, with production from PNR’s leaching circuit now underway.

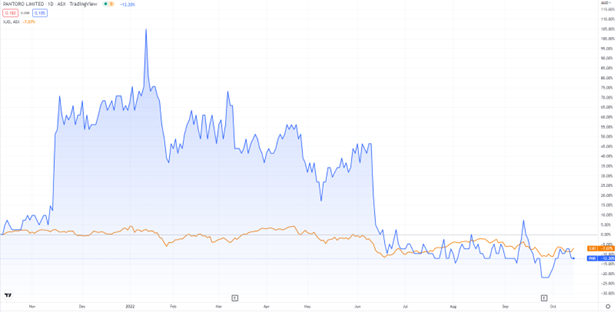

PNR has had a tough time lately, as have other gold stocks.

Year to date, PNR shares are down 45%.

Source: Trading View

Pantoro pours first gold at Norseman

On Friday, the gold producer appeared in high spirits after announcing a new milestone, with its first gold poured at Norseman, creating company history.

The WA-based Norseman Project, which was 50%-acquired by Pantoro in July 2019, boasts a current mineral resource of 4.8 million ounces of gold and has an Ore Reserve of 973,000 ounces.

It’s known as one of the highest gold ore grade areas in the region of Yilgarn Craton, having produced more than 5.5 million ounces of gold since opening in 1935.

And Norseman is still operating without complaint, avoiding any disruptions over the last eight days.

On top of the gold bar milestone, Pantoro also touched on its open pits and underground mine:

‘Mining operations at the Scotia Mining Centre open pits and the OK Underground Mine are progressing well with approximately 160,000 tonnes of ore stocks on the ROM and available for processing.’

The company expects to ramp up nameplate capacity of 125 tonnes every hour through to the end of the December quarter.

Pantoro Managing Director Paul Cmrlec said:

‘We are very pleased to confirm our first gold production at Norseman which represents the culmination of approximately three years of hard work. Norseman has been taken from a dormant site with no Ore Reserves or usable processing facility to full operational status.

‘There have been some unexpected delays resulting from minor but frustrating equipment start up and control programming issues during commissioning, however we are confident that all of those issues have now been resolved and the plant is operating well.

‘We thank all of our staff and contractors for their dedication to achieving this outcome during the past three years, along with our joint venture partner, Tulla Resources Plc.’

How to pick winning ASX gold stocks

What’s the outlook for gold and gold stocks?

It’s a tricky time right now, with the gold price falling to less than US$1,700 an ounce.

The strength of the US dollar isn’t helping; it is trading at 20-year highs against the euro and is at near parity with the British pound.

Investors are potentially seeing the greenback as a better safe-haven asset than gold right now.

Unsurprisingly, gold stocks have been hit hard.

The ASX Gold Index [ASX:XGD] is down 17% year to date.

And our resident gold bug Brian Chu thinks the selling is overdone:

‘The bearish trend seems quite overdone now. Whether it’ll bounce or turn bullish depends on the near-term inflation figures and central banks raising rates.

‘Meanwhile, gold relative to gold stocks is now at its highest in the last seven years, meaning that gold stocks are more undervalued now than in March 2020.’

Now, gold may still fall further from here.

Given the growing fears of a likely recession — coupled with bets central banks won’t be able to tame inflation for a while — the safe-haven appeal of gold isn’t likely to die.

And if gold has its moment once more, what gold stocks should you look for?

How do you go about evaluating the dozens of gold stocks on the ASX?

Brian recently put together a report that should help answer these questions.

In his report, Brian outlines what to look for in a winning gold stock and the types of gold stocks to consider according to your risk profile.

If you’re interested in reading Brian’s report, access it — for free — here.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia