You’ve got to laugh sometimes…

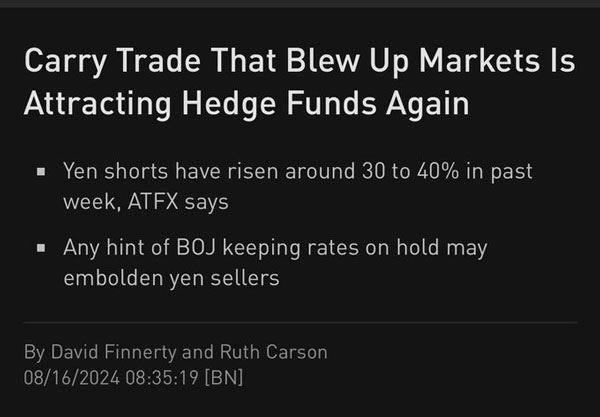

I mean, check this headline out:

| |

| Source: Bloomberg |

Yep, it appears the carry traders who panic sold two weeks ago are now panic buying!

Why?

Well, as I’ve pointed out over the past two weeks, the BOJ (Bank of Japan) blinked.

After the market crash, they quickly came out and said they won’t raise rates if markets are volatile.

Carry trades are immensely profitable in the absence of volatility.

But when volatility rears up, it can wipe them out.

In trading language, they are ‘short volatility.’

So, when you’ve got a central bank telling you they will stop on any signs of volatility, you can imagine their joy.

‘Thank you very much!’ said all the traders as they bought back in last week.

This is a lesson in moral hazard…

If the BOJ and the US Federal Reserve won’t let the Yen appreciate as it should, the market will continue to pile on leverage.

What does that mean?

It means, in the short term more money chasing a finite amount of real assets.

But what assets are they chasing?

Let’s look at some ideas…

Tech Rebounds (but keep an eye on gold)

Tech stocks bore the brunt of the carry trade panic unwind.

So, naturally enough, when the BOJ told traders to wind it back up, it was one of the first beneficiaries.

How’s this for a V-shaped rebound:

| |

| Source: Trading View |

But the question remains…

Is this just a short-term bounce?

Or is it the start of the next up-leg for tech stocks?

The key date to watch will be Wednesday, the 28th of August.

This is the day Nvidia Corp [NASDAQ:NVDA] is due to release their next set of earnings results.

Given Nvidia’s dominance in the production of GPU chips for AI, it will tell us how this story is playing out.

If these results surprise the upside, it could spark the entire tech market back to life after a couple of months pulling back from previous highs.

Carry trade participants borrowing cheap Yen to invest in this trade will reinforce any price momentum.

Especially if this next chart plays ball:

| |

| Source: Trading View |

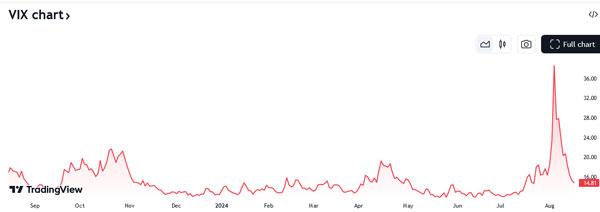

This is a chart of the VIX volatility index.

As you can see, the extreme volatility of the past two weeks is already subsiding.

Remember, carry traders are ‘short volatility,’ so this will suit them a lot better.

Especially when you have central banks actively working to keep volatility low!

Aside from tech, where else could you look?

Gold is a standout.

Unlike tech, it barely flinched in last fortnight’s panic. It’s ripping to new all-time highs, and no one is talking about it.

Check it out:

| |

| Source: Trading View |

To be clear, this isn’t a carry-trade play.

But gold is a big beneficiary of the huge amount of money printing that keeps the whole fiat charade going.

Which makes this chart very interesting for gold investors:

| |

| Source: Willem Middelkoop |

Dutch gold analyst Willem Middelkoop explained the significance of this chart:

‘Gold miners are valued so low (versus gold) that they could have an upside of 40x.’

That’s the kind of opportunity my colleague, gold investor Brian Chu also sees.

If you want to learn more about his current gold stock playbook, read more here.

The following is also good for gold…

This chart shows global liquidity – more money coming into the system – is starting to rise.

| |

| Source: CrossBorder Capital |

More liquidity usually works out very well for both gold and Bitcoin [BTC].

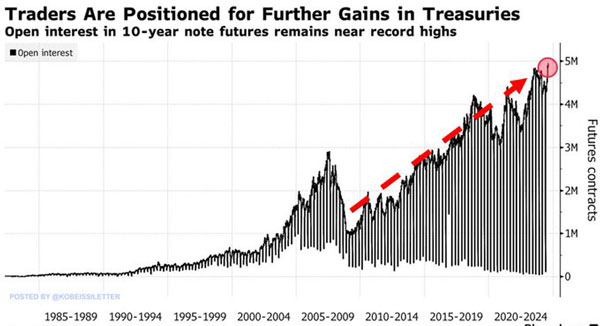

Finally, the chart of ten-year US government bonds shows that many traders are positioning themselves for an imminent interest rate-cutting cycle.

| |

| Source: Bloomberg |

Whether this is because of easing inflation expectations or fears over economic growth remains to be seen.

But the rule of thumb is that looser monetary policy helps to support the value of hard assets like gold and Bitcoin.

And lower interest rates are generally good for tech (in the absence of a complete economic meltdown).

But the bigger point is this…

Different lens, same old story

I’ve spent the past three weeks trying to look at the market through the lens of the carry trade.

While the theory of it is easy enough to grasp, the practicalities of different trading strategies and economic conditions are more nuanced.

I’m by no means an expert in this but what I’ve quickly come to realise is that this is a vast part of the market that often operates unnoticed.

And yet, it can have an outsized effect on market valuations for a sustained period of time, as well as accentuating any short, sharp market shocks.

The kind of shocks that propel central banks into action.

It’s one of those factors that can help you make sense of what you’re seeing when fundamentals alone don’t explain it.

Above all, it’s a reminder that not everyone is playing the same hand as you in markets…or even the same game!

The carry traders are playing a different game than most, looking to borrow cheaply and invest in higher yields.

In theory, they run immense risks in doing so.

But the truth is they’re now so big that central banks often backstop them to avoid systemic issues.

They’re yet another ‘too big to fail’ participant in our financial system.

It means they can take on risks others couldn’t knowing they’ll get rescued if things get too bad.

This isn’t a good thing…

As economists Tim Lee, Jamie Lee and Kevin Colidron write in their excellent book ‘The Rise of Carry.’

‘The economic system is developing toward one in which wealth, or market value, of any individual or individual entity, is much more related to access (to the source of power) than it is to talent, merit, or more importantly, the value of the individual, or entity in terms of his, her or its ability to contribute to increased living standards for society over time.’

This is the bigger story behind the carry trade headlines…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments