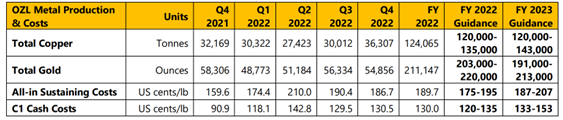

OZ Minerals [ASX:OZL] has reported a record quarter in production, with 36,307 tonnes copper translating to a 21% uplift in copper production — the highest OZ has ever achieved in one quarter.

These results have enabled the mining company to hit its group output and cost guidance for the full year.

OZL’s shares were flat following the report, though, over the past year, they have gone up 11%.

OZ is up 4% on the the ASX 200 average even as the market rallies, momentum charged by the positivity often linked to new year possibilities, especially with hopes of steadying conditions, and predictions for lowered interest rates.

OZ’s record December quarter

Australian copper, nickel, and gold miner OZ revealed it has made enough of a production milestone in the quarter ending 31 December, 2022, to achieve its annual group production and cost guidance.

How did it manage to do this?

It was noted that the fourth quarter was the ‘highest group quarterly copper production on record’ with 21% QoQ (quarter-on-quarter) growth in copper production in the December quarter being the best in the preluding three months — a total of 36,307 tonnes of copper for Q4.

Copper at Prominent Hill also met its original copper guidance for the eighth consecutive year.

Pedra Branca is now set to see a full production ramp up ahead of the company’s initial expectations.

The group also reported Prominent Hill copper production and guidance was met, with gold production remaining within the initial guidance outlined.

Revenue for the financial year hit an unaudited $1.9 billion, boosted by the last — and best — quarter.

Source: OZL

OZ Minerals underpinned by growth

The precious metals miner shared advancements on its ongoing projects, including that construction at West Musgrave has begun, including an MHP study confirming both technical and commercial opportunities promise of high-quality and high-grade MHP.

The company’s Prominent Hill project has now had its pre-sink completed, and the company anticipates a production ramp up to extend into H2 2025.

OZ announced a Scheme Implementation Deed with BHP in December, with BHP set to acquire 100% OZL shares priced at $28.25 a share.

This is an improvement on the initial $25.00 per share offer made by BHP in August, and shareholders are expected to vote favourably.

OZL said it will be focused on hitting operational and growth targets in 2023, improving cost control, construction and expansion projects, even while gearing up to face continuing inflated expenses.

2023 guidance is expected to remain in line with 2022, with improved production at Carrapateena and the Carajás East offsetting lower production at Prominent Hill (which is expected to lower on lesser grade stockpiles).

Australia’s next commodity boom is nearly here

Our in-house resources expert and trained geologist James Cooper thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’… a boom where Australia and its stocks stand to benefit.

where Australia and its stocks stand to benefit.

The next big mining boom is predicted to happen in the next few years. The question is, are you ready for it?

You can access a recent report by James on exactly that topic, AND an exclusive video on his personalised ‘attack plan’ right here.

If that isn’t enough to sate your curiosity, you can also check out this recent interview with James and Greg at ausbiz.

Both are well worth a watch!

Regards,

Mahlia Stewart

For Money Morning