Melbourne glass bottle and aluminium can manufacturer Orora [ASX:ORA] has taken control of Saverglass today. It also changed its board, with Claude-Alain Tardy joining as non-executive director.

Completing the $2.16 billion acquisition is a significant shift within the packaging industry. The addition of Saverglass makes Orora one of the largest glass bottle makers in the world.

Their shares are up by 1.18% today, trading at $2.58 per share this afternoon, but are down -11% in the past year.

Most of the share price fall was after the company announced a $1.35 billion capital raise to bankroll the move.

Now that Saverglass has changed hands, what has changed for Orora, and can their stock regain its losses this year?

Source: TradingView

Orora sees opportunity

Orora acquired the French bottle maker from the US private equity giant The Carlyle Group. Carlyle owns Australia’s second-largest winemaker, Accolade Wines.

Accolade has been struggling with high debt levels after China’s wine tariffs and pandemic woes.

China has announced that it will start reviewing the tariffs, although not as fast as some had hoped.

Carlyle was clearly happy to get out of the space, while Orora saw the opportunity to expand its luxury offerings.

Orora makes about two-thirds of the Australian wine industry’s glass bottles. These have underperformed for Orora, as the cost-of-living crisis hit an already down wine industry.

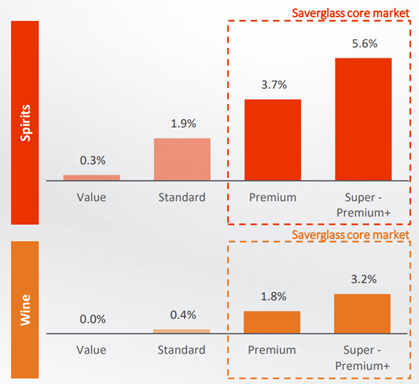

But luxury brands have shown resilience both here and internationally. With Saverglass into the fold, they will now be a leader in premium bottles for both wine and spirits.

Some of their largest serving brands will be spirits like Grey Goose vodka, Glenfiddich, and Hennessy.

Saverglass has an annual revenue of approximately $1.2 billion and operates six factories in France, Belgium, Mexico, and the UAE.

About 65% of that revenue comes from specialist bottles for spirit makers, something that Orora viewed as a big win.

CEO Brian Lowe described Saverglass as having a ‘sticky customer base’. With its top customer relationships averaging 15 years.

Commenting on the news today, he said:

‘We are extremely pleased to announce the completion of the acquisition of Saverglass. This strategic acquisition further strengthens our existing business, establishing Orora as a global player of scale in attractive premium segments.’

Glass is not Orora’s only focus, with the company investing $124 million into its Dandenong can plant in August.

Orora has seen its best growth in its slimline aluminium cans, as younger consumers favour the products.

Outlook for Orora

The deal could be one of the most ambitious of the year for the ASX. Orora heavily discounted its stock for the deal and took on $875 million in debt to fund the bid.

For Orora, they are betting that the deal shouldn’t cost them much more. As Mr Lowe put it:

‘We don’t see that there is any capital needing to be deployed to maintain the assets; they’re well invested in new facilities, like the one in Mexico … they’ve done a really good job.’

Low capex forecasts are certainly optimistic for the outlook, but some shareholders are still nervous.

Buying a company on the other side of the world is not without risks, especially with French factories notorious for their strikes.

However, they’ll gain a company with a 33% market share of global premium wine and spirit bottles. Premium brands have seen the best growth in recent years as the wealthy shrug off cost-of-living pressures.

Source: Journal of Wine Economics 2021

If Orora manages a smooth transition, the company will hold a strong market position.

The acquisition creates a diversified and global packaging player of serious size. In that sector, scale is a significant factor in maintaining margins.

But the scale of the change may be too much for investors. Orora has diluted its shares and ended its four-year run of consistent 22.2% annual earnings per share.

Smooth sailing is crucial from here, or cracks could begin to show in the share price’s performance.

The right mix of growth and income

Investors are at a confusing crossroads coming into Christmas.

The market is currently performing better than it has for much of the year, but headwinds are still blowing.

The ASX 200 benchmark is up this month but is still down -2.4% for the year.

Despite these mixed markets, people are still making money from good old-fashioned dividends.

Dividend income can be a safer play as you don’t have to guess ‘the next big thing’.

Dividend stocks are the ‘Stealth Wealth’ makers of a market going sideways — simple, safer, and stress-free.

But finding the right ones takes more than just finding the best dividend payers.

Editorial Director Greg Canavan has written a simple guide to helping people find the right ones.

Click here to find out how to access the report.

Regards,

Charlie Ormond

For Fat Tail Daily