Major player in the power generation industry, household name Origin [ASX:ORG] has provided an update on its earnings outlook for the fiscal year of 2023.

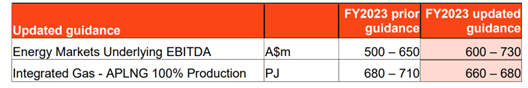

The energy company is now expecting energy markets underlying earnings to be between $600 million and $730 million — a substantial increase from the initial $500–$650 million as predicted in its pervious guidance forecast.

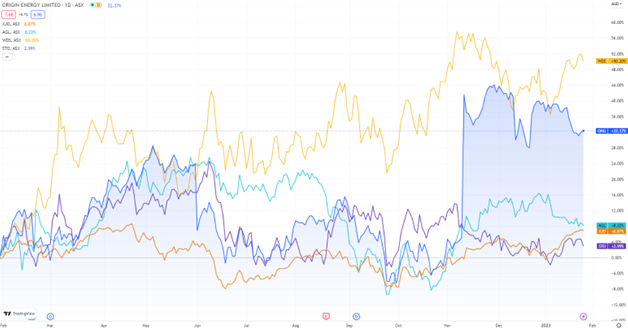

ORG shares were relatively flat on Friday morning, trading around $7.32 a share.

So far in 2023, albeit it has only been a month, the company has slipped more than 5% in share price value.

It remains 35% up for the full year, particularly after its share price spike in November, which occurred after receiving a takeover approach from Brookfield Asset Management, the Canadian investing giant having given up on Origin’s rival AGL.

Source: TradingView

Origin’s earnings update

Origin has revealed expectations of energy markets underlying earnings to be between $600 million and $730 million, substantially up from the initial $500–$650 million previously announced.

It should be noted that this update doesn’t include possible impacts linked to the incoming legislation for the coal price cap, but it does work from an anticipated increase in natural gas and electricity profits, as well as existing legacy contracts.

For the introduction of the $12/GJ cap on uncontracted gas in FY23, no material impact is expected, particularly given Origin’s gas supplies in the year had already been contracted before the cap was introduced.

Compensation related to recovering coal costs that exceed the legislated coal price cap of $125 per tonne — or any further supply contracts executed at the caped price — has not been included in guidance, especially with government policies still uncertain and difficult to predict.

The energy company acknowledged the importance of the coal price cap, saying that it will ‘be important to achieve the Government’s intended aim of lowering wholesale electricity prices in order to put downward pressure on prices for customers in future periods’.

Source: ORG

Origin casts outward to EBITDA in 2026

Origin expects its Energy Markets business to return capital at less than 4% in FY23, noted as the top end of guidance and below the company’s cost of capital.

In FY22, Energy Markets return on capital was negative 1.5%, which reflected recovery levels of wholesale electricity costs linked to customer tariffs.

Production guidance is now expected to be lowered to the range of 660–680PJs, down from 680–710PJs, as the business is continuing to be impacted by disagreeable weather conditions experienced earlier in the year.

And yet ORG’s LNG trading business has improved, thanks to favourable market price hedging, which has resulted in a further $140–$180 million of LNG trading EBITDA.

ORG expects to reach the range of $40–$80 million for FY2023 and FY2024, and now expects to see its target hit the $450–$650 million range in FY25–FY26, up on the previously anticipated $350–$450 million range.

Incoming! Commodity boom Australia

Our resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

Similar patterns that occurred 20 years ago are happening again.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’.

A boom where Australia (and ASX stocks) stands to benefit…

The next big mining boom is predicted to happen in the next few years.

The same investors that got rich last time are preparing to make their move — don’t let them take the monopoly again.

You can learn from James’ experiences AND access an exclusive video on his personalised ‘attack plan’ right here.

If that isn’t enough to sate your curiosity, check out last year’s interview with James and Greg with Ausbiz.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia