Diversified resources company, producer of lithium, iron ore, energy and mining services, Minerals Resources [ASX:MIN] today saw its stock falling more than 4% in share price despite broadcasting a lithium production boom.

MIN said it produced 7,418 tonnes lithium hydroxide during the quarter, while 6,612 tonnes Lithium carbonate was sold.

This represents an increase in lithium sales by 75% on the previous three-month period.

Even though it experienced a dip in shareholder valuation this morning, MIN continues to perform strongly on the ASX with an increase of 54% on the market average.

For the first few weeks of 2023, MIN has gone up nearly 20% in share price.

Source: TradingView

MinRes presents quarterly exploration and mining report

The miner presented its exploration and mining activities report for the quarter, stating mining services production volumes were 70Mt during the period, noted as a steady quarter-on-quarter (QoQ) rate and in line with expectations.

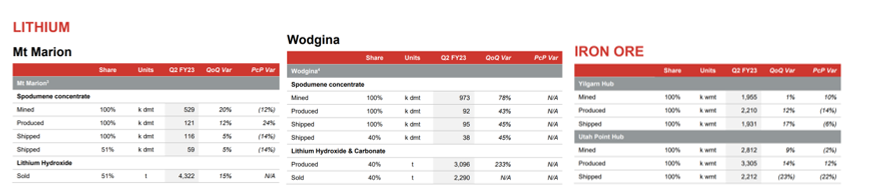

97k dmt (dry metric tonnes) of spodumene concentrate (attributable) was shipped during the quarter, 18% higher QoQ.

7,418 tonnes (attributable) of lithium hydroxide were produced during the quarter, while lithium carbonate was converted with 6,612 tonnes (attributable) sold, representing a 75% increase in three months.

Mt Marion production was 12% higher QoQ due to increased mining activity and improved plant performance. Mt Marion shipped 59k (51% share) dmt of spodumene concentrate over the quarter, up 5% QoQ.

Average realised lithium hydroxide and lithium carbonate revenue was US$65,996/t (exclusive of China VAT).

Iron ore shipments were 4.1 million wmt (wet metric tonnes) during the quarter, down 9% on the prior quarter, which was also in line with the mine plan and company’s FY23 guidance.

The average realised iron ore price was US$97 per dmt, 33% higher QoQ and representing a 98% realisation to the Platts 62% IODEX:

Source: MIN

Corporate summary and times ahead

MinRes stated that its Mt Marion Tolling Agreement with Jiangxi Ganfeng Lithium has been extended to the end of 2023, continuing pre-existing terms and conditions. It may also be extended through to the end of 2024, should both parties wish to.

The timeline for Mt Marion’s expansion of production capacity to 900ktpa has been pushed back due to the delayed supply of processing equipment and labour shortages.

The company now expects the expansion to commence in April, with a ramp up to full run-rate from July.

Mt Marion’s FY23 shipped guidance has been reduced to 250-280k dmt (previously 300–330k dmt).

Wodgina remains on track to achieve FY23 shipped guidance of 190–210k dmt (MinRes 50% share)

Meanwhile, MIN said its’s 30-plus-year Onslow Iron Project is progressing at the Ken’s Bore mine camp, initial earthworks already underway.

Spread across its energy, iron and lithium projects delivering at varied expectations, investors seem reluctant to celebrate the 75% boost in lithium sales in the quarter, especially with Mt Marion’s reduced guidance.

Perhaps a more holistic and transparent summary of the company’s financials in relation to mentioned production and sales would shed more light.

Onslow Iron Project. Source: MIN

Incoming! Commodity boom Australia

Our resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

Similar patterns that occurred 20 years ago are happening again.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’.

A boom where Australia (and ASX stocks) stands to benefit…

The next big mining boom is predicted to happen in the next few years.

The same investors that got rich last time are preparing to make their move — don’t let them take the monopoly again.

You can learn from James’ experiences AND access an exclusive video on his personalised ‘attack plan’ right here.

If that isn’t enough to sate your curiosity, check out last year’s interview with James and Greg with Ausbiz.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia